The Indian government has made it mandatory for taxpayers to link their Aadhaar with their Permanent Account Number (PAN) cards. The last date to link PAN with Aadhaar was extended from 31 March 2023 to 30 June 2023. If you have not yet linked your PAN and Aadhaar, or if you are unsure whether they are linked, you can check their status online or via SMS. Here is a step-by-step guide on how to do so.

| Characteristics | Values |

|---|---|

| Deadline to link Aadhaar-PAN cards | 30 June 2023 |

| Penalty for linking after the deadline | Rs.1,000 |

| Fee for Aadhaar-PAN linking | Free until 31 March 2022; Rs.500 until 30 June 2022; Rs.1,000 after 30 June 2022 |

| Who should link Aadhaar with PAN | All taxpayers with a PAN card, except Non-Resident Indians (NRIs), citizens above 80 years, and residents of Assam, Meghalaya, and Jammu and Kashmir |

| How to check Aadhaar-PAN link status | Online through the Income Tax e-filing portal; Offline; Through SMS |

| Online steps | Visit the Income Tax e-filing portal; Click on 'Quick Links' and select 'Link Aadhaar Status'; Enter PAN and Aadhaar numbers; Click on 'View Link Aadhaar Status' |

| Offline steps | N/A |

| SMS steps | Write SMS in the format: UIDPAN <12-digit Aadhaar number> <10-digit PAN number>; Send SMS to 567678 or 56161; Wait for a response |

What You'll Learn

Check status via SMS

Checking the status of your Aadhaar and PAN card link via SMS is a straightforward process. Here's a detailed, step-by-step guide:

Step 1: Compose the SMS

On your mobile phone, open your messaging app and compose a new SMS. Start by typing "UIDPAN" followed by a space. After the space, enter your 12-digit Aadhaar number. Add another space and then input your 10-digit Permanent Account Number (PAN).

The format should look like this: "UIDPAN [your 12-digit Aadhaar number] [your 10-digit PAN]".

Step 2: Send the SMS

Send the SMS to either '567678' or '56161'. These are the designated numbers provided by the government for this service.

Step 3: Wait for the Response

After sending the SMS, you will need to wait for a response from the government service. This response will confirm the status of your Aadhaar and PAN card link.

Response Messages:

When Aadhaar is Linked with PAN:

If your Aadhaar is already linked to your PAN card, the response message will be similar to the following:

"Aadhaar is already associated with PAN (number) in ITD database. Thank you for using our services."

When Aadhaar is Not Linked to PAN:

If your Aadhaar is not linked to your PAN card, the response message will indicate this:

"Aadhaar is not associated with PAN (number) in ITD database. Thank you for using our services."

Important Notes:

- It is recommended that you send this SMS from your registered mobile number.

- Ensure that you have linked your PAN and Aadhaar before June 30, 2023, to avoid any penalties.

- The penalty for not linking your PAN and Aadhaar is Rs. 500 for the first three months after the deadline and Rs. 1000 thereafter.

- Linking your PAN with Aadhaar is crucial for streamlining financial transactions and preventing fraudulent activities.

- Remember to double-check the accuracy of the information you enter when sending the SMS.

Oil Pan Drain Plugs: Universal Size or Not?

You may want to see also

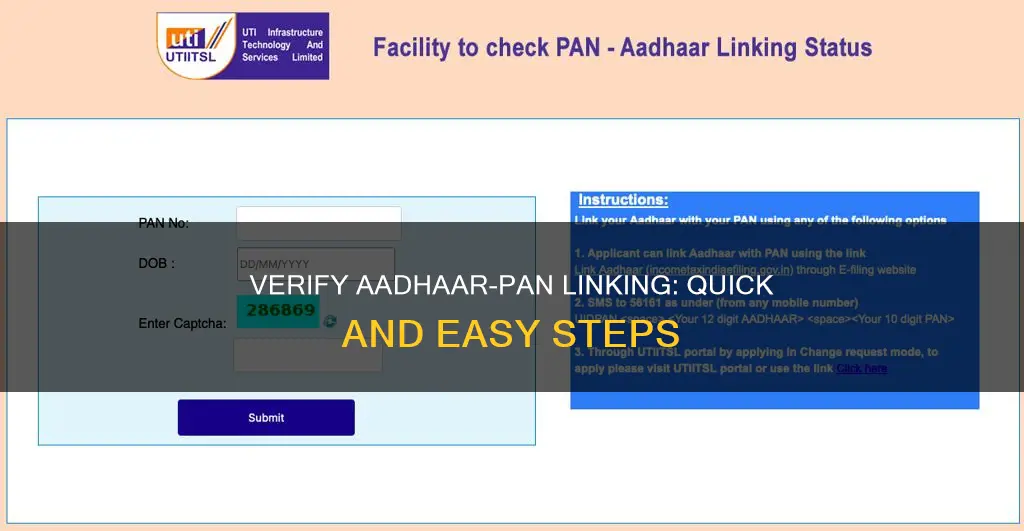

Check status online without logging into the Income Tax portal

You can check if your Aadhaar is linked to your PAN card without logging into the Income Tax portal by following these steps:

Method 1: Check status online without logging into the Income Tax portal

- Go to the Income Tax e-filing portal at www.incometax.gov.in/iec/foportal/.

- On the e-Filing Portal homepage, under 'Quick Links', click 'Link Aadhaar Status'.

- Enter your PAN and Aadhaar Number and click 'View Link Aadhaar Status'.

On successful validation, a message will be displayed regarding your Link Aadhaar Status. If your Aadhaar is linked to your PAN card, you will see the following message: "Your PAN is already linked to the given Aadhaar". If your Aadhaar-Pan link is in progress, you will see the following message: "Your Aadhaar-PAN linking request has been sent to UIDAI for validation. Please check the status later by clicking on 'Link Aadhaar Status' on the Home Page." If your Aadhaar is not linked to your PAN card, you will see the following message: "PAN not linked with Aadhaar. Please click on 'Link Aadhaar' to link your Aadhaar with PAN."

Alternatively, you can also check the Aadhaar PAN card link status by sending an SMS or by logging into the Income Tax portal.

Unlocking the Secrets of the Shado-Pan Geyser Gun

You may want to see also

Check status by logging into the Income Tax portal

To check the status of your Aadhaar and PAN card link by logging into the Income Tax portal, follow these steps:

Step 1: Log in to the Income Tax e-filing portal

Go to the Income Tax e-filing portal and log in to your account. If you do not have an account, you will need to register by creating a user ID and password.

Step 2: Go to 'Dashboard' or 'My Profile'

Once you have logged in, click on the Dashboard option on the homepage. From there, you can select the Link Aadhaar Status option. Alternatively, you can go to the My Profile section and click on the Link Aadhaar Status option under Personal Details.

Step 3: Enter your Aadhaar number and check the status

After selecting the 'Link Aadhaar Status' option, enter your Aadhaar number and click on Validate or View Link Aadhaar Status. If your Aadhaar is already linked to your PAN card, the Aadhaar number will be displayed. If it is not linked, you will see a message stating that your PAN is not linked with Aadhaar, and you will need to initiate the linking process.

Additional Information:

If your request to link your Aadhaar with your PAN is pending with the Unique Identification Authority of India (UIDAI) for validation, you will need to check the status at a later time. In some cases, you may need to contact the Jurisdictional Assessing Officer to delink your Aadhaar and PAN if they are incorrectly linked or if there are issues with the linking process.

Gluten-Free Pancake Sticking: Pan Problems and Solutions

You may want to see also

Linking instructions for new applicants

For new applicants of the PAN card, the Aadhaar-PAN linking is done automatically during the application stage. However, if you are an existing PAN card holder who was allotted a PAN on or before 1 July 2017, it is mandatory to link your PAN with your Aadhaar. This service is available to individual taxpayers, both registered and unregistered on the e-Filing Portal.

To link your Aadhaar and PAN, follow the steps outlined below:

- Visit the e-Filing Portal homepage and click on 'Link Aadhaar' in the 'Quick Links' section. Alternatively, log in to the e-filing portal and click on 'Link Aadhaar' in the 'Profile' section.

- Enter your PAN and Aadhaar Number.

- Click on 'Continue to Pay Through e-Pay Tax'.

- Enter your PAN, confirm PAN, and any mobile number to receive the OTP.

- After OTP verification, you will be redirected to the e-Pay Tax page.

- Click on 'Proceed' on the Income Tax tile.

- Select the relevant Assessment Year and Type of Payment as 'Other Receipts (500)'. Then, click 'Continue'.

- The applicable amount will be pre-filled against 'Others'. Click 'Continue'.

- A challan will be generated. Select the mode of payment. After selecting the mode, you will be redirected to your bank's website to make the payment.

After paying the fee, you can submit your Aadhaar-PAN link request. This can be done both in Post-login and Pre-login modes.

Submit Aadhaar-PAN link request (Post-login):

- Go to the e-filing Portal, log in, and on the Dashboard, click on 'Link Aadhaar to PAN' in the 'Profile' section.

- Alternatively, click on 'Link Aadhaar' in the personal details section.

- Enter your Aadhaar number and click 'Validate'.

Submit Aadhaar-PAN link request (Pre-login):

- Go to the e-filing portal homepage and click on 'Link Aadhaar' under 'Quick Links'.

- Enter your PAN and Aadhaar, then click 'Validate'.

- Enter the mandatory details and click on 'Link Aadhaar'.

- Enter the 6-digit OTP received on the mobile number mentioned in the previous step and click 'Validate'.

- A message will confirm that your request for the link of Aadhaar has been submitted successfully. Now you can check the Aadhaar-PAN link status.

Note: If you have already paid the fee but the payment details are not verified on the e-Filing Portal, wait for 4-5 working days and then submit your request. Ensure that you link your correct Aadhaar with your PAN.

If you encounter any issues or your Aadhaar is already linked with your PAN or vice versa, you may need to contact your Jurisdictional Assessing Officer and submit a request for delinking.

Cleaning Daterra Cucina Pans: Tips and Tricks

You may want to see also

Linking instructions for existing PAN holders

The government of India has made it mandatory for taxpayers to link their Aadhaar with their Permanent Account Number (PAN) cards. If you are an existing PAN holder, here are detailed instructions on how to link your Aadhaar:

- Visit the e-Filing Portal homepage at https://eportal.incometax.gov.in/iec/foservices/#/pre-login/link-aadhaar-status.

- Click on "Link Aadhaar" under the 'Quick Links' section.

- Enter your PAN and Aadhaar Number.

- Click on "Continue to Pay Through e-Pay Tax".

- Enter your PAN again and confirm, along with any mobile number to receive the OTP.

- Verify the OTP sent to your mobile number.

- You will be redirected to the e-Pay Tax page. Click on "Proceed" on the Income Tax tile.

- Select the relevant Assessment Year and Type of Payment as "Other Receipts (500)". Then, click on "Continue".

- The applicable amount of Rs.1,000 will be pre-filled against Others. Click "Continue" again.

- A challan will be generated. Select the mode of payment.

- After selecting the mode of payment, you will be redirected to your bank's website to make the payment.

- Once the payment is successful, return to the e-Filing Portal.

- Go to the Dashboard and click on "Link Aadhaar" under the Profile section. Alternatively, click on "Link Aadhaar" in the personal details section.

- Enter your Aadhaar number and click on "Validate".

- You will receive a 6-digit OTP on your registered mobile number. Enter this OTP and click on "Validate" again.

- Your request for linking Aadhaar with PAN has now been submitted.

- To check the status of your linking request, go back to the e-Filing Portal homepage.

- Under 'Quick Links', click on "Link Aadhaar Status".

- Enter your PAN and Aadhaar Number, and click on "View Link Aadhaar Status".

- The portal will now display the status of your linking request. If successful, your Aadhaar number will be displayed against your PAN details.

Pie Pan Weight: How Much?

You may want to see also

Frequently asked questions

You can check the status of your Aadhaar-PAN link online or via SMS. To check online, go to the Income Tax e-filing portal and follow the steps provided. To check via SMS, send a message in the following format: "UIDPAN <12-digit Aadhaar number> <10-digit PAN number>" to 567678 or 56161.

If your Aadhaar and PAN are not linked by the deadline, your PAN will become inoperative, and you will be unable to perform financial transactions requiring a PAN. You can still request to link your Aadhaar and PAN after the deadline by paying a penalty fee.

The deadline to link Aadhaar and PAN was June 30, 2023. After this date, a penalty fee of Rs.1,000 is required to link the two.

To link your Aadhaar and PAN, visit the e-Filing portal and follow the steps provided. You will need to provide your PAN and Aadhaar numbers and pay the late fee if applicable.

Yes, the Central Board of Direct Taxes (CBDT) has made it mandatory to link Aadhaar and PAN. If you do not link the two, your PAN will become inoperative, and you may face issues with income tax returns and other financial transactions.