A Permanent Account Number (PAN) card is a crucial form of identification in India, not only for tax purposes but also as proof of identity. It is therefore important that all the details on the card are correct and up to date. If there are any errors or inaccuracies on your PAN card, you can correct them by submitting the required documents either through an online or offline process.

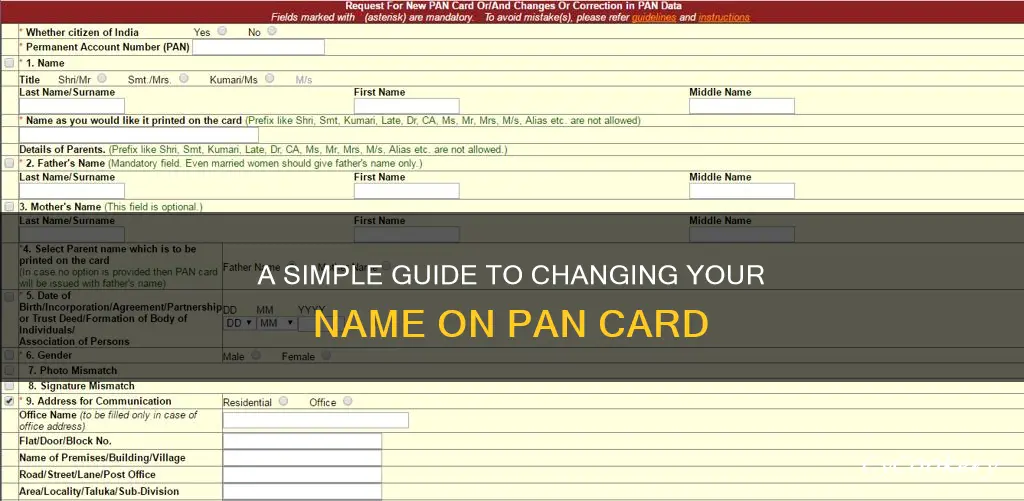

To change the name on your PAN card, you will need to submit any identity proof that carries your correct name and address. This can include an Aadhaar Card, Passport, Birth Certificate, Voter ID, Ration Card, Driving License, Bank Passbook, Gas Connection, Water Bill, and Electricity Bill. You can then submit the 'Request for New PAN Card or/and Changes or Correction in PAN Data' form, either online or at your nearest PAN centre.

If submitting your application online, you can do so via the NSDL or UTIITSL portal. You will need to fill out the request form, mention your existing PAN number details, and select the parameters you wish to change. Once you have uploaded all the supporting documents, you will need to pay a nominal fee. If all the details provided are correct, you will receive an acknowledgment number, which can be used to track the status of your application.

| Characteristics | Values |

|---|---|

| Website | https://www.protean-tinpan.com/ |

| Application Type | Changes or Correction in existing PAN data/Reprint of PAN Card (No changes in Existing PAN Data) |

| Category | Individual |

| Documents Required | Aadhar Card, Passport, Birth Certificate, Voter ID, Ration Card, Driving License, Bank Passbook, Gas Connection, Water Bill, and Electricity Bill |

| Fee | Rs. 110 for online corrections |

| Dispatch Fee for Outside India | Rs. 910 |

| Dispatch Fee for Physical PAN Card in India | Rs. 107 |

| Dispatch Fee for Physical PAN Card Outside India | Rs. 1,017 |

| Dispatch Fee for PAN Application Submitted Online Using Physical Mode | Rs. 72 |

| Dispatch Fee for PAN Application Submitted Online Using Paperless Mode | Rs. 66 |

What You'll Learn

How to change your name on your PAN card online

Changing your name on your PAN card can be done online or offline. Here is a step-by-step guide on how to do it online:

Step 1: Visit the Official Website

Go to the official website of NSDL (https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html) or UTIITSL (https://www.myutiitsl.com/PAN_ONLINE/CSFPANApp).

Step 2: Click on the Relevant Options

On the NSDL website, click on 'PAN Card Services' and then 'Change/Correction in PAN Card'. On the UTIITSL website, click on 'PAN Card Services' and then 'Apply PAN Card', followed by 'Change/Correction in PAN Card' and 'Click to Apply'.

Step 3: Fill Out the Request Form

Provide your existing PAN number details and select the parameters you wish to change, such as your name.

Step 4: Upload Supporting Documents

You will need to provide supporting documents with the correct information, such as your Aadhaar Card, Passport, Birth Certificate, Voter ID, Ration Card, Driving License, Bank Passbook, Gas Connection, Water Bill, and Electricity Bill.

Step 5: Submit and Pay the Nominal Fee

After submitting the form and documents, you will be redirected to the payment page. The fee for online corrections is Rs. 110, and there is an additional dispatch fee for outside India (Rs. 910).

Step 6: Receive an Acknowledgment Number

If all the details provided are correct, you will receive an acknowledgment number that can be used to track the status of your PAN card application.

Step 7: Wait for the Updated PAN Card

It usually takes around 15 days for corrections to be made, and you will receive a text message on your registered mobile number once your updated PAN card is dispatched via post.

Recycling Stainless Steel Pans

You may want to see also

How to change your name on your PAN card offline

Step 1: Download the PAN Card Correction Form

You can download the PAN card correction form from the official websites of NSDL (National Securities Depository Limited) or UTIITSL (UTI Infrastructure Technology And Services Limited). The form is also known as the "Request for New PAN Card or/and Changes or Correction in PAN Data" form (Form CSF).

Step 2: Fill Out the Form

Carefully fill out the form, ensuring that all the mandatory fields are completed. Provide accurate details, including your existing PAN number and the corrections you want to make to your name. Remember to avoid using abbreviations or initials in the name column.

Step 3: Attach Supporting Documents

Along with the completed form, you will need to submit supporting documents as proof of identity and address. These documents should contain your correct name and address. Here is a list of documents that can be provided:

- Aadhar Card

- Birth Certificate

- Voter ID

- Passport

- Driving License

- Ration Card with a photo

- Bank Passbook

- Gas Connection

- Water Bill

- Electricity Bill

Step 4: Submit the Form and Documents

Submit the completed form along with the supporting documents to your nearest NSDL collection center or PAN center. Make sure to keep a copy of all the documents for your records.

Step 5: Pay the Applicable Fees

You will need to pay the fees for the PAN card update or correction. The charges vary depending on whether you submit the application offline or online, and whether you require a physical copy of the updated PAN card or an e-PAN. For offline applications, the fee for correction within India is Rs. 110, while for dispatch outside India, it is Rs. 1,017.

Step 6: Receive the Acknowledgment Slip

After submitting the form, documents, and payment, you will receive an acknowledgment slip from the authority. This slip will contain a 15-digit acknowledgment number that can be used to track the status of your PAN card correction application.

Step 7: Send the Acknowledgment Slip to NSDL

Within 15 days of submitting your application, you need to send the acknowledgment slip to the Income Tax PAN Service Unit of the NSDL. Their address is:

Income Tax PAN Services Unit,

Protean eGov Technologies Limited,

4th Floor, Sapphire Chambers,

Baner Road, Baner, Pune - 411045

By following these steps, you can ensure that your PAN card information is updated with your correct name. Remember to allow some time for the changes to be processed and reflected on your PAN card.

Pan-Seared Chicken: Golden, Juicy Perfection

You may want to see also

Documents required to change your name on your PAN card

To change your name on your PAN card, you will need to submit a combination of the following documents:

- Marriage certificate

- Copy of passport showing husband's name

- Publication of name change in the official gazette

- Certificate issued by a gazetted officer

- Aadhaar card

- Elector's photo identity card

- Ration card with a photograph of the applicant

- Photo identity card issued by the Central Government or State Government or Public Sector Undertaking

- Pensioner card with a photograph of the applicant

- Central Government Health Service Scheme Card or Ex-Servicemen Contributory Health Scheme photo card

- Passport of the spouse

- Post office passbook with the address of the applicant

- Latest property tax assessment order

- Domicile certificate issued by the Government

- Allotment letter of accommodation issued by the Central or State Government of not more than three years old

- Property Registration Document

- Matriculation certificate or Mark sheet of a recognised board

- Birth certificate issued by the municipal authority or any office authorised to issue birth and death certificates by the Registrar of Birth and Deaths or the Indian Consulate as defined in clause (d) of sub-section (1) of section 2 of the Citizenship Act, 1955 (57 of 1955)

- Affidavit sworn before a magistrate stating the date of birth

In case none of the above documents are available, the following can also be submitted:

- Certificate in original signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councillor or a Gazetted officer, as the case may be (in the prescribed format)

- Bank certificate in original on letterhead from the branch (along with the name and stamp of the issuing officer) containing duly attested photograph and bank account number of the applicant (in the prescribed format)

- Employer certificate in original (in the prescribed format)

Spud Study: Exploring the Hot Pot Potato Possibility

You may want to see also

Steps to fill out the PAN card correction form

Step 1: Visit the official website

Go to the NSDL E-Governance website, https://www.protean-tinpan.com, or the UTIITSL website.

Step 2: Navigate to the PAN card correction section

Under the "Services" section on the NSDL website, click on "PAN". Then, click on "Apply" under the "Change/Correction in PAN Data" section.

On the UTIITSL website, under "PAN Card Services", click on "Apply PAN Card", then click on "Change/Correction in PAN Card" and "Click to Apply".

Step 3: Select the type of application

From the 'Application Type' dropdown menu, select 'Changes or Correction in existing PAN data/Reprint of PAN Card (No changes in Existing PAN Data)'.

Step 4: Choose the correct category

From the 'Category' dropdown menu, select the relevant category. For example, if the PAN is registered in your name, choose 'Individual'.

Step 5: Fill in your personal details

Enter your name, date of birth, email address, and mobile number.

Step 6: Complete the CAPTCHA and submit the form

Fill in the CAPTCHA and click "Submit". Your request will be registered, and a Token Number will be sent to your email.

Step 7: Continue with the PAN card update form

You will be redirected to the PAN card update form. There are three options to submit your documents. Click on "Submit scanned images through e-Sign on NSDL e-gov".

Step 8: Provide necessary details

Fill in all the necessary details, such as your father's name, mother's name (optional), and your Aadhaar number.

Step 9: Update your address

You will be redirected to a new page where you can update your address.

Step 10: Upload supporting documents

Upload all the necessary documents, including proof of address, proof of age, proof of identity, and a copy of your PAN card.

Step 11: Sign the declaration

Sign the declaration and click "Submit".

Step 12: Make the payment

You will be redirected to the payment page. Pay the applicable fees through demand draft, net banking, credit card, or debit card.

Step 13: Obtain the acknowledgement slip

After successful payment, an acknowledgement slip will be generated. Print this slip and send it to the NSDL e-gov office, along with the physical proof of documents and two photographs. Write "Application for PAN Change" on the envelope, along with the acknowledgement number.

Step 14: Mail the documents

Send the documents to the following address:

> NSDL e-Gov at Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016

Important notes:

- Keep in mind that you have to pay a fee for correcting or updating your PAN details.

- Do not use abbreviations or initials in the name column.

- Have all the supporting documents ready as scanned copies.

- Make sure to enter the CAPTCHA correctly and keep the acknowledgement number for tracking your application.

- Complete the e-KYC application and sign it digitally.

The Right Amount of Olive Oil to Coat a Pan

You may want to see also

How to submit the PAN card correction form

The PAN card correction form can be submitted online or offline. Here is a step-by-step guide for both processes:

Online Submission:

- Visit the NSDL or UTIITSL portal.

- Fill out the request form online.

- Mention your existing PAN number details.

- Select the parameters you wish to change, such as name or address.

- Upload all the supporting documents.

- Pay the nominal fee.

- Once all the details are submitted, you will receive an acknowledgment number.

Offline Submission:

- Download the PAN card correction form PDF online.

- Fill in all the mandatory fields in the form carefully.

- Attach the supporting documents such as proof of identity, proof of address, and passport-sized photographs.

- Submit the form at the nearest NSDL collection center or PAN center.

- Pay the applicable charges for PAN card correction.

- You will receive a 15-digit acknowledgment number to track your application status.

Important Points to Remember:

- Do not use abbreviations or initials in the name column.

- Keep all the supporting documents handy as scanned documents.

- Make sure to enter the CAPTCHA correctly before submitting the form.

- Note down the acknowledgment number to track your application status.

- Complete the e-KYC application and sign it digitally.

Scraping Away: Removing Stubborn, Baked-On Food from Pans

You may want to see also

Frequently asked questions

You can change your name in PAN by submitting the required documents either through an online or offline process. The supporting documents required for correcting a name are any identity proof that carries your correct name and address such as an Aadhaar Card, Passport, Birth Certificate, Voter ID, Ration Card, Driving License, Bank Passbook, Gas Connection, Water Bill, and Electricity Bill.

Foreign citizens can change their name in PAN by submitting the required documents either through an online or offline process. The supporting documents required for correcting a name are any identity proof that carries your correct name and address such as a Passport, Person of Indian Origin (PIO) card, Overseas Citizen of India (OCI) card, or a Taxpayer Identification Number.

It usually takes around 15 days for your PAN card to get updated/corrected.