The Goods and Services Tax Identification Number (GSTIN) is a 15-digit state-specific unique number that is mandatory for companies with an annual turnover of Rs. 20 lakhs or more. It is used for all GST-related transactions and compliance. GSTIN is made up of the state code, PAN, entity code, and a check digit. GST registration can be done online through the GST portal, and the GSTIN can be found using the PAN. This tool is useful for businesses and individuals to verify the GST registration details of their suppliers or customers.

| Characteristics | Values |

|---|---|

| GSTIN | A 15-digit state-specific unique number consisting of state code, PAN, entity code, and check digit |

| GSTIN Search by PAN | A tool to help businesses and individuals verify the GST registration details of their suppliers or customers |

| Benefits of GSTIN Search by PAN | Verify the legitimacy of a business, locate the state in which the business is active, avoid errors in GST-related transactions |

| GST Number Search Process | Visit GST portal, click on "Search Taxpayer", select "Search by PAN", enter PAN number and captcha code, click "Search" |

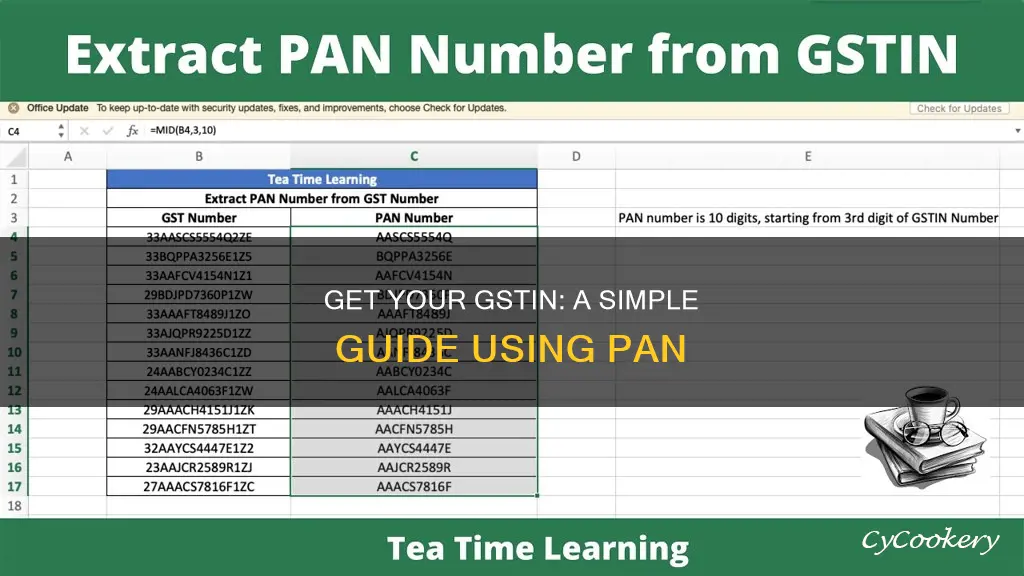

| GSTIN Format | First 2 digits: state code. Next 10 digits: PAN. 13th digit: entity code. 14th digit: "Z". 15th digit: check code |

| GST Registration | Mandatory for companies with an annual turnover of Rs. 20 lakhs or more engaging in buying and selling of goods and services |

| GST Application Process | Online application through the GST portal. Applicants must provide necessary documents and details |

| GST Compliance | Registered taxpayers must regularly file GST returns, including sales, purchases, and tax liability details |

| GSTIN Verification | GSTIN Search by Name or GSTIN Search by PAN on the official GST portal |

What You'll Learn

Visit the GST portal

To get started with GST registration, you must first register your company. The GST registration is primarily conducted online through the GST portal. Here is a step-by-step guide on how to get started:

The first step is to visit the GST department's official portal. You can do this by simply searching for the GST Official Portal online. Once you are on the homepage, you will see the Services tab. Click on this tab, and you will find a header named "Registration". This will give you three options: "New Registration", "Track Application Status", and "Application for Filing Clarifications".

Click on the "Search Taxpayer" Tab

After navigating to the GST portal and selecting the "Services" tab, you will then click on the "Search Taxpayer" tab on the portal's homepage. This will allow you to search for the GSTIN data of a particular taxpayer.

Select the "Search by PAN" Option

Under the "Search Taxpayer" menu, you will find the Search by PAN option. Select this option if you want to search for a GSTIN using the PAN (Permanent Account Number).

Enter the Taxpayer's PAN and Captcha Code

In the field provided, enter the PAN of the taxpayer whose GSTIN you wish to find. Make sure to enter the PAN correctly to avoid any errors in the search results. Additionally, you may need to enter a captcha code or security verification to proceed.

Click on "Search"

After entering the PAN and captcha code, click on the "Search" button. The website will then display the details of the GSTIN registration associated with the provided PAN. You will be able to see the list of GSTINs linked to the PAN, along with their status and any additional details.

By following these steps, you can easily find the GSTIN of a taxpayer using their PAN through the GST portal.

Pampered Chef: Lifetime Warranty?

You may want to see also

Click on the Search Taxpayer tab

Clicking on the "Search Taxpayer" tab will direct you to a new page where you will be given two options: to search for a GST number without logging in or after logging in.

Searching for a GST Number Without Logging In:

Step 2: Click the “Search taxpayer” tab on the portal’s homepage.

Step 3: Select the “Search by PAN” option under the menu search taxpayer.

Step 4: Enter the taxpayer’s PAN, followed by the captcha code reflecting on the screen.

Step 5: Click on “Search”. The website will display the details of the GSTIN registration associated with the provided PAN.

Searching for a GST Number After Logging In:

Step 1: Log in with your valid credentials.

Step 2: Click the “Search taxpayer” tab on the portal’s homepage.

Step 3: Select the “Search by PAN” option, which is under the menu search taxpayer.

Step 4: Enter the PAN of the taxpayer whose details need to be searched, and click on the “Search” button.

Step 5: The details that have been searched will be displayed on the next page.

The Quick Fix: Smoothing Out a Cast Iron Pan

You may want to see also

Select the Search by PAN option

To identify a person's GSTIN (Goods and Services Tax Identification Number) based on their PAN (Permanent Account Number), follow these steps:

Step 1:

Visit the GST portal.

Step 2:

Click on the "Search Taxpayer" tab.

Step 3:

Select the "Search by PAN" option.

Step 4:

Enter the PAN number of the dealer/taxpayer and the captcha code reflecting on the screen.

Step 5:

Click on "Search". The website will display the GSTIN registration details associated with the provided PAN.

Step 6:

Click on any one of the hyperlinked GSTINs. The page will then redirect to the 'Search by GSTIN' page, with the GSTIN auto-filled.

Step 7:

Enter the captcha code and click on the 'Search' button again. Further details of the business registered with the specific GSTIN will be displayed.

This process allows for easy verification and matching of GSTIN, which is a 15-digit state-specific unique number consisting of the state code, PAN, entity code, and a check digit. GSTIN is crucial for consolidating tax-related payments and records onto a unified platform, simplifying tax administration for both tax authorities and taxpayers.

Standard 9x13 Pan Serves How Many?

You may want to see also

Enter the PAN number and captcha code

To get started, visit the GST portal.

Step 1: Visit the GST Portal

The GST portal offers a convenient feature to search for GSTIN data using the PAN (Permanent Account Number). GST registration is mandatory for companies with an annual turnover of Rs. 20 lakhs or more, who engage in the buying and selling of goods and services.

Step 2: Click on the "Search Taxpayer" Tab

Once you are on the GST portal, you will need to click on the "Search Taxpayer" tab. This will allow you to search for specific taxpayer information.

Step 3: Select the "Search by PAN" Option

Under the "Search Taxpayer" menu, you will find the "Search by PAN" option. Select this option to specify that you want to search using a PAN number.

Step 4: Enter the PAN Number and Captcha Code

In the designated field, enter the PAN number of the dealer or taxpayer whose details you wish to search. You will also need to enter the captcha code reflecting on the screen. A captcha code is a type of challenge-response test used to differentiate between real users and automated bots. It typically involves tasks that are easy for humans but difficult for bots, such as identifying distorted or stretched letters or numbers.

Step 5: Click on "Search"

After entering the PAN number and captcha code, click on the "Search" button. The website will then display the details of the GSTIN registration associated with the provided PAN.

Additional Steps:

If you are looking for further details on the business registered with a specific GSTIN, you can follow these additional steps:

Step 6: Click on a Hyperlinked GSTIN

Once the search results are displayed, you can click on any one of the hyperlinked GSTINs. This will redirect you to the "Search by GSTIN" page, with the GSTIN auto-filled.

Step 7: Enter the Captcha Code and Click "Search"

On the "Search by GSTIN" page, enter the captcha code and click on the "Search" button. This will display further details of the business registered with the specific GSTIN.

By following these steps, you can easily verify the GSTIN of a person or business using their PAN number and the corresponding captcha codes.

Get Rid of Water Spots: Pan Perfection

You may want to see also

Click Search

Once you have entered the website www.gst.gov.in in your browser, you will be directed to the GST portal. Here, you will find the “Search Taxpayer” tab on the homepage. Click on this tab.

You will then be given the option to "Search by PAN". Select this option.

Now, you will be prompted to enter the PAN of the taxpayer whose details you wish to search. Enter the PAN in the field provided and then enter the captcha text or code in the box provided.

Finally, click on "Search". The website will then display the GSTIN details of the taxpayer.

Aluminum Cookware: Worth a Fortune?

You may want to see also

Frequently asked questions

Visit the GST portal and enter the PAN number on the GST search tool. The GSTIN of a person can be identified based on their Permanent Account Number (PAN).

The Goods & Service Tax Identification Number (GSTIN) is a 15-digit state-specific unique number consisting of a state code, PAN, entity code, and check digit.

Consumers can verify the legitimacy of a business by using the GSTIN search by PAN tool. They can also use it to locate the state in which the vendor's business is active. Dealers can avoid errors by verifying the GST number via the PAN.