Getting a tan from a pan can be a tricky process, especially if you're not familiar with the techniques involved. The key to achieving a successful tan is understanding the relationship between the pan's heat and the desired color. This guide will provide a step-by-step approach to help you master the art of getting a tan from a pan, ensuring you achieve the perfect shade without any unwanted side effects.

What You'll Learn

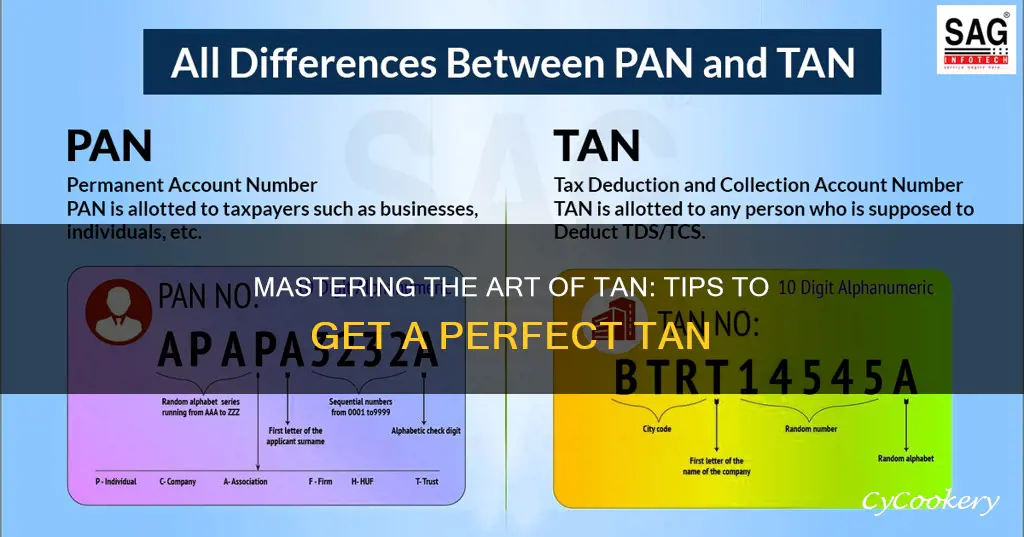

- Understand Tan and Pan: Learn the difference between tan and pan numbers, their roles in financial systems

- Pan Number Basics: Explore how pan numbers are structured, their significance in transactions, and how they're generated

- Tan Number Verification: Discover methods to verify tan numbers, ensuring accuracy and security in financial processes

- Legal and Regulatory Considerations: Understand the legal framework surrounding tan and pan numbers, compliance requirements, and potential penalties

- Security and Fraud Prevention: Learn strategies to protect tan and pan numbers from fraud, including encryption and authentication protocols

Understand Tan and Pan: Learn the difference between tan and pan numbers, their roles in financial systems

The terms "tan" and "pan" are often used in financial contexts, but they represent different concepts and have distinct roles in the financial system. Understanding these differences is crucial for anyone involved in financial operations, especially when dealing with identification numbers and security measures.

Tan Number:

A Tan number, short for Tax Administration Number, is a unique identification code assigned to individuals and businesses by the tax authorities in many countries. It is typically used to ensure accurate tax reporting and compliance. For individuals, the Tan number might be linked to their personal tax identification, allowing the tax authorities to track income, deductions, and tax payments. For businesses, it serves as a reference for tax-related activities, including VAT (Value-Added Tax) registration, sales tax, and other financial obligations. Tan numbers are essential for maintaining transparency and ensuring that tax laws are followed.

Pan Number:

On the other hand, a Pan number, or Permanent Account Number, is a unique 10-digit identification number issued by the Indian Income Tax Department. It is a critical component of the Indian tax system and is used for various tax-related purposes. PAN is a 10-character alphanumeric code that includes letters and numbers. It is used to identify individuals, businesses, and other entities for tax-related transactions. This number is mandatory for various financial activities, such as opening a bank account, filing tax returns, or entering into agreements that require tax-related documentation.

Difference and Role:

The primary difference between Tan and Pan numbers lies in their geographical context and the specific financial systems they operate within. Tan numbers are more commonly associated with general tax identification, while Pan numbers are specific to the Indian tax system. Tan numbers are used to ensure compliance with tax laws and facilitate the tracking of financial activities, whereas Pan numbers are essential for individual and business identification in India, enabling the government to monitor and regulate financial transactions.

In the financial world, these numbers play a vital role in security and verification. For instance, when applying for financial services or transactions, providing the correct Tan or Pan number is essential to verify the identity of the applicant or entity, reducing the risk of fraud. Understanding the distinction between these numbers is crucial for individuals and businesses to navigate the financial system effectively, especially when dealing with tax-related matters and compliance.

The Meaning of 716 C on Cast Iron Pans

You may want to see also

Pan Number Basics: Explore how pan numbers are structured, their significance in transactions, and how they're generated

A Pan (Permanent Account Number) is a unique 10-digit identification number issued by the Indian Income Tax Department to all resident taxpayers in India. It is a crucial component of the Indian tax system, serving as a primary identifier for tax-related purposes. The Pan Number is structured in a specific format, which is essential to understand its generation process.

The Pan Number is a 10-digit alphanumeric code, where the first five digits are allocated by the Income Tax Department, and the last five are chosen by the applicant. The first digit is always '2', '5', or '8', and the subsequent digits are a combination of letters and numbers. This structure ensures that each Pan Number is unique and easily verifiable. The system is designed to minimize the chances of duplicate or similar numbers being issued, which is vital for maintaining the integrity of the tax system.

The significance of the Pan Number lies in its role as a universal identifier for tax-related transactions. It is mandatory for individuals and businesses to quote their Pan Number when filing tax returns, claiming refunds, or making tax payments. This ensures that the tax authorities can accurately track and verify the transactions, reducing the potential for fraud and errors. Moreover, the Pan Number is linked to various financial institutions, allowing for seamless information sharing and verification during financial transactions.

The generation of a Pan Number involves a meticulous process. When an individual applies for a Pan Number, the Income Tax Department uses a computer-generated algorithm to create a unique code. This algorithm considers various factors, including the applicant's date of birth, the last five digits of their address, and a unique verification code. The resulting Pan Number is then issued to the applicant, ensuring a secure and reliable identification system.

Understanding the structure and significance of Pan Numbers is essential for individuals and businesses operating in India. It empowers taxpayers to navigate the tax system efficiently and securely. Additionally, knowing how Pan Numbers are generated can help individuals protect their personal information and ensure compliance with tax regulations. This knowledge is particularly valuable for those engaging in financial transactions or seeking to understand the Indian tax system's intricacies.

Pan-Roasted Chicken Perfection

You may want to see also

Tan Number Verification: Discover methods to verify tan numbers, ensuring accuracy and security in financial processes

Verifying TAN (Tax Deduction and Collection Account Number) numbers is a crucial process in financial operations, especially in India, where it is used for tax-related transactions. TAN numbers are unique identifiers assigned to businesses and individuals for tax purposes, and ensuring their accuracy is essential to avoid legal issues and maintain compliance. Here's a guide on how to verify TAN numbers effectively:

Cross-referencing with PAN: One of the primary methods to verify a TAN number is by cross-referencing it with the Permanent Account Number (PAN). PAN is a unique 10-digit alphanumeric code issued by the Income Tax Department of India. When you have a PAN, you can easily find the associated TAN. The TAN is typically the last 4 digits of the PAN. For example, if a PAN is 'ABCDE1234F', the TAN would be '1234'. This method is straightforward and widely used by tax authorities and financial institutions.

Online Verification: Many government and financial institutions provide online platforms for TAN verification. These platforms allow users to input the PAN or TAN and retrieve the corresponding details. The process usually involves entering the PAN or TAN on a secure website, after which the system will display the verified TAN details, including the name, address, and other relevant information. This method is convenient and provides quick access to TAN verification, especially for businesses dealing with multiple tax-related transactions.

Contacting the Income Tax Department: In cases where the above methods do not yield results, or if there is a discrepancy, you can directly contact the Income Tax Department. They can assist in verifying the TAN number and provide guidance on any issues related to tax identification numbers. This approach is more time-consuming but can be necessary for resolving complex verification cases.

Security and Accuracy: When verifying TAN numbers, it is crucial to ensure security and accuracy. Always use official sources and platforms provided by the government or reputable financial institutions. Avoid using unverified websites or sources that may lead to potential security risks. Additionally, double-check the TAN number against multiple sources to ensure its validity, especially when dealing with financial transactions that require TAN for deductions or payments.

By implementing these verification methods, individuals and businesses can maintain the integrity of their financial processes, ensuring that TAN numbers are accurate and secure. This practice is essential for compliance with tax regulations and helps in avoiding any potential legal complications. It is always advisable to stay updated with the latest verification procedures provided by the relevant tax authorities.

Effective Cleaning Methods for Your Bread Pan Stoneware

You may want to see also

Legal and Regulatory Considerations: Understand the legal framework surrounding tan and pan numbers, compliance requirements, and potential penalties

The process of obtaining a TAN (Tax Deduction Account Number) from a PAN (Permanent Account Number) involves understanding the legal and regulatory framework set by the Indian Income Tax Department. This framework is designed to ensure compliance with tax laws and to prevent tax evasion. Here's an overview of the legal and regulatory considerations:

Legal Framework and Compliance: The Indian Income Tax Act, 1961, and the rules framed thereunder govern the TAN and PAN system. Every person or business entity in India is required to have a PAN, which is a unique 10-digit alphanumeric number. When a business exceeds a certain turnover threshold, it is mandatory to obtain a TAN, which is a 10-digit number used for tax deduction and collection. The TAN is linked to the PAN, ensuring a direct connection between the tax payer and the tax deducted. Compliance with these regulations is essential to avoid legal consequences.

Compliance Requirements: To obtain a TAN, businesses must file an application with the Income Tax Department, providing details such as the nature of the business, turnover, and the estimated tax liability. The application process involves submitting necessary documents, including proof of business registration, financial statements, and a declaration of compliance. Once approved, the TAN is issued, and businesses are required to use it for all tax deductions and collections. It is the responsibility of the business owner or authorized representative to ensure that the TAN is registered and used correctly.

Potential Penalties: Non-compliance with the TAN and PAN regulations can result in severe penalties. The Income Tax Department imposes fines and penalties for various offenses, such as failing to obtain a TAN when required, incorrect reporting, or non-submission of necessary documents. These penalties can be substantial and may include fines, interest charges, and even legal proceedings. In some cases, the business may be required to pay a penalty equivalent to the tax amount that should have been deducted but was not. Therefore, it is crucial to understand the specific requirements and deadlines to avoid any legal repercussions.

Staying Informed: It is essential to stay updated with the latest tax regulations and guidelines provided by the Income Tax Department. The department regularly updates its website with new instructions, forms, and procedures. Subscribing to official notifications and seeking professional advice can help ensure that all legal and regulatory requirements are met. This proactive approach will enable businesses to maintain compliance and avoid any unnecessary legal issues.

By understanding the legal framework, compliance procedures, and potential penalties, businesses can navigate the process of obtaining a TAN from a PAN smoothly. Adherence to tax laws is vital for maintaining a good standing with the tax authorities and avoiding any financial or legal consequences.

CT Pan: His Country and Career

You may want to see also

Security and Fraud Prevention: Learn strategies to protect tan and pan numbers from fraud, including encryption and authentication protocols

In the digital age, safeguarding sensitive information like TAN (Transaction Account Number) and PAN (Primary Account Number) numbers is paramount to prevent fraud and protect financial assets. These numbers are critical for online transactions and banking, making them prime targets for malicious actors. Here's an in-depth look at strategies to fortify your defenses against fraud, emphasizing encryption and authentication protocols.

Encryption: The Unbreakable Shield

Encryption is the cornerstone of data security. It transforms readable information (plaintext) into an unreadable format (ciphertext) using complex algorithms. When applied to TAN and PAN numbers, encryption ensures that even if data is intercepted, it remains indecipherable to unauthorized parties. Here's how it works:

- Data Encryption Standards: Utilize industry-standard encryption algorithms like AES (Advanced Encryption Standard) with key lengths of 128 bits or higher. These algorithms are proven to be highly secure and resistant to brute-force attacks.

- Key Management: Securely store and manage encryption keys. Strong, unique keys are essential for successful encryption. Implement key management practices like key rotation, access controls, and secure storage to prevent unauthorized access.

- End-to-End Encryption: Implement end-to-end encryption for data transmitted between devices and servers. This ensures that even if data is intercepted during transit, it remains encrypted and unreadable.

Authentication Protocols: Verifying Identity

Authentication protocols go beyond encryption by verifying the identity of users attempting to access sensitive information. This multi-layered approach strengthens security significantly:

- Multi-Factor Authentication (MFA): Implement MFA to require users to provide multiple forms of verification. This could include something they know (password), something they have (mobile device), and something they are (biometric data). MFA significantly reduces the risk of unauthorized access.

- One-Time Passwords (OTPs): Generate time-sensitive, single-use passwords for login attempts. OTPs add an extra layer of security, making it much harder for attackers to gain access even if they have obtained login credentials.

- Behavioral Biometrics: Utilize behavioral biometrics to analyze user behavior patterns. This includes mouse movements, typing speed, and device interactions. Deviations from normal behavior can trigger alerts and prevent unauthorized access.

Secure Data Storage and Transmission:

- Database Encryption: Encrypt databases storing TAN and PAN numbers. This ensures that even if databases are compromised, the sensitive data remains protected.

- Secure APIs: If your system exposes TAN and PAN numbers via APIs, implement robust security measures. Use HTTPS for secure communication, validate input data, and implement rate limiting to prevent abuse.

- Data Minimization: Only store the necessary TAN and PAN information. Avoid storing unnecessary data that could be exploited if compromised.

Regular Security Audits and Training:

- Penetration Testing: Conduct regular security audits and penetration testing to identify vulnerabilities in your systems. Address any weaknesses found promptly.

- Employee Training: Educate employees about security best practices, including phishing awareness, strong password policies, and the importance of reporting suspicious activity.

By implementing these encryption and authentication strategies, you can significantly enhance the security of TAN and PAN numbers, safeguarding your financial assets and users' data from fraudulent activities. Remember, security is an ongoing process, and staying vigilant is crucial in the ever-evolving landscape of cyber threats.

Stainless Steel Pan: Blotchy Appearance Explained

You may want to see also

Frequently asked questions

This phrase typically refers to a Japanese expression, where "tan no" means "address" or "location," and "pan no" translates to "postal code." So, it's asking for the address or location using the postal code.

You can use online mapping services or postal code lookup tools that are available on various websites. Simply enter the postal code, and it will provide you with the corresponding address, including the street name, city, and sometimes even the country.

Yes, there are numerous geocode APIs and mapping platforms that offer this service. For example, Google Maps, OpenStreetMap, or dedicated postal code lookup websites can help you find the address details based on the provided postal code.

Absolutely! Knowing the exact address from a postal code is crucial for accurate shipping and delivery. It ensures that packages or goods are sent to the correct location, making the process more efficient and reducing the chances of errors.

No, postal code systems vary globally. Each country has its own unique format and structure for postal codes. For instance, Japan uses a system where the first three digits represent the prefecture, and the last three digits specify the city or town. Understanding the specific postal code system of the country in question is essential for accurate address interpretation.