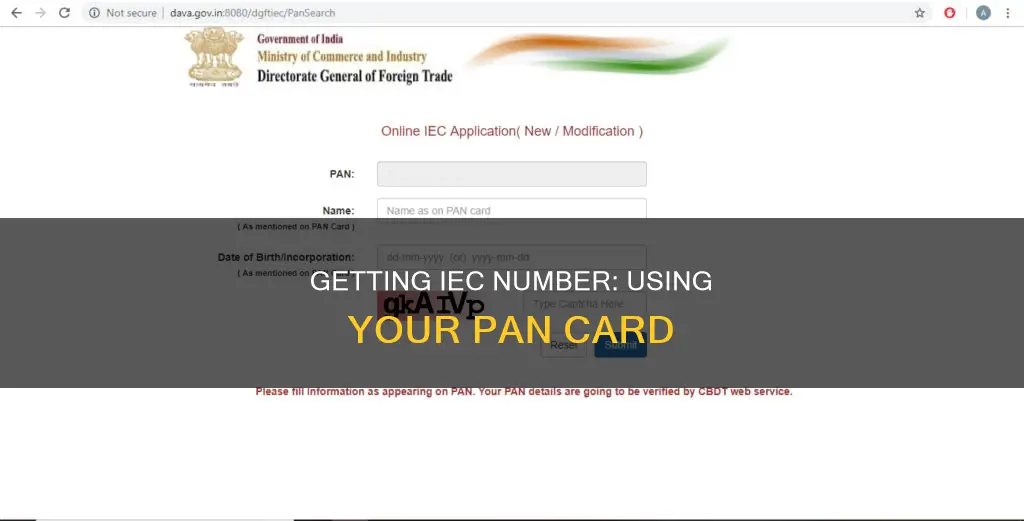

The IEC, or Importer Exporter Code, is a 10-digit code number issued to exporters or importers by the regional office of the Director-General of Foreign Trade (DGFT). It is required for customs clearance, banking transactions, and export benefits. To obtain an IEC, an application must be submitted, documents provided, and a payment made. While a PAN number is required to obtain an IEC, the IEC number is not the same as the PAN number.

| Characteristics | Values |

|---|---|

| What is IEC? | IEC (Importer Exporter Code) is a 10-digit code number given to an exporter or importer by the regional office of the Director General of Foreign Trade (DGFT), Department of Commerce, Government of India. |

| Where to apply? | Designated regional office of DGFT. |

| Documents required | Bank account and income tax PAN number. Other documents can be generated at the time of application. |

| Application process | Fill Part A, B & D of the application form. Submit one copy of the application. Each individual page of the application must be signed by the applicant. The application must be accompanied by documents as per the details given on the DGFT website. |

| Application fee | Rs.250 as the application fee. |

| IEC validity | An IEC number is valid forever and does not need to be renewed. |

| IEC modification | No fee is payable for modification/amendment of IEC if the application is made within 90 days. Applications submitted after 90 days are considered on payment of a penalty fee of Rs.1000. |

| IEC surrender | If an IEC holder does not wish to operate the allotted IEC number, they may surrender it by informing the issuing authority, who will then cancel it and transmit it to DGFT and Customs authorities. |

What You'll Learn

IEC number application process

The Importer Exporter Code (IEC) is a 10-digit business identification number that is mandatory for export from India or import to India. It is issued by the Directorate General of Foreign Trade (DGFT), a department under the Ministry of Commerce, Government of India.

The IEC registration certificate is mandatory for businesses involved in import and export. The IEC is valid forever and does not need to be renewed.

- Go to the official DGFT website.

- Click on the 'Services' tab on the homepage and select 'IEC Profile Management' from the drop-down list.

- A new page will open. Click on the 'Apply for IEC' option.

- Click on the 'Register' option. Enter the required details and click on the 'Sent OTP' button.

- Enter the OTP and click on the 'Register' button.

- After registering, log in to the website by entering your username and password.

- Click on "Apply for IEC" on the Dashboard.

- Click on the "Start Fresh Application" button or the "Proceed with Existing Application" button if you have already saved a draft application.

- Fill out the application form (ANF 2A format) and enter the details in the General Information Section.

- Select the nature of Concern/Firm, Preferred Activities, enter the corporate entity number (CIN), GSTIN Number of Concern/Firm, Firm Mobile Number, and attach address proof of the Firm.

- Enter the details in the "Details of Proprietor/Partner/Director/Karta/Managing Trustee" Section.

- Enter the details in the "Bank Account Details" Section.

- Enter the details in the "Other Details (Exports Sectors preferred)" Section.

- Under the declaration, accept the terms and conditions by clicking on the checkbox.

- Check the Application Summary and click on the Sign button to sign the Application using a digital signature certificate or Aadhaar.

- Confirm and proceed to make the payment against the Application.

- After successful payment, a receipt shall be displayed, and the User can also download the ticket.

- The User shall receive the IEC Certificate via email.

- The IEC shall be transmitted to CBIC, and the transmission status can be checked by navigating to "My IEC" and viewing the IEC Status bar with "CBIC Transmission Status."

Documents Required:

- Proof of establishment/incorporation/registration: This includes the Firm's Permanent Account Number (PAN) and details like Name as per PAN, Date of Birth, or Incorporation.

- Proof of Address: This can include a telephone landline bill, mobile post-paid bill, or other acceptable documents (for proprietorship only).

- Proof of Firm's Bank Account: Active bank account details in the Name of the Firm.

- Certificate from the Banker of the applicant firm in the specified format.

- Self-certified copy of Permanent Account Number (PAN) issued by Income Tax Authorities.

- Two copies of passport-sized photographs of the applicant.

- A self-addressed envelope and stamp of Rs. 30.

The above documents can be sent by post or hand-delivered to the concerned Regional Office of DGFT.

Pan-roasted Swordfish: Butter Alternatives

You may want to see also

Documents required for IEC registration

To obtain an Importer Exporter Code Number (IEC), you must apply to the designated regional office of the Director-General of Foreign Trade (DGFT), Department of Commerce, Government of India.

Sole Proprietorship

- Digital Photograph (3x3cm) of the Proprietor

- Copy of the PAN card of the Proprietor

- Copy of Passport (first & last page)/Voter’s I-Card/ Driving Licence/UID (Aadhar card) (any one of these)

- Sale deed in case the business premise is self-owned; or Rental/Lease Agreement, if the office is rented/leased; or the latest electricity/telephone bill

Partnership Firm

- Digital Photograph (3x3cm) of the Managing Partner

- Copy of Passport (first & last page)/Voter’s I-Card/UID (Aadhar Card)/Driving Licence/PAN (any one of these) of the Managing Partner signing the application

- Copy of Partnership Deed

- Sale deed in case the business premise is self-owned; or Rental/Lease Agreement, if the office is rented/leased; or the latest electricity/telephone bill

- Bank Certificate as per ANF 2A (I)/Cancelled Cheque bearing the pre-printed name of the applicant entity and account number

LLP

- Digital Photograph (3x3cm) of the Designated Partner/Director of the Company signing the application

- Copy of the PAN card of the applicant entity

- Copy of Passport (first & last page)/Voter’s I-Card/UID (Aadhar Card)/Driving Licence/PAN (any one of these) of the Managing Partner/Director signing the application

- Certificate of incorporation as issued by the RoC

- Sale deed in case the business premise is self-owned; or Rental/Lease Agreement, if the office is rented/leased; or the latest electricity or telephone bill

- Bank Certificate as per ANF 2 A(I)/Cancelled Cheque bearing the pre-printed name of the company and account number

Trust

- Digital Photograph (3x3cm) of the signatory applicant/Secretary or Chief Executive

- Copy of Passport (first & last page)/Voter’s I-Card/UID (Aadhar Card)/Driving Licence/PAN (any one of these) of the Secretary or Chief Executive/Managing Trustee signing the application

- Sale deed in case the business premise is self-owned; or Rental/Lease Agreement, if the office is rented/leased; or the latest electricity/telephone bill

- Registration Certificate of the Society/Copy of the Trust Deed

- Bank Certificate as per ANF 2A(I)/Cancelled Cheque bearing the pre-printed name of the Registered Society or Trust and account number

HUF

- Digital Photograph (3x3cm) of the Karta

- Copy of the PAN card of the Karta

- Copy of Passport (first & last page)/Voter’s I-Card/UID (Aadhar card)/Driving Licence (any one of these) of the Karta

- Sale deed in case the business premise is self-owned or Rental/Lease Agreement, if the office is rented/leased or the latest electricity/telephone bill

- Bank Certificate as per ANF 2A(I)/Cancelled Cheque bearing the pre-printed name of the applicant and account number

In addition to the above, you will also need a bank account and income tax PAN number. All other documents can be generated at the time of application.

Half Steam Pan: What's the Measure?

You may want to see also

IEC registration benefits

To obtain an IEC (Importer Exporter Code) number, you will need to provide a bank account and income tax PAN number. Here is a step-by-step guide on how to apply:

- Fill out Part A, B, and D of the application form.

- Submit one copy of the application.

- Ensure each page of the application is signed by the applicant.

- Attach the required documents, including a demand draft, certificate from the banker, self-certified copy of the PAN, two copies of passport-sized photos, and a self-addressed envelope with a stamp.

- Send the documents by post or deliver them by hand to the concerned Regional Office of DGFT.

- Enables International Trade:

IEC Registration is crucial for businesses intending to engage in foreign trade. It allows companies to access the global market, improving and growing their operations. Without IEC registration, no business can operate in the import/export industry.

Avail Various Benefits from the Government:

IEC registration offers several government benefits, including lifetime validity, retention of business links, improvement of business quality, and access to government schemes. Businesses can also claim a return of taxes paid when sending goods overseas.

Expand Your Business Globally:

IEC registration helps organisations expand their operations internationally, enhancing their reputation and creating confidence in the global market. It is a vital document for any business dealing with imports and exports and is required for all types of entities, from proprietorship firms to societies.

Establish Credibility in the International Market:

IEC registration builds trust in the foreign market by providing official proof that a business has met the requirements set by the DGFT. It is a necessary condition for engaging in foreign trade, ensuring smooth import and export operations and improving business standards.

No Requirement to File Returns:

There is no need to file returns under the IEC system. Once the code is assigned, there is no ongoing compliance burden to maintain its validity.

Only One-Time Registration:

IEC registration is a one-time requirement. While it is mandatory for any business activities related to export and import, there is no need to renew this license once it is obtained.

Quick Online Processing:

The IEC registration process is entirely online, making it faster and more efficient than offline procedures. Applicants receive an OTP during the initial application stage, streamlining the process.

Authorised by the Government:

IEC registration is authorised by the Director General of Foreign Trade (DGFT) and recognised by customs officials and other government agencies. This enhances the reputation of exporting businesses and ensures compliance with government regulations.

Donut Pan: Is It Worth the Hype?

You may want to see also

IEC validity and renewal

The IEC, or Importer Exporter Code, is a 10-digit identification number that is essential for businesses in India that want to trade overseas. It is issued by the Directorate General of Foreign Trade (DGFT) and is valid for the duration of the entity, meaning it does not need to be renewed. However, there is a mandatory annual update process that must be completed between April and June each year. This process involves updating business and bank details to ensure all information is current and compliant.

IEC holders must update their IEC details electronically every year, even if there are no changes. This can be done through the official website of the DGFT. Failure to update within the specified timeframe will result in the IEC being deactivated, blocking any import or export activities.

To update your IEC, follow these steps:

- Access the official website of the DGFT and select the IEC profile management option from the services list.

- Click on the "update IEC" option.

- Provide login details. If you are not registered, you will need to register first.

- After logging in, link your IEC. An OTP will be sent to your registered email ID.

- Once linked, click the "Update/Modify IEC" option and make any necessary changes. If there are no changes, simply save the information.

- At the end of the process, check the application summary and submit it.

- Attach the DSC of the registered person to submit the summary.

- Once the update is successful, the IEC will be reactivated, and the revised status will be submitted to the Customs system.

The following documents are required for the annual IEC update:

- A photograph of the applicant.

- Self-attested PAN card of the entity.

- Proof of address for the entity (sale deed, rent agreement, latest utility bill, etc.).

- Pre-printed cancelled cheque or bank certificate.

It is important to note that the IEC renewal process and requirements may change over time, so it is advisable to check the official DGFT website or consult local authorities for the most up-to-date information.

Greasing the Pan: Oatmeal Cookies

You may want to see also

IEC exemptions

The IEC (Importer Exporter Code) is a 10-digit code number given to exporters and importers by the regional office of the Director General of Foreign Trade (DGFT) in India. While the IEC is mandatory for all exporters and importers, there are some categories of importers or exporters that are exempt from obtaining it.

The following categories of importers or exporters are exempt from obtaining an IEC number:

- Importers covered by clause 3(1) [except sub-clauses (e) and (l)] and exporters covered by clause 3(2) [except sub-clauses (i) and (k)] of the Foreign Trade (Exemption from application of Rules in certain cases) Order, 1993.

- Ministries or Departments of the Central or State Government.

- Persons or entities importing or exporting goods for personal use not connected with trade, manufacturing, or agriculture.

- Persons importing or exporting goods from or to Nepal, provided the CIF value of a single consignment does not exceed Rs.25,000.

- Persons importing or exporting goods from or to Myanmar through Indo-Myanmar border areas, provided the CIF value of a single consignment does not exceed Rs.25,000.

- Indians returning from or going abroad and claiming benefits under the Baggage Rules.

- Persons/Institutions/Hospitals importing or exporting goods for personal use not connected with trade, manufacturing, or agriculture.

- Persons importing or exporting goods from or to Nepal and Myanmar through Indo-Myanmar border areas.

- Importers importing goods for display or use in fairs, exhibitions, or similar events under the provisions of the ATA carnet.

- Director, National Blood Group Reference Laboratory, Bombay, or their authorized offices.

- Individuals/Charitable Institutions/Registered NGOs importing goods that have been exempted from Customs duty under the notification issued by the Ministry of Finance for bona fide use by victims affected by natural calamity.

- Persons importing or exporting permissible goods as notified from time to time, from or to China through Gunji, Namgaya Shipkila, and Nathula ports, subject to value ceilings of single consignment.

- Non-commercial imports and exports by entities authorized by the Reserve Bank of India.

It is important to note that the exemption from obtaining an IEC number is not applicable for the export of Special Chemicals, Organisms, Materials, Equipment, and Technologies (SCOMET) listed in Appendix 3, Schedule 2 of ITC (HS), except in specific cases.

Unsticking Your Cast Iron Pan: A Quick Guide

You may want to see also

Frequently asked questions

The IEC number, or Importer Exporter Code, is a 10-digit code number given to an exporter or importer by the regional office of the Director General of Foreign Trade (DGFT), Department of Commerce, Government of India.

You can apply for an IEC number by filling out an application form and submitting it to the designated regional office of the DGFT. The application must be accompanied by the following documents: a demand draft of Rs.250 as an application fee, a certificate from the applicant's banker, a self-certified copy of the Permanent Account Number (PAN) issued by the Income Tax Authorities, two copies of passport-sized photographs, and a self-addressed envelope with a Rs.30 stamp.

The application fee to get an IEC number is Rs.500.