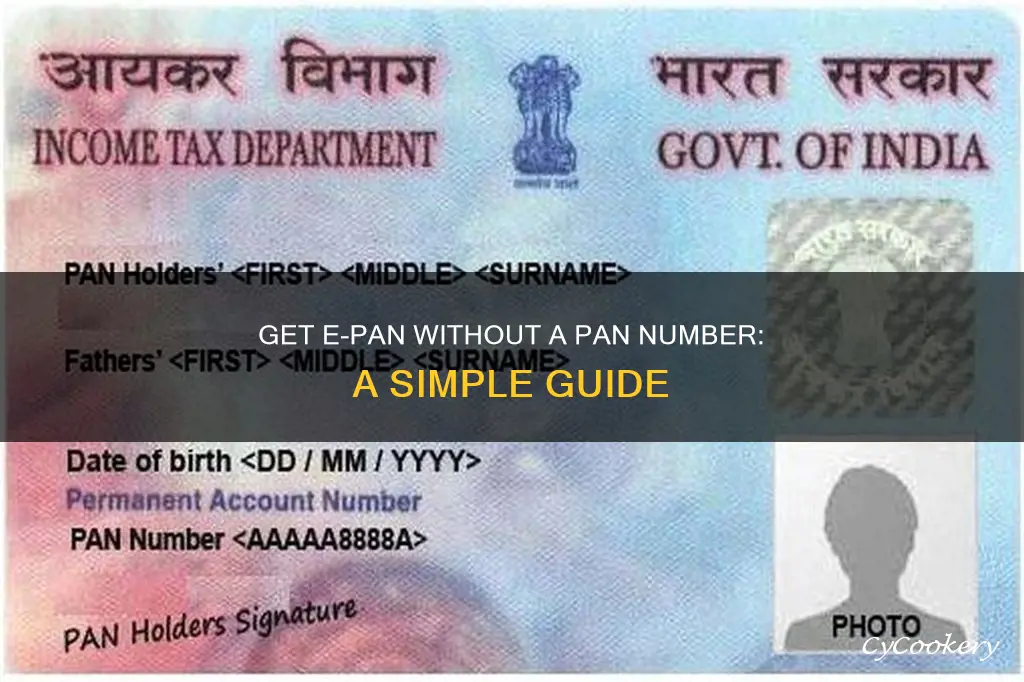

The Permanent Account Number (PAN) is a crucial document for all Indian citizens. It is a 10-digit alphanumeric code used for various identity and financial transactions. The Income Tax Department issues the PAN card, which is mandatory for all tax-paying entities in India. The e-PAN card is the digital version of the physical PAN card, offering a swift and eco-friendly alternative. It is widely accepted as a valid proof of identity and can be used for bank transactions and even a passport application. An instant e-PAN card can be obtained for free in just 10 minutes by individuals with a valid Aadhaar number and an active mobile number linked to their Aadhaar. Notably, this process does not require any physical documents or in-person verification. However, it is important to remember that possessing more than one PAN card is illegal in India.

| Characteristics | Values |

|---|---|

| Who can apply for an e-PAN card? | Indian resident, does not hold a PAN, has an Aadhaar card, has an active mobile phone number linked to Aadhaar, has updated and correct details on Aadhaar |

| Where to apply for an e-PAN card? | NSDL or UTIITSL website, Income Tax e-Filing portal |

| Documents required | Aadhaar number, OTP received on the registered mobile number |

| Time taken to allot e-PAN card | 10 minutes |

| Fee for e-PAN card | Free of cost |

| Mode of receiving e-PAN card | Sent to the applicants' email |

| Format of e-PAN card | |

| Password for e-PAN card | Date of birth in DDMMYYYY format |

What You'll Learn

Using the NSDL portal

The NSDL e-PAN download service allows individuals to obtain a digital copy of their Permanent Account Number (PAN) card online through the National Securities Depository Limited (NSDL) portal. This process is secure and straightforward, ensuring the security and authenticity of your e-PAN card.

To download your e-PAN card through the NSDL portal, follow these steps:

- Visit the official NSDL website and navigate to the e-PAN section, which is designed for electronic PAN card services.

- Click on the 'e-PAN download' option and provide the necessary details, including your PAN card number, date of birth, and Aadhaar details. Ensure that the information you enter is accurate.

- You will receive an OTP on your registered mobile number. Enter this OTP to validate your identity and proceed to the next step.

- NSDL will authenticate your details against the Aadhaar database. Ensure that your Aadhaar details are up to date for a smooth authentication process.

- Once the authentication is successful, you will be directed to the download section. Click on the 'Download e-PAN' option, and your electronic PAN card will be saved to your device.

It is important to note that e-PAN cards can be downloaded free of charge within 30 days of issuance. After this period, a fee of Rs. 8.26 is applicable for each download. Additionally, you can opt to receive your e-PAN card on your registered email ID up to three times for free if your latest application was processed through Protean.

If you have applied for an e-PAN card through the NSDL portal and do not have your PAN number yet, you can still download your e-PAN. Here's how:

- Access the NSDL portal and select the "Acknowledgement Number" option.

- Enter the acknowledgement number, date of birth, and captcha code.

- Verify your identity by entering the OTP sent to your registered mobile number.

- Proceed to download your e-PAN card.

Alternatively, if you have your PAN number, you can follow these steps:

- Access the NSDL portal and select the "PAN" option.

- Enter your PAN number, date of birth, Aadhaar number (if applicable), and captcha code.

- Verify your identity by entering the OTP.

- Download your e-PAN card.

The downloaded e-PAN card will be in a password-protected PDF format. The password to open the file is typically your date of birth in the DDMMYYYY format.

When to Season Your Non-Stick Pan

You may want to see also

Using the UTIITSL portal

The UTIITSL portal can be used to apply for a new PAN card or to make corrections to an existing one. The process is paperless and can be done without manual submission.

To apply for a PAN card using the UTIITSL portal, you must use the Aadhaar-based e-KYC services. First, fill in the basic details in the application form. Once you have submitted the application, you will be redirected to the payment gateway. After successful payment, Aadhaar authentication will take place. If the authentication is successful, an OTP will be generated and sent to your Aadhaar-registered mobile number. After successful authentication of the OTP, your address details will be fetched from the UIDAI and populated in the PAN form. After successful completion of the e-KYC process, you will need to verify the application data and provide any other necessary information before submitting.

If you are applying for a PAN card through the UTIITSL portal, you can download your e-PAN card online. To do this, visit the e-PAN downloading portal of UTIITSL. Enter the required details, such as your PAN, date of birth, GSTIN (if applicable), and the security code, then submit the application. Check that the mobile number and email ID are correct, enter the security code, and tick the declaration. You will then be given the option to send the OTP to either your mobile number, email ID, or both. After entering the OTP and submitting, if your PAN card was issued more than one month ago, you will be directed to make an online payment of Rs. 8.26. Once the payment has been processed, you will be able to download the e-PAN card online.

If you are applying for a Reprint of your PAN card (with no changes to the PAN data), you can do so through the UTIITSL website. You will need to apply and pay a fee of Rs. 50 for delivery to an Indian address or Rs. 959 for delivery to a foreign address.

It is worth noting that if you apply for your PAN card through the UTIITSL portal, you can only download your e-PAN from the UTIITSL website.

Copper Pans: Safe or Not?

You may want to see also

Using the Income Tax e-filing portal

The Instant e-PAN service is available to all Indian taxpayers who do not have a Permanent Account Number (PAN) but possess an Aadhaar card. Here is a step-by-step guide on how to use the Income Tax e-filing portal to obtain an e-PAN:

Generate New e-PAN

- Step 1: Go to the e-Filing portal homepage and click Instant e-PAN.

- Step 2: On the e-PAN page, click Get New e-PAN.

- Step 3: On the Get New e-PAN page, enter your 12-digit Aadhaar number, select the confirmation checkbox, and click Continue.

- If your Aadhaar is already linked to a valid PAN, a message will inform you of this. If your Aadhaar is not linked with any mobile number, another message will inform you of this.

- Step 4: On the OTP validation page, click the checkbox to confirm that you have read the consent terms, then click Continue.

- Step 5: On the next OTP validation page, enter the 6-digit OTP received on the mobile number linked with Aadhaar, select the checkbox to validate the Aadhaar details with UIDAI, and click Continue.

- You will have 3 attempts to enter the correct OTP, which will be valid for 15 minutes.

- Step 6: On the Validate Aadhaar Details page, select the I Accept checkbox and click Continue.

- Linking or validating your email ID (registered with your Aadhaar) is optional. If you wish to validate your email, click Validate Email, enter the 6-digit OTP received on your mobile number linked with Aadhaar, and click Continue. If you need to link your email, click Link Email ID, enter the 6-digit OTP, and click Continue.

- Upon successful submission, you will see a success message along with an Acknowledgement Number. You will also receive a confirmation message on your mobile number linked with Aadhaar.

Update PAN details as per Aadhaar e-KYC

- Step 1: Go to the e-Filing portal homepage and click Instant e-PAN.

- Step 2: On the e-PAN page, click Update PAN.

- Step 3: On the Update PAN Details page, enter your 12-digit Aadhaar number, select the confirmation checkbox, and click Continue.

- If your Aadhaar is already linked to a valid PAN, a message will inform you of this. If your Aadhaar is not linked with any mobile number, another message will inform you of this.

- Step 4: On the OTP Validation page, enter the 6-digit OTP received on your mobile number registered with Aadhaar and click Continue.

- The OTP will be valid for 15 minutes, and you will have 3 attempts to enter the correct code.

- Step 5: After OTP validation, Aadhaar e-KYC details will be displayed alongside the details registered with PAN. Select the details to be updated as per Aadhaar e-KYC by clicking on the respective checkboxes, then click Continue.

- Please note that only the following details can be updated: date of birth, mobile number (updated by default), and email ID (which must be validated).

- Step 6: After selecting all the details you want to update, click Confirm.

- On confirmation, a success message will be displayed with an Acknowledgement Number. You will also receive a confirmation message on your mobile number and email ID linked with Aadhaar.

Check the status of your e-PAN request, create an e-Filing Portal account, or download e-PAN

- Step 1: Go to the e-Filing portal homepage and click Instant e-PAN.

- Step 2: On the e-PAN page, click Continue on the Check Status/Download PAN option.

- Step 3: On the Check status/Download PAN page, enter your 12-digit Aadhaar and click Continue.

- Step 4: On the OTP Validation page, enter the 6-digit OTP received on your mobile number registered with Aadhaar and click Continue.

- Step 5: On the Current status of your e-PAN request page, you will be able to see the status of your e-PAN request. If your new e-PAN has been generated and allotted, click View e-PAN to view or Download e-PAN to download a copy. Click Create e-Filing Account to register on the e-Filing portal.

- Note: If you did not validate your email ID (as per your Aadhaar KYC) when generating your e-PAN, or while updating PAN details, you must do so during registration.

Download e-PAN – Post Login

Step 1: Log in to the e-Filing portal using your User ID and password.

Bug Bodies: Weighing the Parts

You may want to see also

Using the NSDL e-Gov portal

The NSDL e-Gov portal (now Protean eGov Technologies) is a platform that offers a range of services related to Permanent Account Number (PAN) cards. Here is a step-by-step guide on how to use the NSDL e-Gov portal to obtain an e-PAN:

Step 1: Visit the NSDL e-Gov portal

Go to the official website of NSDL e-Gov, which is now known as Protean eGov Technologies. The URL for the portal is https://www.onlineservices.nsdl.com/.

Step 2: Select the "Instant e-PAN" option

On the homepage of the NSDL e-Gov portal, look for the "Instant e-PAN" option, which is usually listed under the "Quick Links" or "e-Filing" section. Click on this option to initiate the process of obtaining your e-PAN.

Step 3: Provide your Aadhaar details and accept the terms

On the "Instant e-PAN" page, you will be required to enter your 12-digit Aadhaar number. Review and accept the terms and conditions provided, and then click on the "Continue" button. Ensure that your Aadhaar details, including your mobile number, are up to date and accurate.

Step 4: Enter the OTP and validate

You will receive a One-Time Password (OTP) on your mobile number registered with Aadhaar. Enter this 6-digit OTP on the NSDL e-Gov portal and click "Continue". You may have up to three attempts to enter the correct OTP, and it will be valid for 15 minutes.

Step 5: Validate Aadhaar details and submit

Review and validate your Aadhaar details, including your name, date of birth, and other personal information. Select the "I Accept" or "I Confirm" checkbox, as applicable, and then click "Continue" to submit your request.

Step 6: Receive the acknowledgement number

Once your e-PAN request is submitted, you will receive an acknowledgement number. Make a note of this acknowledgement number, as it will be useful for future references and tracking the status of your e-PAN application.

Step 7: Download the e-PAN

After submitting your application, you can download your e-PAN card from the NSDL e-Gov portal. Visit the portal and navigate to the "Download e-PAN" section. Enter the required details, such as your acknowledgement number, PAN, date of birth, and/or Aadhaar number. You may also need to enter an OTP and pay a fee for downloading the e-PAN after 30 days of its allotment.

It is important to note that the NSDL e-Gov portal allows you to download your e-PAN card free of cost up to three times within one month of PAN card issuance. After that, a fee of Rs. 8.26 (including taxes) is charged for each download request.

Additionally, if you have not validated your email ID during the application process, you must do so at the time of registration to download your e-PAN.

By following these steps, you can conveniently obtain your e-PAN using the NSDL e-Gov portal without the need for a physical PAN card or a PAN number.

Potato Salad Safe in Aluminum?

You may want to see also

Using the Aadhaar number

If you do not have a PAN number but want to obtain an e-PAN, you can do so using your Aadhaar number. Here is a step-by-step guide:

Eligibility:

To be eligible for an instant e-PAN using your Aadhaar number, you must:

- Not have been previously allotted a PAN card.

- Be above the age of 18 (not a minor) at the time of application.

- Have a valid Aadhaar number with an active mobile number linked to it.

- Have your full date of birth (DD/MM/YY) on your Aadhaar card.

- Not fall under the category of Representative Assessee as per section 160 of the Income Tax Act.

Step-by-Step Process:

- Visit the official e-filing homepage of the IT department (www.incometax.gov.in).

- Click on the 'Instant E-PAN' option under the 'Quick Links' section of the homepage.

- Click on the 'Get New PAN' or 'Get New e-PAN' button.

- Enter your 12-digit Aadhaar number, select the 'I confirm that' checkbox, and click 'Continue'.

- On the OTP validation page, tick the checkbox to accept the terms and conditions, and click 'Continue'.

- Enter the 6-digit OTP received on your mobile number linked with Aadhaar, select the checkbox to validate the Aadhaar details with UIDAI, and click 'Continue'.

- If your email ID is not validated, click on 'Validate email ID', select the checkbox, and click 'Continue'.

- You will receive an acknowledgement number once your Aadhaar details are submitted for validation.

Check Status/Download Instant e-PAN:

- Visit the official e-filing homepage of the IT department (www.incometax.gov.in) again.

- Click on the 'Instant E-PAN' option under the 'Quick Links' section.

- Click on the 'Check Status/Download PAN' button.

- Enter your valid Aadhaar number and captcha code, and click 'Submit'.

- Validate your request by entering the OTP received on your registered mobile number within the specified time limit.

- You will be redirected to a new page where you can check the status of your PAN allotment request.

- If the PAN allotment was successful, a PDF link will be generated within 10 minutes to download your PAN file.

Note: The PDF file containing your PAN is password-protected. The password to open the PDF file is your date of birth in the format 'DDMMYYYY'.

Restore Stainless Steel: Removing Brownish Discoloration

You may want to see also

Frequently asked questions

You can download a duplicate PAN card through the 'Know your PAN' facility on the official website of the Income Tax Department of India.

You can download an e-PAN card without an Acknowledgement Number by entering your name, date of birth, GSTIN (if applicable), Aadhaar Number (only for individuals and when downloading through the NSDL portal) and other details through the NSDL e-Governance (Protean) and/or UTIITSL website.

If you are new to the PAN ecosystem and have never possessed a PAN card before, you can download an instant ePAN online via the Income Tax department website.

If you have lost your PAN card and do not remember your PAN, you can download a copy of your PAN card from the official website of either NSDL or UTIITSL.