Gold is a precious metal that has been valued by civilisations for thousands of years. It is a commodity that is used to back the value of a currency and is often used as an investment. The price of gold is constantly fluctuating and is affected by numerous factors, including economic conditions, geopolitical events, currency movements, and supply and demand. Gold is typically quoted by the ounce in U.S. dollars, and one troy ounce of gold is equal to 31.10 grams. The spot price of gold refers to the price of gold for delivery at the current time, as opposed to a future date. This spot price is constantly changing, making it crucial for investors to stay updated on market conditions and current events.

| Characteristics | Values |

|---|---|

| Weight in grams | 31.10 grams |

| Price | $1,979.60 USD |

| Price per gram | $63.64 USD |

| Price per kilogram | $63,642.11 USD |

What You'll Learn

Gold is priced per troy ounce

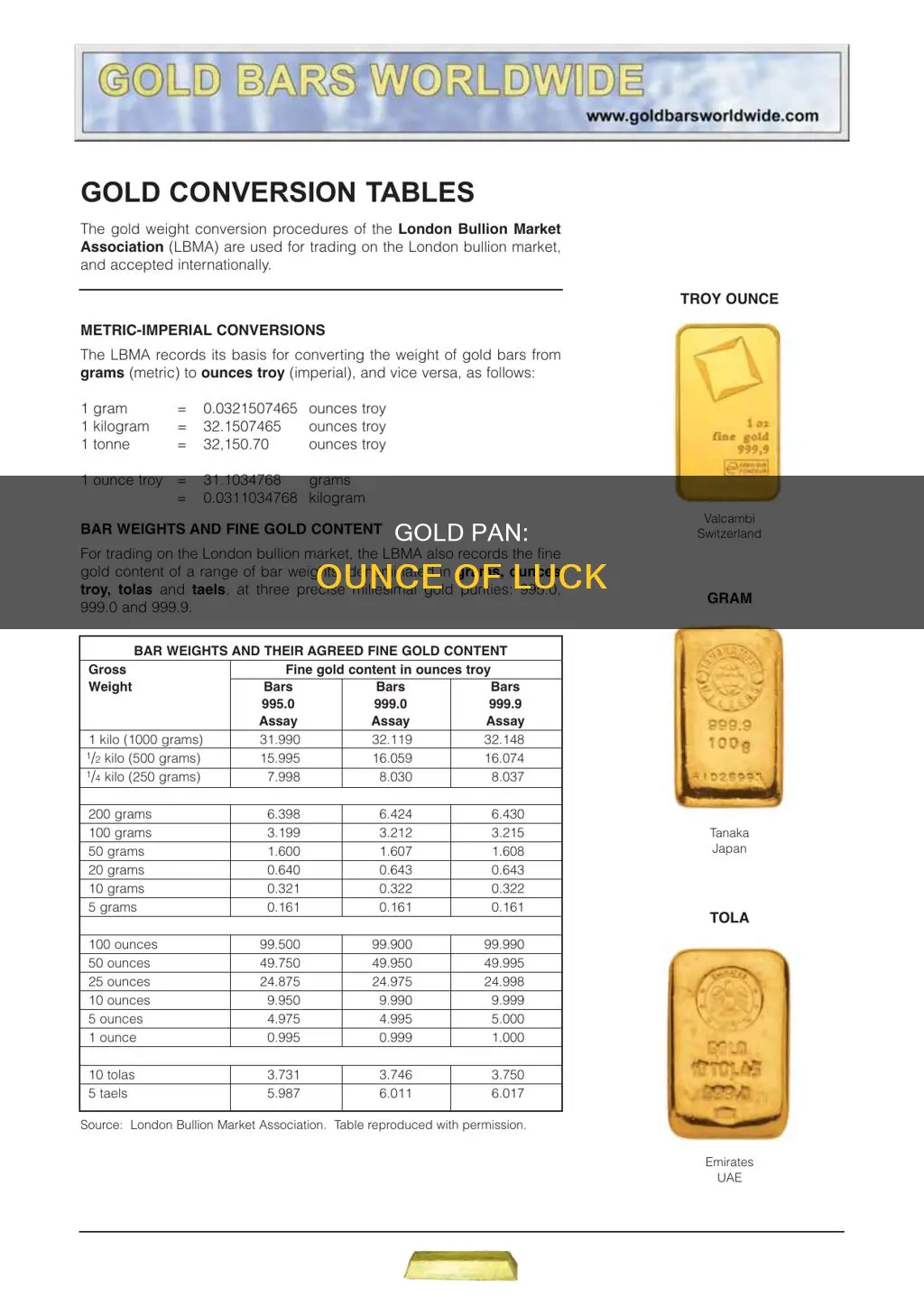

Gold is priced by weight, with the standard unit of measurement being the troy ounce. A troy ounce is equal to 31.1034768 grams and is the typical unit of measurement used in the precious metals industry. The troy ounce is different from the standard "avoirdupois" ounce that Americans use in everyday life, with a troy ounce equalling 1.09711 avoirdupois ounces.

Gold is usually quoted by the ounce in U.S. dollars, but the price can be converted and quoted in any currency by the ounce, gram, or kilogram. The spot price of gold is the market price at which one troy ounce of gold can be bought or sold for instant delivery. This price is constantly changing and is influenced by various factors, including market conditions, supply and demand, and current events.

Gold is traded worldwide and is most often transacted in U.S. dollars. However, gold can also be traded in any other currency after accounting for appropriate exchange rates. The price of gold is the same worldwide, as an ounce of gold is the same whether it is bought in the U.S. or Asia. Gold prices are available around the clock and can be found in newspapers and online. While prices per ounce in U.S. dollars are commonly used, gold prices in alternative currencies and weights can also be easily accessed.

The gold spot price is determined through a globally coordinated process overseen by the London Bullion Market Association (LBMA). The LBMA sets the standards for gold trading and conducts electronic auctions twice daily, where market participants submit buy and sell orders until a supply and demand equilibrium is reached, establishing the spot price. Other major exchanges, such as the COMEX (Commodity Exchange, Inc.), also play a role in determining gold spot prices.

Base Pan Heaters: Necessary for Mini-Splits?

You may want to see also

Gold panning is a hobby, not a living

Gold panning is a fun hobby for many, but it is unlikely to be a primary source of income. Gold is currently selling for close to $2,000 an ounce, and a one-tenth-ounce US gold coin is worth about $200. While this may seem enticing, it is important to remember that gold panning is a recreational activity and not a reliable way to make a living.

Gold panning is a simple process that involves using a pan to extract gold from a placer deposit. The principle behind gold panning is that gold is heavier than most other materials. By agitating the dirt and water in a pan, the gold will sink to the bottom, while the lighter materials will wash away. This process, called stratification, allows gold prospectors to collect the dense materials, including gold, that remain in the pan.

Gold panning requires some basic equipment, such as a gold pan, waterproof boots, warm socks, a classifier (or sieve), digging tools, and a sniffer bottle for sucking up small bits of gold. It also requires finding a suitable stream or river with a history of producing placer gold. Gold prospectors should also be mindful of the legalities of panning in different areas, as it is illegal on US government property and may be restricted on some state and private lands.

While gold panning can be enjoyable and provide a sense of connection to the pioneers of the past, it is not a reliable way to make a living. The amount of gold found through panning is typically very small, with most prospectors only finding minor gold dust or flakes. Even in areas with a history of gold mining, such as California, the likelihood of finding significant amounts of gold is low. Additionally, gold panning can be physically demanding and time-consuming, requiring several hours to sift through 20 pounds of dirt by hand.

For those interested in gold panning as a hobby, there are gold prospecting clubs and organizations, such as the Gold Prospectors Association of America (GPAA), that can provide guidance and community. These groups offer a great way to learn about gold panning and connect with other enthusiasts. However, it is important to remember that gold panning is unlikely to replace a regular source of income.

The Age of Pan Pizza Rebel Taxi

You may want to see also

Gold is heavy

Gold's density means that it will settle at the bottom of a gold pan when panning for gold. This is because gold is heavier than most other gravels or metals. The weight of gold is also what makes it valuable. An ounce of gold, worth over $1,300, can be pounded into a thin sheet that can be spread over an area of 100 square feet. This means that 36 pounds of gold would be enough to cover a football field and would be worth three-quarters of a million dollars.

The density of gold is 19.3 times greater than that of water, and it is one of the densest substances on Earth. However, there are substances with far more amazing densities, such as the core of the Sun, which has a density 115 times that of water.

Gold is also unique among heavy metals because it lacks the brittleness of many others. Gold atoms are not tightly linked and can slide past each other relatively easily, making the metal soft and malleable. This is why gold is often used in jewellery and gilding.

Gotham Steel Pans: Lifetime Warranty?

You may want to see also

Gold is scarce

Gold is a precious metal that has been valued by societies for thousands of years. Its scarcity is one of the key factors contributing to its enduring value.

While gold is difficult to extract, advancements in technology and mineral recovery techniques have the potential to increase gold production rates. Reprocessing tailings and waste to capture gold that was previously missed is also becoming more prevalent. These advancements can help bring down mining costs and make lower-grade gold deposits economically viable for extraction.

Despite these advancements, gold supply has plateaued in recent years, with total gold supply in 2021 falling to 4,666 tonnes, the lowest level since 2017. This trend has sparked concerns about the scarcity of future gold supply. However, experts believe that identified reserves and resources are sufficient to sustain current production levels for many years, and the insulated nature of the gold market will prevent significant supply challenges.

Gold's scarcity, combined with its lustrous and metallic qualities, makes it a valuable commodity. Its rarity and difficulty of extraction contribute to its perception as a symbol of wealth, power, and majesty. Gold's enduring value is further enhanced by its role as a store of value and its utility in various industries, such as electronics, dentistry, medical tools, defence, aerospace, and automotive.

Stainless Steel Pan Seasoning: Why and How?

You may want to see also

Gold is traded globally

Gold is traded all over the world and is most often transacted in US dollars. However, gold can be transacted in any currency after the appropriate exchange rates have been accounted for. The spot price of gold is the market price at which one ounce of gold can be bought and sold for instant delivery. The spot price of gold is constantly changing, making it crucial for investors to remain updated.

The gold price is always quoted in troy ounces but can be converted into any quantity a person wants to buy or sell. Gold spot prices are universal, as most gold markets use live gold prices listed in US dollars, so the price of gold per ounce is the same worldwide.

The three most important gold trading centres are the London OTC market, the US futures market, and the Shanghai Gold Exchange (SGE). These markets comprise more than 90% of global trading volumes and are complemented by smaller secondary market centres around the world. The London OTC market has historically been the centre of the gold trade and today comprises approximately 70% of global notional trading volume. The London market attracts participants from all around the world and sets the twice-daily global reference benchmark for gold.

Other important markets include Dubai, India, Japan, Singapore, and Hong Kong. There are exchanges in all these markets offering a range of spot trading facilities or listed contracts but these have not attracted the liquidity seen on the market's primary venues.

Hard Panning: When and Why?

You may want to see also

Frequently asked questions

The spot price of gold is the market price at which one ounce of gold can be bought and sold for instant delivery. The price of gold is constantly changing, but as of May 2023, it was around $1,900.

The amount of gold you find when panning will depend on the location and your technique. It is unlikely that you will find a large gold nugget, especially on the East Coast of the US. Instead, you will likely find tiny flakes of gold in your pan.

Panning for gold is hard work and it can take several hours to sift through 20 pounds of dirt by hand. Using a sluice can speed up the process, allowing you to process 20 pounds of dirt in around 10-15 minutes.