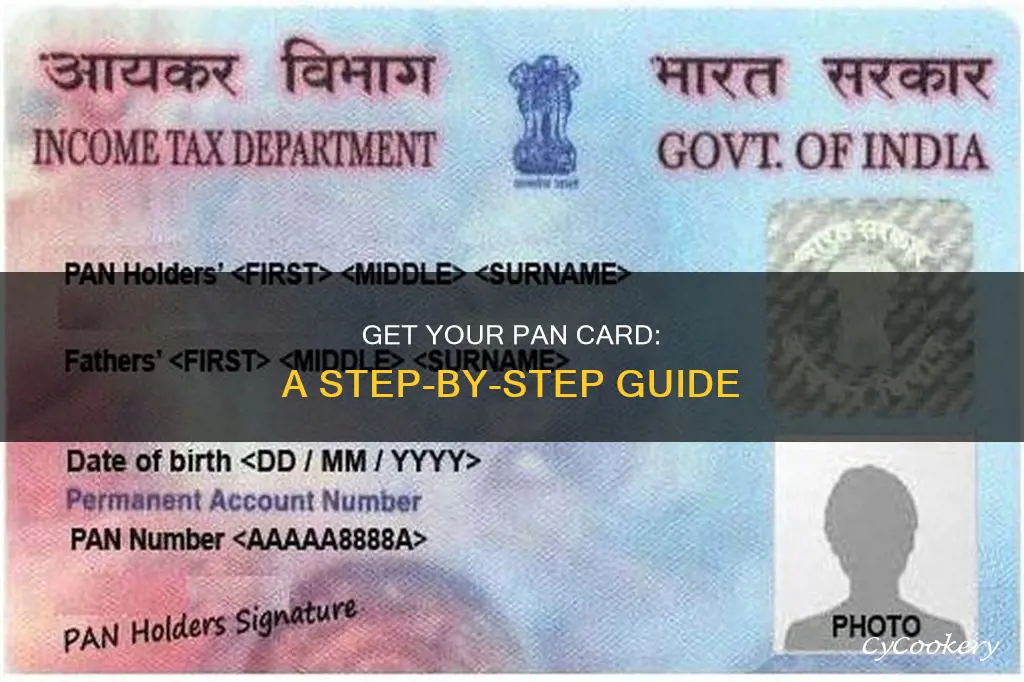

A Permanent Account Number (PAN) is a vital document in India, serving as a widely accepted form of ID and address proof. The PAN is a unique 10-digit alphanumeric code, e.g. ABCDE1234F, that helps identify an individual drawing an income or a tax-paying citizen. It is required to obtain financial facilities, specific benefits, and subsidies on select services. While taxpayers in India need a PAN, all Indian citizens, including minors, can apply for one. PAN applications can be made online or offline, and the process is relatively straightforward.

| Characteristics | Values |

|---|---|

| What is PAN? | Permanent Account Number |

| Who issues PAN? | Income Tax department of India |

| Who needs a PAN? | All Indian citizens, including minors |

| What is PAN used for? | Obtaining financial facilities, specific benefits, and subsidies on select services |

| What does the PAN comprise? | A unique code of 10 letters and numerals, e.g. ABCDE1234F |

| How to get a PAN? | Submit an application online or offline |

| How to apply for PAN offline? | Visit the NSDL e-Gov website, download and fill out Form 49A, submit the form with required documents at the local PAN centre or to an agent, pay the applicable charges |

| How to apply for PAN online? | Visit the NSDL/UTIITSL website, fill out Form 49A or Form 49AA (for foreign nationals), pay the applicable fees, submit the form, e-sign the application via Aadhaar-OTP authentication |

| Documents required for PAN? | Proof of identity, address, and date of birth |

| Fee for PAN application? | Rs. 107 for dispatch to an Indian address, Rs. 1017 for dispatch outside India |

What You'll Learn

How to apply for a PAN card online

Applying for a PAN card online is a straightforward process. Here is a step-by-step guide on how to do it:

Step 1: Visit the Official Website

Go to the official website of the Income Tax Department or the websites of NSDL (https://www.onlineservices.nsdl.com/) or UTIITSL (https://pan.utiitsl.com/). Both NSDL and UTIITSL are authorised by the Government of India to issue PAN cards and make changes on behalf of the Income Tax Department.

Step 2: Select the Correct Form

On the website, select the application type as 'New PAN - Indian Citizen (Form 49A)' or 'New PAN - Foreign Citizen (Form 49AA)'. Form 49A is for Indian citizens who have never applied for a PAN before, while Form 49AA is for foreign citizens.

Step 3: Fill in the Required Details

Provide the necessary details, such as your name, date of birth, email, and mobile number. You may also need to provide additional information like personal details, contact details, and AO code.

Step 4: Upload Documents

You will be required to upload certain documents along with your application form. The specific documents needed depend on your category as an applicant (individual, company, firm, etc.). Here is a general list of documents required:

- Registration certificate (for companies, firms, HUF, and association of persons)

- Proof of identity, address, and date of birth (for individuals)

- Certificate of Registration (for partnership firms and LLPs)

- Certificate of Registration or Partnership Deed (for Hindu Undivided Families - HUF)

- Copy of Trust Deed or Certificate of Registration (for trusts)

Step 5: Submit the Application and Make Payment

After filling out the form and uploading the documents, submit your application. You will then be redirected to the payment page. Make the required payment, which can be done through credit/debit card, demand draft, or net banking.

Step 6: Receive Acknowledgement and PAN Card

Upon successful payment, you will receive an acknowledgement with a number to track your application status. This will be sent to your email. Your PAN card will be dispatched within 15-20 days, and you will be notified via email or SMS when it is allotted.

Please note that there are different procedures for instant e-PAN cards for individuals with a valid Aadhaar number and Aadhaar-linked mobile number. The process is similar but faster, and the e-PAN card can be obtained within 10 minutes.

Additionally, the application fee varies depending on the mode of submission and dispatch of the PAN card. Make sure to refer to the official websites for the latest information on fees and required documents.

Fertilizing Potted Plants in Summer: To Feed or Not to Feed?

You may want to see also

How to apply for a PAN card offline

Applying for a PAN card offline is a straightforward process. Here is a step-by-step guide to help you:

Step 1: Download the PAN Card Application Form

Download Form 49A if you are an Indian citizen or Form 49AA if you are a foreign citizen from the NSDL website. You can also obtain the form from a PAN card application centre.

Step 2: Fill Out the Application Form

Complete the form with all the necessary details. Use BLOCK letters and a black ink pen. Provide your personal information, such as name, date of birth, address, etc. Make sure to follow the instructions provided with the form.

Step 3: Attach Required Documents

Attach two recent colour passport-sized photographs with a plain background to the designated boxes on the form. Sign the form in the specified areas, and also sign across the photograph on the top left side of the form.

Step 4: Submit the Form and Documents

Submit the completed form along with the necessary documents, such as proof of identity, address, and date of birth, to the nearest PAN centre or an authorised agent. You may be required to pay an administrative or service fee in addition to the application fee.

Step 5: Pay the Fees

Pay the applicable charges for the PAN card, which includes the PAN issuing charge and any administrative or service fees. You can pay by cash, cheque, demand draft, or through e-payment methods like credit card, debit card, or net banking.

Step 6: Receive Acknowledgment and Track Application

After submitting your application, you will receive an acknowledgment slip containing an acknowledgment number. This number can be used to track the status of your PAN card application. Typically, the NSDL/UTIITSL department issues the PAN card within 15 days of receiving your application.

Preventing Nougat Nightmares: Solutions for Sticky Situations

You may want to see also

How to apply for a PAN card for free

Applying for a PAN card for free in India

A Permanent Account Number (PAN) is a unique identification number issued by the Income Tax Department of India to identify every taxpayer in the country. It is mandatory to quote your PAN while filing your Income Tax Return. PAN is also required to conduct high-value financial transactions, operate bank accounts with KYC, receive a salary, sell or buy property, etc.

Step 1: Visit the official website of the Income Tax Department of India (https://www.incometax.gov.in/).

Step 2: Look for the "Instant e-PAN" option under the "Quick Links" section on the homepage. If you are unable to find it, use the search function on the website.

Step 3: On the e-PAN page, click on "Get New e-PAN".

Step 4: Enter your 12-digit Aadhaar number and click on "Continue". Please note that this service is only available if you have never been allotted a PAN before and possess a valid Aadhaar with your active mobile number linked to it.

Step 5: On the next page, click on the checkbox "I have read the consent terms and agree to proceed further" and then click on "Continue".

Step 6: Enter the 6-digit OTP received on your Aadhaar-linked mobile number and click on "Continue".

Step 7: Select the checkbox to validate your Aadhaar details with UIDAI and then click on "Continue".

Step 8: On the next page, select the "I Accept" checkbox and click on "Continue".

Step 9: Upon successful submission, a success message will be displayed on the screen along with an Acknowledgement Number. Please make a note of this Acknowledgement Number for future reference. You will also receive a confirmation message on your Aadhaar-linked mobile number.

Please note that the Instant e-PAN is only a digital PAN card. If you wish to obtain a physical PAN card, you will need to apply through the NSDL (Protean) or UTIITSL website by paying the applicable charges.

Additionally, if you are an NRI (Non-Resident Indian) or a foreign citizen, you may follow the steps below to apply for a PAN card:

Step 1: Identify the type of applicant: Individual with an Indian passport, Individual with a foreign passport, or Company registered outside India.

Step 2: Visit the NSDL (https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html) or UTIITSL (https://www.utiitsl.com/) website to initiate the application process.

Step 3: Fill in the online application form with your personal details such as name, address, and contact information.

Step 4: Make the payment of the applicable fees. For NRIs and foreign citizens, the price may include the shipping of the PAN card to your international address.

Step 5: Send proof of name and address, such as a copy of your passport or other accepted documents, over email for review.

Step 6: Print the PDF application form, paste your photographs, and sign the form as per the instructions received via email.

Step 7: Send the signed application form along with the supporting documents to India or the nearest NSDL/UTIITSL office by post or courier.

Please note that the processing time for PAN applications may vary, but it typically takes around 5 to 10 working days for the PAN number to be allotted and the e-PAN to be issued. The physical PAN card will be dispatched within a couple of weeks after the allotment.

Removing Mold from Your Dehumidifier's Drop Pan

You may want to see also

Documents required for a PAN card

The documents required for a PAN card application depend on the applicant's category and type, such as whether they are an individual or a company, and their citizenship. Here is a detailed list of the documents required for each category:

Documents Required for PAN Card Application by Indian Citizens:

Indian citizens need to fill out Form 49A and provide one copy each of their age, ID, and address proof. The list of accepted documents includes:

- Birth certificate issued by a municipal authority

- Matriculation certificate

- Pension payment order

- Government-issued Domicile Certificate

- Marriage Certificate issued by the Marriage Registrar’s Office

- An affidavit, duly signed, affirming the date of birth before a Magistrate

- Photo ID card issued by the State or Central Government, Central Public Sector Undertaking, or State Public Sector Undertaking

- Ration card with a photograph

- Pensioner Card with a photograph

- Applicant’s Ration Card

- Card issued by the Central Government Health Scheme

- A certificate from the applicant's bank, including their photo and bank account number

- Utility bills (electricity, water, gas)

- Post office passbook with address

- Bank account statement

- Domicile certificate issued by the government

- Property registration paperwork

- Property tax assessment notice

- Broadband service bill

- Credit card statement

- Applicant's postal passbook with an address

- Accommodation allotment letter from central or state government (not exceeding 3 years old)

Documents Required for PAN Card for NRIs and HUFs:

Non-Resident Indians (NRIs) and members of Hindu Undivided Family (HUFs) must fill out Form 49A and provide one copy each of their ID and address proof. The list of accepted documents includes:

- OCI (Overseas Citizen of India) card issued by the Indian Government

- PIO (Person of Indian Origin) card issued by the Indian Government

- Other valid identification documents such as Taxpayer ID number, National ID number, and Citizenship ID number (authenticated by an 'Apostille' or by an Indian Embassy/Consulate/High Commission in the applicant's home country)

- Foreign bank account statements in the applicant's home country

- OCI/PIO card issued by the Indian Government

- NRE (Non-Resident External) bank account statement in India

- Registration Certificate issued by the Office of Foreigner's Registration, indicating the Indian address

- Visa granted by any foreign country

- Copy of appointment letter issued by an Indian company or employer, along with an original Certificate of Address in India

Documents Required for PAN Card for Companies:

The documents required for a company PAN card application depend on the type of company. Here is a list of documents based on company type:

- Indian Registered Company: Certificate of Registration issued by the Registrar of Companies.

- Certificate of Registration issued by the Registrar of Limited Liability Partnership/Firms or Partnership deed.

- Association of Persons (Trusts) in India: Trust Deed or Certificate of Registration Number issued by the Charity Commissioner.

- Company registered outside India: Registration Certificate issued by India or approval from Indian Authority to set up an office in India; or Certificate of Registration from the applicant's country (attested by 'Apostille' or Indian Embassy/High Commission/Consulate).

- Firm registered outside India: Similar documents as the company registered outside India.

- Association of Persons (Trusts) formed outside India: Similar documents as the company registered outside India.

- Other entities registered outside India: Similar documents as the company registered outside India.

Documents Required for PAN Card for Students and Minors:

Students and minors applying for a PAN card must submit one copy each of their Address and ID proof. The list of accepted documents includes:

- Aadhar card, Driving License, Passport, Bank account statement (last 3 months), Electricity, gas, or telephone Bill, Voter ID card, Government-issued Domicile Certificate, Original Certificate of Address attested by Gazetted officer or MLA, Central/State Government issued letter of Accommodation Allotment (latest).

- Aadhar card, Voter ID card, Passport, Driving License, Ration Card, Original identity Certificate attested by Gazetted officer or MLA, Bank Certificate signed by Branch Manager.

GreenPan Aluminum: Safe or Not?

You may want to see also

How to apply for a PAN card for minors

Overview

In India, a Permanent Account Number (PAN) card is issued to all citizens, including minors, non-resident Indians, and foreign nationals. This unique identifying number connects all taxable financial activities, making it easy for the government to record tax-related information. While most people apply for a PAN card after turning 18, minors are also eligible, and there are several benefits to doing so.

- When parents intend to make their child a nominee of their investments, shares, or other financial products

- When parents invest in the child's name

- When opening a bank account or a Sukanya Samriddhi Yojana account for a minor daughter

- When the minor is earning an income, which will be taxed separately under the following circumstances:

- If they are physically disabled, blind, deaf, etc.

- If they earn income by applying their own skills, knowledge, or manual labour

How to apply for a minor PAN card online

- Visit the official portal of the NSDL website

- Click on the "Online PAN Application" tab and select the relevant application type: “New PAN for Indian Citizen (Form 49A)” or “New PAN for Foreign Citizen (Form 49AA)"

- Enter the applicant's personal details, such as name, date of birth, email ID, and mobile number

- Upload the required documents, including the minor's photographs, address proof, proof of identity, and proof of age, as well as those of the guardian

- Submit the guardian's signature

- Pay the application fee of ₹93 (₹864 for non-resident Indians), excluding GST, via credit/debit card, net banking, or demand draft

- Click "Submit" and use the acknowledgement number to track the application status

- The PAN card will be posted to the address provided within 15-20 working days after verification

How to apply for a minor PAN card offline

- Download Form 49A or Form 49AA from the NSDL website, depending on your residency status

- Carefully fill out all personal information and attach copies of the required documents

- Submit the form, along with the processing fee, to the nearest NSDL or UTIITSL office

- After verification, the PAN card will be mailed to the address provided

Documents required for a minor PAN card application

- Proof of identity: Photo ID card issued by the government, original certificate of identity signed by an authorised official, etc.

- Proof of address: Post office passbook, property registration document, domicile certificate, original certificate of address signed by an authorised official, etc.

- Proof of date of birth: Mark sheet of a recognised board, photo ID card issued by the government, domicile certificate, affidavit sworn before a magistrate, etc.

Fees for a minor PAN card

The fees for a minor PAN card vary based on the mode of application and the applicant's address. For Indian citizens, the fee is Rs. 107, while for non-resident Indians, it is Rs. 989.

The Reflex Unraveled: Why We Don't Drop the Hot Pot

You may want to see also

Frequently asked questions

You can apply for a PAN card online or offline. To apply online, you can use the NSDL or UTIITSL website. To apply offline, you can visit your local PAN centre or use an agent.

You need to provide proof of identity and proof of address. For proof of identity, you can submit a photocopy of your Aadhaar card, ration card, photo ID card issued by the government, or bank certificate on letterhead from your branch. For proof of address, you can submit a photocopy of your Aadhaar card, spouse's passport, post office passbook, latest property tax assessment order, or domicile certificate.

The fee for applying for a PAN card that needs to be dispatched to an Indian address is Rs. 107/-. The fee for a new PAN application for dispatch outside India is Rs. 1017/- (inclusive of GST).

It usually takes about 15 working days to receive your PAN card once your application has been submitted.

Yes, according to Section 160 of the IT Act, 1961, minors can apply for a PAN card. A parent or guardian can apply on their behalf using their own identity and address proofs.