The Indian government has made it mandatory for taxpayers to link their Aadhaar with their Permanent Account Number (PAN) cards. The last date to link the two was 30 June 2023, and a penalty of Rs. 1,000 is imposed for those who link them after 30 June 2022. If you are unsure whether your Aadhaar is linked to your PAN card, you can check your Aadhaar-PAN card link status online, offline, or via SMS.

| Characteristics | Values |

|---|---|

| How to check the status | Visit the Income Tax e-filing portal. Click on Quick Links and then Link Aadhaar Status. Enter your PAN and Aadhaar Number and click 'View Link Aadhaar Status' |

| Statuses | Aadhaar is linked with PAN, Aadhaar is not linked with PAN, Aadhaar is linked to some other PAN, Aadhaar-PAN linking request is pending for approval from the UIDAI |

| How to link PAN and Aadhaar | Login to the e-Filing portal, pay the late fees of INR 1000, go to 'Profile Settings', click on 'Link Aadhaar', enter the Aadhaar number and click 'validate' |

| When will PAN become operative after linking with Aadhaar? | Within 30 days from the date of the Aadhaar PAN linking request |

| Deadline to link PAN with Aadhaar | 30th June 2023 |

| Fee for linking PAN with Aadhaar | INR 1000 |

| Fee for not linking PAN with Aadhaar before the deadline | PAN will become inoperative |

What You'll Learn

Check status without logging into the Income Tax portal

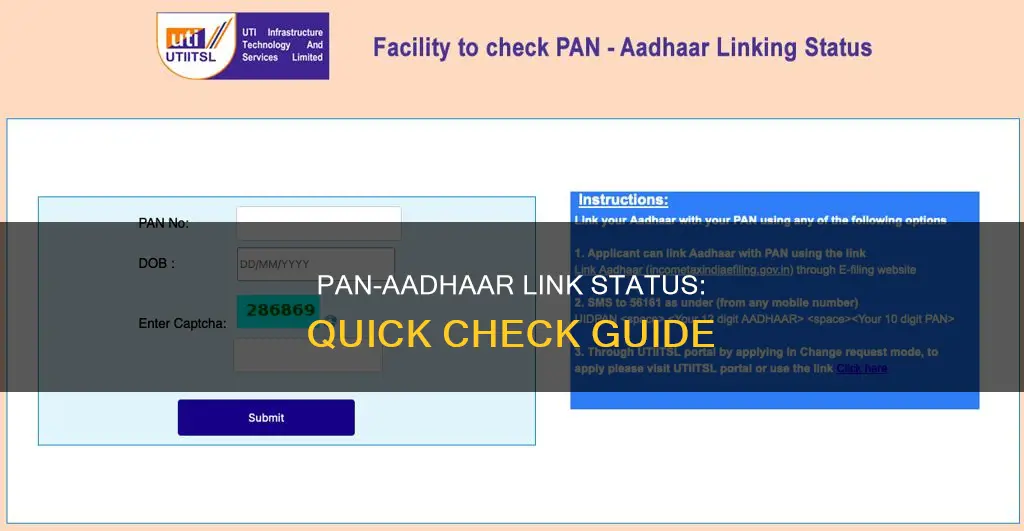

You can check the status of your PAN-Aadhaar link without logging into the Income Tax portal by following these steps:

Method 1: Using the Income Tax e-Filing Portal

- Go to the Income Tax e-filing portal.

- Under the Quick Links heading, click on the Link Aadhaar Status option.

- Enter your PAN and Aadhaar Number.

- Click on the View Link Aadhaar Status button.

Messages you may receive:

- If your Aadhaar is linked to your PAN card, the following message will appear: "Your PAN is already linked to the given Aadhaar."

- If your Aadhaar-PAN link is in progress, the following message will appear: "Your Aadhaar-PAN linking request has been sent to UIDAI for validation. Please check the status later by clicking on 'Link Aadhaar Status' on the Home Page."

- If your Aadhaar is not linked to your PAN card, the following message will appear: "PAN not linked with Aadhaar. Please click on 'Link Aadhaar' to link your Aadhaar with PAN."

Method 2: Sending an SMS

- Write the following SMS: UIDPAN <12-digit Aadhaar number> <10-digit PAN number>.

- Send the SMS to '567678' or '56161'.

- Wait for the response from the government service.

Messages you may receive:

- If your Aadhaar is linked to your PAN, the message will appear as follows: "Aadhaar is already associated with PAN (number) in ITD database. Thank you for using our services."

- If your Aadhaar is not linked to your PAN, the message will appear as follows: "Aadhaar is not associated with PAN (number) in ITD database. Thank you for using our services."

Stainless Steel Pans: Removing Dark Stains

You may want to see also

Check status by logging into the Income Tax portal

To check the status of your PAN-Aadhaar link, you can log in to the Income Tax e-filing portal. Here are the steps to do so:

Step 1: Log in to the Income Tax e-filing portal

Visit the e-Filing Portal Home page and click on 'Link Aadhaar' in the Quick Links section. You can also log in to the e-filing portal and click on 'Link Aadhaar' in the Profile section.

Step 2: Enter your PAN and Aadhaar Number

On the homepage, enter your PAN (Permanent Account Number) and Aadhaar (Unique Identification Number).

Step 3: Click on 'View Link Aadhaar Status'

After entering your PAN and Aadhaar numbers, click on the 'View Link Aadhaar Status' button.

Step 4: View the Link Aadhaar Status

On successful validation, a message will be displayed regarding your Link Aadhaar Status. If your Aadhaar is linked to your PAN card, the following message will be displayed: "Your PAN is already linked to the given Aadhaar." If your Aadhaar-Pan link is in progress, a message will inform you that your linking request has been sent to UIDAI for validation, and you should check the status later. If your Aadhaar is not linked with your PAN card, the following message will appear: "PAN not linked with Aadhaar. Please click on 'Link Aadhaar' to link your Aadhaar with PAN."

Additional Information:

If your PAN card is inoperative due to non-linking with your Aadhaar card, you can activate it by paying a fine of Rs.1,000 through the 'e-Pay Tax' option on the Income Tax e-filing portal. After paying the penalty, click on the 'Link Aadhaar' option and enter your PAN and Aadhaar numbers. Enter the Aadhaar number, mobile number, and OTP, and then click 'Validate'. Your request to link PAN-Aadhaar will be sent to the UIDAI, and the reactivation process will take around 30 days from the submission date.

Understanding the Significance of Oil Pan Drain Plug's O-Ring

You may want to see also

Check status via SMS

To check your PAN Aadhaar link status via SMS, you can follow these steps:

Firstly, it is important to note that for new applicants of the PAN card, the Aadhaar PAN linking is done automatically during the application stage. For existing PAN holders who were allotted PAN on or before 01-07-2017, it is mandatory to link PAN with Aadhaar by a specified date. If you do not link your PAN with Aadhaar by the specified date, your PAN will become inoperative, restricting you from making necessary financial transactions where PAN is mandatory.

To check the status of your PAN-Aadhaar link via SMS, you can use the following methods:

Method 1:

- Login to the e-Filing portal.

- Navigate to the 'e-Pay Tax' option under the 'e-File' menu.

- Pay the late fees (if applicable).

- Go to 'Profile Settings' on the Menu bar and click on 'Link Aadhaar'.

- Enter your Aadhaar number and click on 'Validate'.

- After validation, a pop-up message will inform you that your PAN-Aadhaar link request has been submitted successfully.

- Now, you can check the PAN Aadhaar link status by clicking on the 'Link Aadhaar Status' option.

Method 2:

- Visit the e-Filing portal homepage.

- Under the 'Quick Links' section, click on 'Link Aadhaar Status'.

- Enter your PAN and Aadhaar Number.

- Click on 'View Link Aadhaar Status'.

- On successful validation, a message will be displayed regarding your Link Aadhaar Status.

It is important to ensure that you have linked your correct Aadhaar with your PAN. If you face any issues or your Aadhaar is linked with the wrong PAN, you may need to contact your Jurisdictional Assessing Officer to submit a request for delinking and correcting the link.

Daiso Pans: Safe or Not?

You may want to see also

What to do if there's a mismatch in the details of your PAN and Aadhaar card

If there is a mismatch in the details of your PAN and Aadhaar card, you must rectify the discrepancies. The information provided on both cards, such as your name, date of birth, and gender, should be accurate and identical. If there are any errors, you can update your information by following the steps outlined below.

Updating your PAN card details:

- Visit the NSDL website and download the New PAN Form.

- Fill out all the necessary information.

- Include supporting documents, such as identification and address proofs, as well as passport-size photos.

- Submit the form at a local NSDL collecting facility.

Updating your Aadhaar card details online:

- Visit the official portal of SSUP.

- Select the fields that you need to change or update.

- Fill in those fields with accurate details.

- Submit the form, and the website will generate a Unique Request Number (URN).

- Select BPO for a review of the update and attach scanned copies of the original documents.

- Check your Aadhaar status using the provided URN.

Updating your Aadhaar card details offline:

- Go to the nearest Aadhaar enrolment centre.

- Provide your Aadhaar card and personal information to the executive.

- Complete the form and submit it along with the necessary documents.

- Provide your biometrics to authenticate the information.

- Once the information is verified, your original documents will be returned.

- After the procedure is completed, you will receive a receipt with an acknowledgment number.

- You can use the acknowledgment number to track the progress of your Aadhaar updates.

It is important to ensure that the details on your PAN and Aadhaar cards are consistent to avoid any issues with linking the two.

The Hawaiian Hot Pot: A Cultural Fusion Sensation

You may want to see also

How to pay the fees

The fee for linking your Aadhaar and PAN cards on the e-filing website is Rs. 1000. This fee has been in place since 1 July 2022.

To pay the fee, you can use the e-Pay Tax functionality available on the e-filing portal. Here are the steps to follow:

- Visit the e-Pay Tax page on the Income Tax e-Filing website.

- Enter your PAN, confirm PAN, and mobile number to receive an OTP.

- After OTP verification, you will be redirected to a page with different payment tiles.

- Click on the "Proceed" button on the Income Tax tile.

- Select the relevant Assessment Year and Type of Payment as Other Receipts (500).

- Enter the amount of Rs. 1000 under the "Others" field in the tax break-up and proceed to make the payment.

Once the payment is successful, you can then submit your Aadhaar-PAN link request on the e-Filing portal.

Payment methods

You can pay the late penalty on the Income Tax e-filing Portal using net banking, debit card, over the counter, NEFT/RTGS, or payment gateway option.

For the payment gateway option, you can use it if you bank with the following authorised banks:

- Central Bank of India

- Indian Overseas Bank

- Jammu & Kashmir Bank

- Punjab National Bank

- Union Bank of India

Hot Pot Harmony: Exploring the Perfect Ingredients for a Balmy Broth

You may want to see also