The Employees' Provident Fund (EPF) is a savings scheme that helps working professionals build their savings throughout their careers. It is a mandatory contributory fund for all employed professionals in India. To monitor their EPF accounts, employees must know their EPF account number, which is also required for EPF withdrawals.

If an employee does not receive their EPF account number from their employer, they can find it in several ways. One way is to check their salary slip, as employers often print the EPF account number on it. Employees can also contact their company's Human Resources (HR) department to request their EPF account number. Alternatively, employees can visit the Employees' Provident Fund Organisation (EPFO) office and provide the necessary identification documents to obtain their EPF account number.

Another way to find the EPF account number is by using the Universal Account Number (UAN). The UAN is a 12-digit unique code provided to EPF holders, which can be used to log in to the UAN portal and access all PF-related information, including the EPF account number.

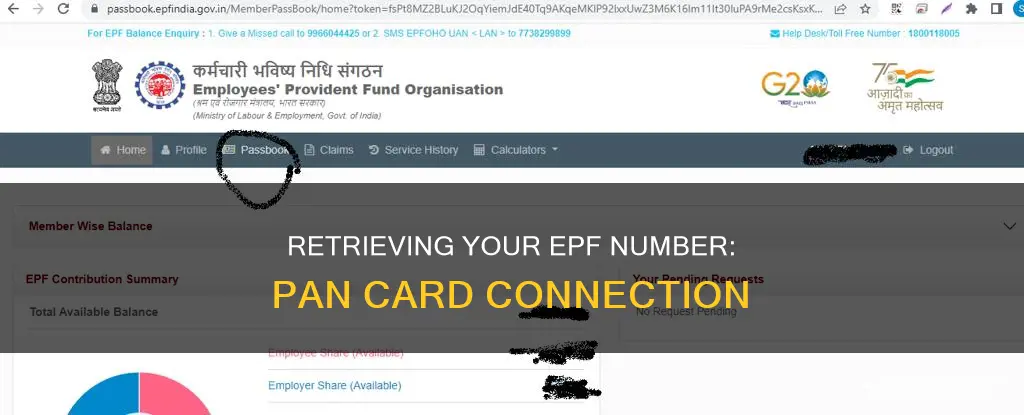

Additionally, employees can find their EPF account number using their Permanent Account Number (PAN) card details. By logging in to the EPF portal and entering their PAN details, name, date of birth, mobile number, and CAPTCHA code, they can obtain their UAN, which will help them access their EPF account number.

| Characteristics | Values |

|---|---|

| What is EPF Number? | A unique identification assigned to every individual enrolled in the Employee Provident Fund (EPF) scheme. |

| Why is EPF Number Important? | To track and manage provident fund transactions, check PF balance, etc. |

| How to get EPF Number? | Check salary slip, consult the HR department, use the UAN portal, visit the regional office, use the UMANG app, etc. |

| EPF Number Format | A 22-digit alphanumeric identifier containing vital information about the employee's EPF account activities and the organisation's code. |

| How to find EPF Number using PAN? | Visit the EPF portal, enter PAN details, name, DOB, mobile number, and CAPTCHA code, click on 'Get Authorisation PIN', enter OTP, and click on 'Validate OTP and Get UAN'. |

What You'll Learn

Log in to the EPFO online portal using your UAN and password

To log in to the EPFO online portal, you will need your UAN and password. If you do not have a password, you can create one by visiting the EPFO member portal and clicking on "Activate UAN". You will need to provide personal details such as your UAN/member ID, Aadhaar number, date of birth, name, mobile number, and captcha code. Once you enter the required details and submit them, an authorisation PIN will be sent to your registered mobile number. Enter the PIN to validate your details and complete the UAN activation.

Once your UAN is activated, you can log in to the EPFO online portal by following these steps:

- Go to the EPFO Unified Login portal.

- Under the 'Services' section, click on 'For Employees'.

- As the new dashboard opens, go to 'Member UAN/Online Services' in the 'Services' section. You can also go directly to the EPFO Member Portal/e-SEWA Portal.

- On the login page, enter your UAN, password, and captcha code. Click on 'Sign In'.

- Fill in the 6-digit OTP that you will receive on your registered mobile number, along with the captcha code, and click on the 'Submit' button to complete the second-factor authentication and log in to your EPF account.

Note that you can only log in using your UAN if it has been activated. If it hasn't been activated yet, click on 'Activate UAN' and follow the instructions as mentioned above. Once your UAN is activated, you can log in to the EPFO member portal at any time to check your Provident Fund balance, claim status, or perform a partial PF withdrawal.

Additionally, if you have forgotten your password, you can reset it by visiting the EPFO/UAN member e-Sewa Portal and clicking on the 'Forgot Password' option.

Steel Pan: What Qualifies as Stainless?

You may want to see also

From the main menu bar, click on 'Manage', followed by 'KYC'

To get your EPF number from your PAN number, you will need to follow these steps:

- Log in to the EPF portal.

- Enter your PAN number, name, date of birth, mobile number, and CAPTCHA code.

- Click 'Get Authorisation Pin'.

- Click 'I Agree' and enter the One-time password (OTP) received through email and the registered mobile number associated with your PAN card.

- Finally, click on 'Validate OTP and Get UAN'.

Your UAN, or Universal Account Number, is a 12-digit ID issued to eligible employees by the EPFO. This number remains the same throughout an individual's career, even if they switch jobs, and facilitates the seamless transfer and withdrawal of PF funds.

Now, from the main menu bar, click on 'Manage', followed by 'KYC'. Here, you will be able to view and update your KYC information.

KYC, or Know Your Customer, is the process of verifying the identity and address of customers. This process is essential to ensure the security of your EPF account and to prevent any unauthorised access. During the KYC process, you will be required to provide proof of identity and address. This can include documents such as your PAN card, Aadhaar card, passport, driver's license, utility bills, or bank statements.

It is important to keep your KYC information up to date, as it may impact your ability to access and manage your EPF account. You can update your KYC information by following these steps:

- Log in to your EPF account using your UAN and password.

- From the main menu bar, click on 'Manage', followed by 'KYC'.

- Here, you will be able to view and update your personal information, including your name, date of birth, address, and contact details.

- Make the necessary changes and submit the updated information.

- Your KYC update request will then be processed, and you will receive a notification once it has been approved.

It is recommended to review and update your KYC information periodically to ensure its accuracy and to avoid any disruptions in accessing your EPF account.

Baking Pan Size: 15 x 10 Dimensions

You may want to see also

Enter your PAN and name as it appears on your PAN card

To get your EPF number from your PAN card, you will need to visit the EPF portal. Once you are on the EPF portal, you will need to enter your PAN details, name, date of birth, mobile number, and CAPTCHA code. It is important that you enter your name exactly as it appears on your PAN card. After entering all the required information, click on the 'Get Authorisation PIN' button.

Next, click on the 'I Agree' button and enter the One-Time Password (OTP) that you will receive on your registered email and mobile number. Finally, click on 'Validate OTP and Get UAN'. This will provide you with the UAN number on your registered mobile number.

The UAN, or Universal Account Number, is a 12-digit ID issued to eligible employees by the EPFO. It remains the same throughout an individual's employment life, even if they switch jobs. It is important to have your UAN to monitor your EPF account details, such as checking your balance, retrieving statements, and initiating withdrawals.

Additionally, you can use your UAN to log in to the UAN portal and access all your PF-related information. You can also access your account on the UMANG app by logging in with your UAN and selecting the EPF service.

Aluminum Pans: How Much Can They Hold?

You may want to see also

Click 'Save'

Once you have entered your PAN details, name, date of birth, mobile number, and Captcha code on the EPF portal, you will need to click on the 'Get Authorisation PIN' button. This will prompt the system to send an OTP to your registered email address. After entering the OTP, you will need to click on 'I Agree' and then finally, click on 'Validate OTP and Get UAN'. This will provide you with the UAN number on your registered mobile number.

Clicking on 'Validate OTP and Get UAN' is the final step in the process of finding your UAN number through the EPF portal. This step is crucial as it authenticates your identity and ensures that your personal information is secure. By clicking on this button, you are authorising the EPF portal to verify your details and provide you with your unique UAN number.

The UAN, or Universal Account Number, is an important identifier for individuals with EPF accounts. It remains constant throughout an individual's employment journey, irrespective of the number of job changes. The UAN helps simplify PF transactions by allowing individuals to manage all their PF accounts in one place. It also provides access to various online services, such as viewing and downloading the PF passbook, updating KYC details, and applying for PF withdrawals.

Therefore, it is essential to keep your UAN secure and safely stored. If you cannot recall your UAN, you can retrieve it by visiting the EPFO homepage and selecting the appropriate options, or by contacting the UAN customer care service through their toll-free number or email address.

UV Rays: Safe for Plastic Drip Pans?

You may want to see also

Your PAN will be linked to your EPF account

Linking your PAN with your EPF account is a crucial step towards better financial management and offers a host of benefits. Here's a comprehensive guide on how to link your PAN with your EPF account.

Online Method:

- Log in to the EPFO online portal using your UAN and password.

- From the main menu bar, click on 'Manage' followed by 'KYC'.

- You will be redirected to the 'KYC' page, where you will find a list of documents to be updated under the 'Document type' option.

- Click on 'PAN' and enter your PAN number and name as it appears on your PAN card.

- Click on 'Save'.

- If the details entered are correct, they will be automatically verified with the Income Tax Department, and your PAN will be linked to your EPF account.

- Once your PAN is successfully linked, you will be able to find it on the homepage of the EPFO portal under the 'Manage Profile' tab.

Offline Method:

- Visit your nearest EPFO branch and ask the concerned official for an EPF-PAN linking form.

- Fill in all the required fields, such as your PAN, UAN, name, etc., in the form.

- Self-attest a copy of your PAN card and UAN and submit it along with the EPF-PAN linking form.

- After submitting the above documents, your application will be verified, and your PAN will be linked to your EPF account after approval.

- The status of your EPF-PAN linking will be notified to you via phone and email.

Benefits of Linking PAN with EPF Account:

Linking your PAN with your EPF account offers several advantages, including:

- Streamlined tax deductions.

- Simplified financial record-keeping.

- Compliance with income tax regulations.

- Easy redressal of compliance and grievance for employees.

- Availability of online services provided by EPFO.

- Faster claim settlement.

- Promotion of voluntary compliance.

- Long-term savings for retirement.

- Ability to transfer EPF corpus when switching jobs.

- A major tax-saving instrument.

Wilton Ball Pan: How Much Batter?

You may want to see also