The e-PAN card is a digital version of the physical PAN (Permanent Account Number) card, which is issued by the Income Tax Department in India. It is a crucial document for all Indian citizens and is used for financial and tax-related activities. The e-PAN card can be obtained instantly and for free on the Income Tax website by anyone who does not already have a PAN card. To apply, individuals must be Indian residents, have a valid Aadhaar card with updated details, and have an active mobile phone number linked to their Aadhaar. The application process is simple and requires no physical documents. The e-PAN card is widely accepted as a valid proof of identity and can be used for various financial transactions, making it a convenient and secure option for Indian citizens.

| Characteristics | Values |

|---|---|

| Format | Digital |

| Application Process | Online |

| Application Time | 10 minutes |

| Application Requirements | Aadhaar number, mobile number linked with Aadhaar, updated details on Aadhaar |

| Applicant Type | Indian residents, individual taxpayers |

| Applicant Requirements | No existing PAN card |

| Cost | Free |

| Delivery | |

| Validity | Accepted as proof of identity, valid for a passport application, valid for bank transactions |

What You'll Learn

Applying for an e-PAN card

Eligibility Criteria:

Before applying, ensure you meet the following criteria:

- You must be an Indian resident.

- You must not already hold a PAN card.

- You must possess a valid Aadhaar card with updated and correct details.

- You must have an active mobile phone number linked to your Aadhaar card.

Application Process:

You can apply for an e-PAN card through the NSDL, UTIITSL, or Income Tax e-filing portal. Here's a general overview of the application process:

- Visit the website of your chosen portal: NSDL, UTIITSL, or Income Tax e-filing portal.

- Select the option for obtaining an e-PAN card. On the NSDL and UTIITSL websites, you will need to choose the option to not receive the physical PAN card.

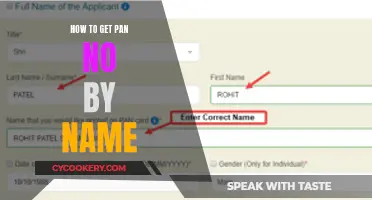

- Fill in the required details on the application form. Ensure that the information matches the details on your Aadhaar card.

- Upload any necessary documents as specified during the application process.

- Pay the required fees, if applicable.

- You will receive an acknowledgement number on your email or mobile phone, which you can use to track your application status.

- Once your PAN is allotted, the e-PAN card will be sent to your registered email address.

Instant e-PAN via Income Tax e-filing portal:

If you possess a valid Aadhaar number and fulfil the eligibility criteria, you can obtain an instant e-PAN card within 10 minutes through the Income Tax e-filing portal. Here's how:

- Log on to the Income Tax India e-filing website.

- Ensure you have the registered mobile number linked to your Aadhaar card.

- Click on the "Instant e-PAN" option.

- Enter the details as registered on your Aadhaar card, including your Aadhaar number.

- Enter the OTP sent to your registered mobile number.

- Upload a scanned copy of your signature (specified requirements may vary across portals).

- You will receive an acknowledgement number on your registered mobile number.

Downloading your e-PAN card:

You can download your e-PAN card from the portal where you applied. Here's a general overview of the process:

- Visit the relevant portal (NSDL, UTIITSL, or Income Tax e-filing portal).

- Enter the required details, such as acknowledgement number, PAN, date of birth, and/or Aadhaar number.

- Enter the OTP sent to your registered mobile number or email.

- Pay the applicable fees, if any. Typically, there is no fee for downloading within the first month of issuance.

- Download your e-PAN card in PDF format.

Your e-PAN card will be password-protected, and the password will be your date of birth in the format 'DDMMYYYY'.

Spaghetti Squash: Grease Pan with Olive Oil

You may want to see also

e-PAN card eligibility

The e-PAN card is a digital version of the physical PAN (Permanent Account Number) card, which is issued by the Income Tax Department. It is crucial for financial and tax-related activities in India and is widely accepted as a valid proof of identity.

To be eligible for an e-PAN card, you must fulfil the following criteria:

- Residency: You must be a resident of India to be eligible for an e-PAN card.

- Existing PAN Card: Individuals who already possess a PAN card are not eligible for an e-PAN card.

- Aadhaar Card: It is mandatory to have a valid Aadhaar card with updated and correct details.

- Mobile Number: You must have a registered and active mobile number linked to your Aadhaar card.

The e-PAN card is available to Indian citizens/companies/entities, and there is no minimum age requirement. Minors, as well as mentally challenged individuals (through their representatives), can also apply for an e-PAN card.

For foreign citizens/entities, the following eligibility criteria and documents are required to obtain an e-PAN card:

- Foreign Citizens/Individuals: Foreign individuals intending to engage in financial transactions in India must apply for an e-PAN card by submitting valid ID, address proof, and date of birth proof. They can furnish documents such as a passport, PIO card, OCI card, TIN or CIN (attested by the relevant authorities), a bank account statement from their country of residence, an NRE bank account statement held in India, a certificate showing their residence status in India, or a copy of their visa or appointment letter from an Indian company.

- Foreign Entities: Foreign entities can apply for an e-PAN card by submitting a photocopy of their registration certificate issued by the country in which they are situated, duly attested by the relevant Indian authorities. They must also provide a copy of their registration certificate issued in India or approval obtained from Indian authorities to set up a branch office in the country.

Ikea's Best Cabinet for Pots and Pans

You may want to see also

e-PAN card application process

The e-PAN card is a digital version of the physical PAN (Permanent Account Number) card, which is used for financial and tax-related transactions in India. The Income Tax Department issues the PAN card, which is an essential document for all Indian citizens. The e-PAN card is widely accepted as a valid proof of identity and can be used anywhere a PAN is required.

To apply for an e-PAN card, you must fulfil the following criteria:

- You must be an Indian resident.

- You must not already hold a PAN.

- You must have a valid Aadhaar Card with updated and correct details.

- You must have an active mobile phone number linked with your Aadhaar.

There are several ways to apply for an e-PAN card:

Instant e-PAN Card

An instant e-PAN card can be obtained in 10 minutes by visiting the Income Tax e-Filing portal and selecting the 'Instant e-PAN' option on the homepage. You will need to enter your Aadhaar number and the OTP received on your registered mobile number. The e-PAN card will then be sent to your email address. This service is free of cost.

NSDL or UTIITSL Website

Alternatively, you can apply for an e-PAN card on the NSDL or UTIITSL website. Here are the steps to follow:

- Visit the NSDL or UTIITSL website.

- Select the option to not receive the physical PAN card or choose 'e-PAN card' on the PAN card application.

- Enter the required details on the PAN application, upload the necessary documents, and submit the form.

- Pay the required fees and obtain the acknowledgement number.

- The e-PAN card will be sent to your email address.

Once you have submitted your e-PAN card application, you can check its status on the NSDL or UTIITSL website by entering the acknowledgement or application number and the captcha code.

After receiving your e-PAN card, you can download it from the NSDL or UTIITSL website by providing the required details, such as acknowledgement number, PAN, date of birth, etc. There is no fee for downloading the e-PAN card within 30 days of its allotment. However, a fee is applicable if you download it after 30 days.

Pan-Seared Chuck Roast Perfection

You may want to see also

e-PAN card download

The e-PAN card is a digital version of the physical PAN (Permanent Account Number) card, which is issued by the Income Tax Department in India. It is a crucial document for financial and tax-related activities in the country and is widely accepted as a valid proof of identity. The e-PAN card can be easily downloaded online and stored on digital platforms, making it a convenient and eco-friendly alternative to the physical card. Here is a step-by-step guide on how to download the e-PAN card:

Eligibility Criteria to Download e-PAN:

To download the e-PAN card, you must meet the following criteria:

- You must have selected the option of e-PAN or both physical PAN card and e-PAN while applying for your PAN card.

- If you applied for your PAN card through the NSDL (Protean) website, you can only download your e-PAN from the NSDL portal. Similarly, if you applied through the UTIITSL portal, you can only download your e-PAN from their website.

- New applicants and applicants who have applied for changes or corrections in their PAN data can download their e-PAN card free of cost up to three times from the NSDL or UTIITSL website within one month of PAN card issuance.

Steps to Download e-PAN Card:

Via NSDL Portal:

The NSDL portal offers two options for downloading the e-PAN card:

- Using the Acknowledgement Number: Visit the NSDL PAN portal and enter the Acknowledgement Number issued after submitting your PAN card application, along with other necessary details such as your date of birth. Enter the captcha code and click "Submit" to download your e-PAN card.

- Using PAN and Date of Birth: Visit the e-PAN downloading portal and enter the required details, including your PAN, Aadhaar number (for individuals), date of birth, and GSTN (if applicable). Agree to the terms and conditions, enter the security code, and click "Submit" to download your e-PAN card for free.

Via UTIITSL Portal:

- Visit the e-PAN downloading portal of UTIITSL and enter the required details, such as PAN, date of birth/incorporation, GSTIN (if applicable), and security code. Submit the application.

- Check the mobile number and email ID associated with your PAN and enter the security code. You will receive an OTP on your selected source (mobile number, email ID, or both).

- Enter the OTP and click "Submit". If it has been more than one month since your PAN card was issued, you will be directed to make an online payment of Rs. 8.26.

- After successful processing, you will be able to download your e-PAN card online.

Downloading e-PAN Card from the Income Tax Website:

- Visit the Income Tax website and click on "Instant E-PAN" under the Quick Links section.

- On the next page, click on "Get New e-PAN".

- Enter your Aadhaar number, agree to the terms and conditions, and click "Continue".

- On the OTP validation page, agree to the terms and conditions again and click "Continue".

- Enter the OTP received on your registered mobile number, accept the terms and conditions once more, and click "Continue".

- Validate your Aadhaar details and select "Continue".

- Once your details are submitted, you will see the acknowledgement number, and you will also receive an SMS on your registered mobile number.

Please note that the facility to download Instant E-PAN from the Income Tax website is only available for applicants with a valid Aadhaar who have never been allotted a PAN card before.

Password for e-PAN Card:

To open the downloaded e-PAN card PDF, you will need a password. The password is your date of birth in the format 'DDMMYYYY'.

Detecting Panning: The Art of Audio Analysis

You may want to see also

e-PAN card password

The e-PAN card is a digital version of the physical PAN (Permanent Account Number) card, which is an essential document for all Indian citizens. The Income Tax Department issues the PAN card, which is used for financial and tax-related activities. The e-PAN card can be downloaded from the NSDL or UTIITSL website and is accepted as a valid proof of identity.

When downloading the e-PAN card, individuals must ensure they select the option for the e-PAN card or both the physical and e-PAN card when filling out the application form. The e-PAN card can be downloaded for free up to three times within one month of issuance. After that, a small fee is charged for each download.

To open the downloaded e-PAN card PDF, individuals must enter a password. This password is the individual's date of birth or date of incorporation, as written on the PAN card application form, in the format DDMMYYYY. For example, if an individual's date of birth is 05/07/1995, their password will be 05071995. This password is essential to protect personal information and prevent unauthorised access.

The process to download the e-PAN card and access it using the password is as follows:

- Visit the Download e-PAN Card portal and enter your 10-digit PAN number.

- Enter the necessary details, including your Aadhaar number and date of birth/incorporation (GSTN number is optional).

- Tick the Aadhaar acceptance box, enter the Captcha code, and submit.

- If prompted, enter the acknowledgement number and any generated OTP.

- Click 'Download PDF'.

- The e-PAN will be downloaded to your device. To open the PDF, enter your PAN password in the DDMMYYYY format.

The e-PAN card and its password provide a convenient and secure way for Indian citizens to access and use their PAN card digitally, eliminating the need to carry the physical card everywhere.

Personal Pan Pizzas: Still on Pizza Hut's Menu?

You may want to see also

Frequently asked questions

To apply for an e-PAN card, you must be an Indian resident, an individual taxpayer, not have an existing PAN, have a valid Aadhaar card with updated and correct details, and have a mobile number linked to your Aadhaar.

The process to apply for an e-PAN card can be done online through the NSDL, UTIITSL, or Income Tax e-filing portal. On the respective websites, you will need to select the option for applying for an e-PAN card, fill in the required details, and submit the necessary documents. For the Income Tax e-filing portal, you can obtain an instant e-PAN card by providing your Aadhaar number and the OTP sent to your registered mobile number.

The instant e-PAN card applied for on the Income Tax website is free of cost. However, a fee is applicable when applying through the NSDL or UTIITSL website. The fee structure varies depending on the submission method of required documents, with a higher fee for physical submission compared to paperless mode.