The Indian government has set a deadline of June 30, 2023, for linking Aadhaar and PAN cards, with a penalty of Rs. 1000 for non-compliance. This can be done by paying the penalty through the e-Pay Tax feature on the e-filing portal or by using Challan No. ITNS 280 to make a payment on the NSDL portal. The process involves visiting the official Income Tax Department e-filing website, clicking on the Link Aadhaar option, entering the required details, and verifying the information. Alternatively, individuals can send an SMS with their Aadhaar and PAN numbers to a specified number to link the two. It is important to link Aadhaar and PAN cards to comply with government regulations and avoid any inconvenience in financial transactions.

| Characteristics | Values |

|---|---|

| Deadline for linking PAN and Aadhaar | 30 June 2023 |

| Fee for linking PAN and Aadhaar | Rs. 1000 |

| Fee for linking PAN and Aadhaar between 1 April 2022 and 30 June 2022 | Rs. 500 |

| Fee for linking PAN and Aadhaar before 1 April 2022 | Free |

| Where to pay the fee | e-Pay Tax feature on the e-filing portal |

| How to pay the fee | Through net banking or debit card |

| What happens if PAN is not linked to Aadhaar by the deadline | PAN becomes inoperative; pending tax refunds and interest on such refunds will not be issued; TDS will be deducted at a higher rate; TCS will be collected at a higher rate |

What You'll Learn

How to pay the fee for Aadhaar-PAN linkage

The fee for linking your Aadhaar Card and PAN Card on the e-filing website is Rs 1000. This fee has been in place since 1 July 2022. Before this date, there was no fee for Aadhaar-PAN linking, and between April and 30 June 2022, a fee of Rs 500 was levied.

To pay the fee, PAN cardholders can use the e-Pay Tax functionality on the e-filing website. The process differs depending on the bank you are a customer of.

For customers of the following banks:

- Axis Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- City Union Bank

- Federal Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank

- IndusInd Bank

- Jammu & Kashmir Bank

- Karur Vyasa

- Kotak Mahindra Bank

- Punjab National Bank

- UCO Bank

- Union Bank of India

Go to the e-Pay Tax functionality on the e-filing website (https://eportal.incometax.gov.in/iec/foservices/#/e-pay-tax-prelogin/user-details). Provide your PAN, confirm your PAN and mobile number to receive an OTP. Verify the OTP and you will be redirected to a page with different payment tiles. Click "Proceed" on the Income Tax tile. Select AY 2023-24 and Type of Payment – "other Receipts (500)" and continue. Enter Rs 1000 under the "Others" field in the tax break-up and proceed with the further steps.

For customers of other banks not listed above:

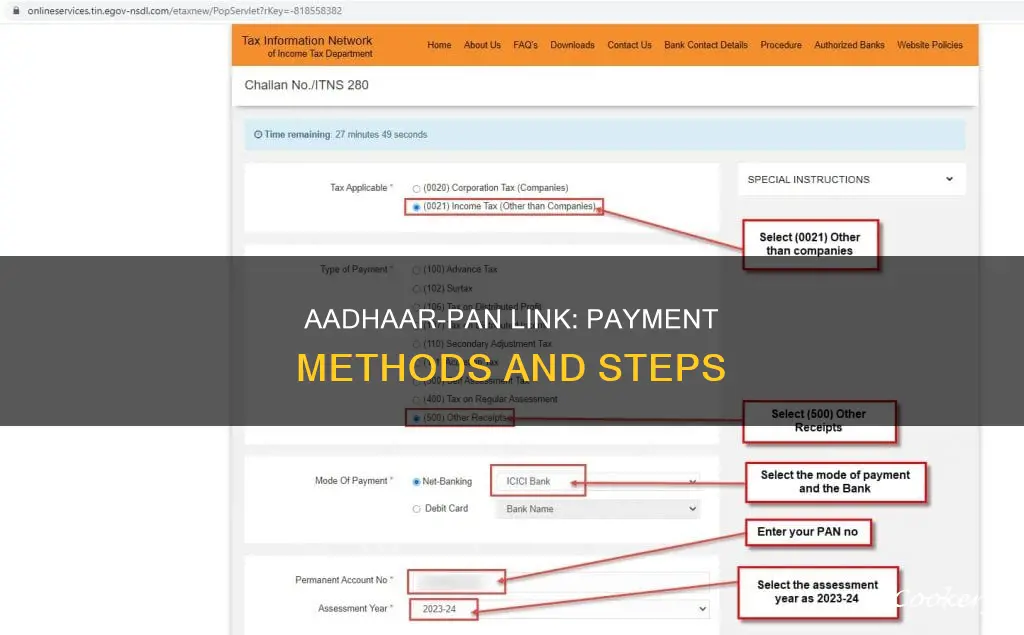

Go to the e-Pay Tax functionality on the e-filing website (https://eportal.incometax.gov.in/iec/foservices/#/e-pay-tax-prelogin/user-details). Click on the hyperlink "Click here to go to NSDL (Protean) tax payment page for other banks" on the e-Pay tax page to redirect to the Protean (NSDL) portal. Click Proceed under Challan No./ITNS 280. Select (0021) Income Tax (Other than Companies) under Tax Applicable (Major Head). Select (500) Other Receipts) under Type of Payment (Minor Head). Select AY as 2023-24, provide other mandatory details and Proceed.

The Secret to a Perfect Pan-Seared Chicken

You may want to see also

How to pay the penalty for Aadhaar-PAN linkage

The deadline to link Aadhaar and PAN was June 30, 2023. If you missed the deadline, your PAN will become inoperative and you will have to pay a penalty of Rs. 1000. This fee must be paid in a single challan before you submit your Aadhaar-PAN linkage request on the e-filing portal.

Step 1: Visit the e-filing portal

Go to the Income Tax e-filing portal: https://www.incometax.gov.in/iec/foportal/.

Step 2: Login and navigate to the dashboard

Login using your credentials. On the dashboard, in the Profile Section under the "Link Aadhar to PAN" option, click "Link Aadhar."

Step 3: Enter your Aadhaar and PAN details

Enter your Aadhaar and PAN numbers.

Step 4: Proceed to payment

Click "Continue to Pay Through e-Pay Tax."

Step 5: Enter your details and verify OTP

Enter your PAN, confirm PAN, and enter your mobile number to receive an OTP. Verify the OTP.

Step 6: Proceed to the e-Pay Tax page

You will be redirected to the e-Pay Tax page.

Step 7: Click on "Proceed" under the Income Tax tile

Select AY 2024-25 and Type of Payment as "Other Receipts (500)." Click "Continue."

Step 8: Make the payment

The applicable amount of Rs. 1000 will be pre-filled against "Others." Complete the payment process.

Please note that the consequences of not linking your Aadhaar with PAN by the deadline include:

- Your PAN will become inoperative, and you will not be able to use it for various transactions.

- No refund shall be made against such PANs.

- Interest will not be payable on such refunds for the period during which the PAN remains inoperative.

- TDS and TCS will be deducted/collected at a higher rate.

Therefore, it is advised to link your Aadhaar and PAN as soon as possible to avoid any inconvenience.

Pan Size for 1.8 Liters: What's Ideal?

You may want to see also

How to link PAN to Aadhaar through the e-filing website

Linking your PAN to your Aadhaar is a simple process that can be done online through the e-filing website. Here is a step-by-step guide on how to do it:

Step 1: Visit the e-filing website

Go to the official e-filing portal of the Income Tax Department: https://www.incometax.gov.in/iec/foportal/.

Step 2: Login to your account

If you are a registered user, log in to the e-filing portal using your User ID and password. If you are not a registered user, you will need to register yourself by creating a User ID and password.

Step 3: Click on 'Link Aadhaar'

Once you are logged in, click on the 'Link Aadhaar' option. You can find this under the 'Quick Links' section on the homepage, or under the 'My Profile' section in the 'Personal Details' tab.

Step 4: Enter your Aadhaar details

Enter your Aadhaar number and click on 'Validate'. The website will verify your Aadhaar details.

Step 5: Enter your PAN details

After your Aadhaar is validated, enter your PAN number and click on 'Link Aadhaar'.

Step 6: Verify your details

Check the details displayed on the screen, including your name, date of birth, and gender. Make sure that these details match the information on your Aadhaar card.

Step 7: Submit the linking request

Click on the 'Submit' or 'Link Aadhaar' button to submit your request. You may be asked to enter an OTP sent to your registered mobile number for verification.

Step 8: Check the status of your linking request

You can check the status of your linking request by clicking on the 'Link Aadhaar Status' option under 'Quick Links' on the homepage. Enter your PAN and Aadhaar number and click on 'View Link Aadhaar Status'. If your PAN and Aadhaar are successfully linked, you will see a confirmation message.

Please note that there is a late fee of Rs. 1000 for linking your PAN to your Aadhaar after the deadline. This fee can be paid through the e-Pay Tax functionality on the e-filing website.

Repairing Oil Pan Holes: DIY Guide for Quick Fix

You may want to see also

How to link PAN to Aadhaar by SMS

As per the sources, there is no provision to link your PAN with Aadhaar via SMS. However, here is a step-by-step guide on how to link Aadhaar with PAN:

Step 1: Payment of the penalty

Follow the steps mentioned below to pay the penalty for linking PAN-Aadhaar:

- Visit the Income Tax e-Filing Portal.

- Click the ‘e-Pay Tax’ option under the ‘Quick Links’ heading.

- Enter the ‘PAN’ number under the ‘PAN/TAN’ and ‘Confirm PAN/TAN’ column, enter your mobile number and click the ‘Continue’ button.

- After OTP verification, you will be redirected to the e-Pay Tax page. Click the ‘Continue’ button.

- Click the ‘Proceed’ button under the ‘Income Tax’ tab.

- Select Assessment Year as ‘2025-26’, ‘Type of Payment (Minor Head)’ as ‘Other Receipts (500)’ and Sub-type of Payment as ‘Fee for delay in linking PAN with Aadhaar’ and click the ‘Continue’ button.

- The applicable amount will be pre-filled against ‘Others’ option. Click ‘Continue’ and make the payment.

Step 2: Submit the Aadhaar-PAN link request

You can do the online linking of the Aadhaar number with your PAN by logging on to the Income Tax e-filing portal. There are two ways of linking your PAN to your Aadhaar:

Method 1: Without Logging in to Your Account:

- Go to the Income Tax e-filing portal. Under quick links, click on the ‘Link Aadhaar’ tab.

- Enter your PAN and Aadhaar number and click the ‘Validate’ button.

- Enter your name as per your Aadhaar card and mobile number and click the ‘Link Aadhaar’ button.

- Enter the OTP received on your mobile number and click the ‘Validate’ button.

- The request for PAN Aadhaar linking will be sent to the UIDAI for validation.

Method 2: Logging in to Your Account:

- Register yourself at the Income Tax e-filing portal, if you are not already registered.

- Log in to the e-filing portal of the income tax department by entering the user ID.

- Confirm your secure access message and enter the password. And click ‘Continue’ to proceed further.

- After logging in to the website, click on ‘Link Aadhaar’. Alternatively, go to ‘My Profile’ and select ‘Link Aadhaar’ under the ‘Personal Details’ option.

- Enter your Aadhaar number and click the ‘Validate’ button.

- A pop-up message will inform you that your Aadhaar number has been successfully linked to your PAN card.

Get Rid of Black Stains on Pans: Easy Cleaning Methods

You may want to see also

How to check the status of Aadhaar-PAN linkage

To check the status of your Aadhaar-PAN linkage, you can either log in to the Income Tax e-filing portal or check without logging in. Here are the steps for both methods:

Checking Aadhaar-PAN Linkage Status Without Logging In:

- Visit the Income Tax e-filing portal homepage.

- Under the 'Quick Links' heading, click on 'Link Aadhaar Status'.

- Enter your PAN and Aadhaar numbers, then click on 'View Link Aadhaar Status'.

- On successful validation, a message will be displayed regarding your linkage status.

Checking Aadhaar-PAN Linkage Status After Logging In:

- Log in to the Income Tax e-filing portal.

- Go to the 'Dashboard' on the homepage and click on the 'Link Aadhaar Status' option.

- Alternatively, go to 'My Profile' and click on the 'Link Aadhaar Status' option.

- If your Aadhaar is linked to your PAN card, the Aadhaar number will be displayed. If not, a 'Link Aadhaar Status' message will be shown.

- If your request to link your Aadhaar with your PAN is pending with the Unique Identification Authority of India (UIDAI) for validation, check the status later.

Checking Aadhaar-PAN Linkage Status via SMS:

- Write the SMS in the following format: UIDPAN <12-digit Aadhaar number> <10-digit PAN number>.

- Send the SMS to '567678' or '56161'.

- Wait for a response from the government service.

Understanding the Responses:

When your Aadhaar is linked to your PAN, the message will be: "Your PAN is already linked to the given Aadhaar."

If your Aadhaar-PAN linkage is in progress, the message will be: "Your Aadhaar-PAN linking request has been sent to UIDAI for validation. Please check the status later by clicking on 'Link Aadhaar Status' on the Home Page."

If your Aadhaar is not linked to your PAN, the message will be: "PAN not linked with Aadhaar. Please click on 'Link Aadhaar' to link your Aadhaar with PAN."

SBC Oil Pan Compatibility: Universal Fit or Unique?

You may want to see also

Frequently asked questions

The fee for linking Aadhaar and PAN cards is Rs. 1000.

The deadline for linking Aadhaar and PAN cards was June 30, 2023.

If you don't link your Aadhaar and PAN cards by the deadline, your PAN card will become inoperative, and you may have to apply for a new one.

You can link your Aadhaar and PAN cards through the e-filing website or by sending an SMS.

To link your Aadhaar and PAN cards through the e-filing website, visit the official Income Tax Department e-filing website, click on the "Link Aadhaar" option, enter your PAN and Aadhaar numbers, name as mentioned on your Aadhaar card, verify the captcha code, tick the relevant box, and click on "Link Aadhaar".