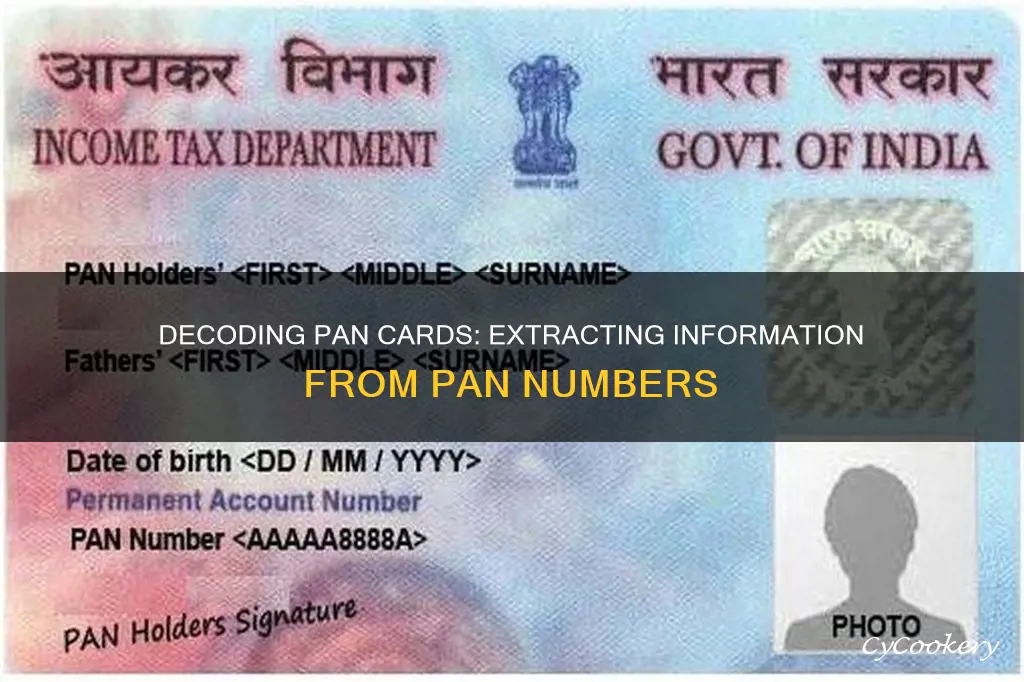

The Permanent Account Number (PAN) is a 10-digit alphanumeric code issued by the Income Tax Department of India to taxpayers. It serves as a form of identification and is mandatory for conducting financial transactions such as opening a bank account, filing income tax returns, and applying for loans. To access information linked to your PAN card, follow these steps:

- Visit the Income Tax Department e-Filing website.

- Click on Register Yourself and enter your PAN card number.

- Fill out the registration form and submit it.

- Activate your account by clicking the link sent to your email.

- Log in to your account and navigate to Profile Settings.

- Click on PAN Details to access your personal information, including name, address, area code, and jurisdiction.

| Characteristics | Values |

|---|---|

| Number of characters | 10 |

| Format | Alphanumeric |

| Purpose | Identification of taxpayers |

| Availability | Mandatory for taxpayers |

| Uses | Financial transactions, tax purposes, proof of identity, proof of age |

| Issuing authority | Income Tax Department of India |

What You'll Learn

How to get PAN card details by name and date of birth

PAN, or Permanent Account Number, is a 10-digit alphanumeric code issued by the Income Tax Department of India to each taxpayer. It is used to identify the income of a taxpayer or PAN cardholder and is required for various purposes, such as filing Income Tax Returns, purchasing and selling fixed tangible assets, and opening a bank account.

While there is no direct way to check your PAN card details using your name and date of birth, you can verify your PAN card details by entering your name and date of birth. Here's how:

Steps to verify your PAN card details by name and date of birth:

- Visit the Income Tax E-Filing page.

- Click on "Verify your PAN" under the "Quick Links" section.

- Enter your PAN, full name, date of birth, and mobile number.

- Enter the OTP you receive on your mobile number and click "Validate".

- You will be redirected to a new page, which will show whether your PAN is active and if the details match.

Alternatively, you can also check your PAN card details by visiting the official website of the Income Tax Department and following the registration process. Here are the steps:

Steps to check your PAN card details through the Income Tax Department website:

- Visit the official website of the Income Tax Department.

- Click on "Register Yourself" if you are a new user, or log in with your credentials if you are already registered.

- Select your user type and click "Continue".

- Fill out the Registration Form and submit it.

- An activation link will be sent to your email address. Click on the link to activate your account.

- Log in to your account on the e-Filing website.

- Select "Profile Settings" and then "My Account".

- Your PAN card details, such as your name, address, area code, and jurisdiction, will be displayed.

Please note that you will need to have an active PAN to carry out these steps. If your PAN is not active, you may not be able to perform certain high-value transactions.

Sewing Simmer: Crafting Hot Pot Holders with Care

You may want to see also

How to get PAN card details by using your permanent account number

PAN, or Permanent Account Number, is a 10-digit alphanumeric code issued by the Income Tax Department of India to each taxpayer. It is mandatory to have a PAN for conducting financial transactions such as filing for Income Tax Returns, buying mutual funds, and applying for loans. PAN card details include personal information such as name, address, date of birth, and PAN card number. Here is a step-by-step guide on how to get PAN card details using your permanent account number:

Step 1: Visit the Income Tax Department e-Filing website

Go to the official website of the Income Tax Department: https://incometaxindia.gov.in/iec/foportal/.

Step 2: Click on "Register Yourself"

On the website, find and click on the "Register Yourself" option.

Step 3: Enter your PAN card number and complete the registration form

You will be asked to enter your PAN card number and fill out a registration form. Provide the necessary details and submit the form.

Step 4: Activate your account

After submitting the form, you will receive an activation link via email. Click on this link to activate your account.

Step 5: Log in to your account

Go back to the Income Tax Department e-Filing website and log in to your account using your credentials.

Step 6: Go to "Profile Settings" and click on "PAN Details"

Once you are logged in, navigate to "Profile Settings" and click on "PAN Details."

Step 7: View your PAN card details

After clicking on "PAN Details," your PAN card details will be displayed on the screen. This includes your name, address, area code, jurisdiction, and other relevant information.

By following these steps, you can easily access and view your PAN card details using your permanent account number. This process allows you to check and verify the information associated with your PAN card, ensuring its accuracy and helping you to keep your records up to date.

Melt Cheddar in a Pan: No-Stick Tricks

You may want to see also

How to know the address linked to your PAN card

To know the address linked to your PAN card, you can either check it online or in person. Here are the steps for both:

Online:

- Visit the Income Tax Department e-Filing website.

- If you are not already registered, you will need to register for an account.

- Once registered, log in and click on the "My Account" tab.

- Under "Profile Settings", click on "PAN Details".

- Your PAN card address will be displayed on this page, along with other information such as your name, area code, and jurisdiction.

Offline:

- Visit your nearest Income Tax PAN Service Center.

- Fill out a PAN card address change form.

- Submit the form to a center official, along with your PAN card and a copy of your address proof.

- You will receive a new PAN card with your updated address within a few weeks.

Other Tips:

- Make sure that you have your PAN card number before you start the process.

- If checking your PAN card address online, ensure that you have a stable internet connection.

- If checking your PAN card address offline, be prepared to wait in line.

Pan-Africanism: Africa's Future?

You may want to see also

How to update your PAN card details

Updating your PAN card details is a straightforward process that can be done online or offline. Here is a step-by-step guide on how to update your PAN card details:

Online Process:

- Visit the official website of NSDL E-Governance (https://www.protean-tinpan.com/) or the UTIITSL website.

- Under the 'Services' section, click on 'PAN'.

- Click on 'Apply' under the 'Change/Correction in PAN Data' option.

- From the dropdown menu, select 'Changes or Correction in existing PAN data/Reprint of PAN Card (No changes in Existing PAN Data)'.

- Choose the correct category of the assessee (e.g., 'Individual') from the dropdown menu.

- Provide your name, date of birth, email address, and mobile number.

- Fill in the Captcha and click 'Submit'.

- You will receive a Token Number via email to continue the process.

- Proceed to the PAN card update form and select the option to submit scanned images through e-Sign on NSDL e-gov.

- Fill in the necessary details, such as your father's name, mother's name (optional), and Aadhaar number.

- Update your address, if required.

- Upload the necessary documents, including proof of address, proof of age, proof of identity, and a copy of your PAN card.

- Sign the declaration and click 'Submit'.

- Make the payment through net banking or a credit or debit card. Demand drafts are also accepted.

- After successful payment, download and print the acknowledgement form.

- Send the acknowledgement form, along with two photographs and document proof, to the NSDL office.

Offline Process:

- Download the PAN card correction form (Form 49A for Indian citizens or Form 49AA for non-citizens) from the NSDL or UTIITSL website.

- Fill in all the mandatory fields in the form.

- Attach the required supporting documents, such as proof of identity, proof of address, and passport-size photographs.

- Submit the completed form at the nearest NSDL collection center or PAN center.

- Pay the applicable charges for the PAN card update/correction offline.

- You will receive a 15-digit acknowledgement number to track the status of your PAN card application.

It typically takes around 15-20 days to process the PAN card update/correction. Once processed, you will receive your updated PAN card at your registered postal address.

Perfect Pie Pans: Measure for Success

You may want to see also

How to search for your PAN card details by name and date of birth

The PAN, or Permanent Account Number, is a 10-digit alphanumeric code issued by the Income Tax Department of India to each taxpayer. It is used to identify the income of a taxpayer or PAN cardholder and is mandatory for conducting financial transactions such as filing for Income Tax Returns, buying mutual funds, and applying for loans.

While there is no direct way to check your PAN card details using your name and date of birth, you can verify your PAN card details by entering your name and date of birth. Here's how:

Steps to verify your PAN card details:

- Visit the Income Tax E-Filing page.

- Click on "Verify your PAN" under the "Quick Links" section.

- Enter your PAN, full name, date of birth, and mobile number.

- Enter the OTP you receive on your mobile number and click "Validate".

- You will be redirected to a new page, which will display a message confirming that your "PAN is active and details are as per PAN".

Alternatively, you can also search for your PAN card details by name and date of birth through the following process:

- On the e-Filing website, click on "Know Your PAN".

- Enter your date of birth in DD/MM/YYYY format.

- Enter your surname, middle name, and first name.

- Enter the Captcha Code as shown on the screen.

- You will receive details such as remarks indicating whether your card is active, inactive, or in any other status.

It is important to note that the "Know Your PAN" service has been recently discontinued by the Income Tax Department website and replaced by the "Verify your PAN Details" service.

Easy Frittata Removal: Tips for a Perfect Dish

You may want to see also

Frequently asked questions

Log on to the Income Tax Department e-Filing website, click "Register Yourself", enter your PAN card number and complete the registration form. A link will be sent to your email address to activate your account. Then, go to "My Account" and choose "Profile Settings", where you can click "PAN Details" to access your PAN information.

You can get personal information such as your name, area code, jurisdiction, address, date of birth, and other details.

Yes, you can verify your PAN card details by entering your name and date of birth on the e-Filing website. Go to "Quick Links", click on "Know Your PAN", enter your personal information, and verify with the OTP sent to your registered mobile number.

Visit the NSDL or Protean website, select "PAN" from the "Services" tab, and click "Apply" under "Change/Correction in PAN Data". Fill in the details, submit, and upload the necessary documentation to support the requested change. Sign the declaration, make the payment, and download and print the acknowledgement form. Mail the form, along with two pictures and document proof, to the NSDL office. The process usually takes 15-20 days.

PAN card details are important for tax purposes, as they are used to submit taxes and receive refunds. They are also used as identification proof for various financial transactions, such as opening a bank account.