If you're applying for a PAN card, you'll need to include the AO (Assessing Officer) code in your application form. The AO code is a combination of the area code, the range code, the AO number, and the AO type. It's important because it helps the Income Tax Department identify the relevant Assessing Officer and the tax laws that apply to the applicant. The Assessing Officer is responsible for assessing the applicant's Income Tax Returns and can seek clarification from the applicant if any discrepancies are found. The AO code can be obtained from the Income Tax Office or found online. It's worth noting that the AO code for a PAN card holder may change over time due to policy updates by the Income Tax Department.

| Characteristics | Values |

|---|---|

| What is it? | A code assigned to every officer who carries out the assessment of income tax returns. |

| What does it consist of? | Area Code, AO Type, Range Code, and AO Number |

| Where to find it? | Income Tax Office, NSDL Website, UTIITSL Website, or Income Tax e-Filing Website |

| When to use it? | When applying for a PAN card, mention the AO code in the form. |

| Why is it important? | It ensures that various individuals and companies are assessed as per their entity type and by the appropriate Assessing Officers. |

What You'll Learn

What is an AO code?

An AO code is a unique combination of four elements: the area code, the range code, the AO type, and the AO number. This code is assigned to every officer who carries out an assessment of income tax returns and is known as the Assessing Officer's code. The AO code is important when filing income tax returns as it helps determine the jurisdictional officer who will assess an individual's income tax return.

The four elements of the AO code are as follows:

- Area Code: This indicates the region of jurisdiction and is represented by three letters.

- Range Code: It helps to locate the ward or circle of the PAN cardholder's permanent address.

- AO Type: It mentions the category of the applicant, which can be an individual, organisation, non-resident, or defence personnel.

- AO Number: A unique number assigned to each assessing officer.

The AO code for a PAN cardholder may change over time according to updates in the policies of the Income Tax Department. PAN card applicants are required to provide their AO code in their application, which can be obtained from the Income Tax Office or found online.

Hot Pot Hazards: Towel Trouble and Safer Alternatives

You may want to see also

How to find your AO code online

An AO code is a combination of an area code, AO type, range code, and AO number. It is required for all applicants when applying for a PAN card. This code is important as it helps the Income Tax Department identify the taxpayer and their tax jurisdiction.

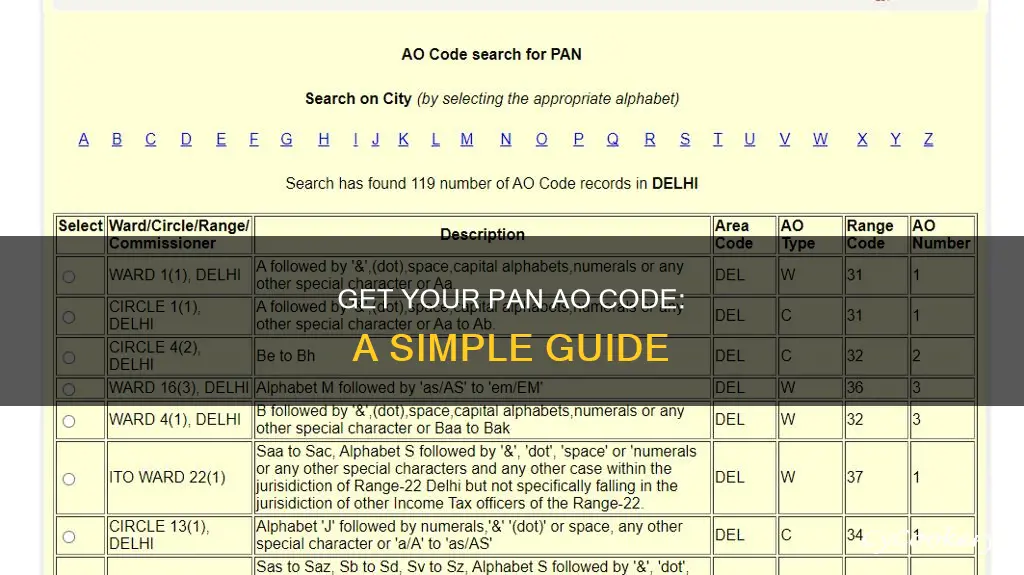

Know your AO Code through the NSDL website:

- Visit NSDL's PAN Portal to search for your AO Code.

- Select the city of your residence.

- A list of AO codes in your city will be displayed.

- Select the appropriate AO code as per the details mentioned and click on the submit button.

Find your AO Code through the UTIITSL website:

- Visit the UTIITSL website.

- Click on "Search for AO Code Details" listed under PAN Card Services.

- Select the suitable AO code type and click on "View Details".

- Select the city name by choosing the appropriate alphabet.

- Choose from the list of AO codes and other details mentioned.

Find your AO Code through the Income Tax e-Filing website:

- Visit https://incometaxindiaefiling.gov.in and log in.

- Click on "Profile Settings" and then click on "My Profile".

- Click on "PAN Card" to view details like the Area Code, AO Type, Range Code, AO Number, and Jurisdiction.

If you already have a PAN card, you can verify/check your AO code by following these steps:

- Log on to the Income Tax portal.

- Click on "Know Your AO".

- Enter your PAN card number and mobile number.

- Enter the OTP and click on "Validate".

- Your PAN card details will be displayed along with your Area Code, AO Type, and AO Number.

Additionally, you can download the spreadsheet containing AO codes and use the search function to look for your city name.

Green Non-Stick Pans: Safe or Not?

You may want to see also

How to find your AO code in person

To find your AO code in person, you can visit your local Income Tax Office. Here, you can obtain your AO code, which is required when applying for a new PAN card. This code will be dependent on your address and the Income Tax assessing officer's jurisdiction.

The AO code is made up of four components: the area code, the range code, the AO number, and the AO type. The area code is represented by three letters and indicates the region of jurisdiction. The range code helps to locate the ward or circle of the PAN cardholder's permanent address. The AO type mentions the category of the applicant, whether they are an organisation, an individual, defence personnel, or a non-resident. The AO number is a unique number assigned to the assessing officer.

If you are an individual with sources of income other than salary, your AO code will depend on your home address. If you are an individual taxpayer who is solely dependent on a salary or a combination of salary and business earnings, your AO code will be based on your official address. If you are a HUF, LLP, partnership firm, trust, or body of individuals, your AO code will be based on your office address.

It is important to note that the AO code for a PAN cardholder may change over time according to the policy updates of the Income Tax Department. Therefore, it is recommended to contact your local Income Tax Office to know the Assessing Officer under whose jurisdiction you fall.

Pan-Seared Calamari Perfection

You may want to see also

What to do if you are a student

As a student, you will need to obtain an AO code when applying for a PAN card. Here is a step-by-step guide on what you need to do:

- Understand what an AO Code is: AO stands for Assessing Officer, and the code is a combination of the Area Code, AO Type, Range Code, and AO Number. This code is essential for your PAN application.

- Determine your Jurisdiction: The AO code you select should be under the jurisdiction of your residential address. You can search for your AO Code by selecting your city based on your residence address. Some cities have additional descriptions to help identify the correct code.

- Find your AO Code: You can search for your AO Code on the official website of the Income Tax Department. You may also visit your local Income Tax Office to seek assistance in finding the correct AO Code.

- Provide the AO Code in your PAN Application: When filling out the PAN card application form, make sure to mention the AO code accurately. Double-check the details, as providing incorrect information may lead to delays or complications in the application process.

- Contact for Assistance: If you need further help, you can contact the local office of the Income Tax Department or call the Aaykar Sampark Kendra at 0124-2438000. They can provide additional information and guide you through the process.

- Keep Track of your Application: After submitting your PAN application with the AO code, make sure to keep the acknowledgment slip or reference number for future reference. You can use this to track the status of your application.

Remember to have all the necessary documents ready when applying for your PAN card, and ensure that the information you provide, including your AO code, is accurate and up-to-date.

The Art of Re-Blackening Cast Iron: A Guide to Restoring Your Pan's Glory

You may want to see also

How to change your AO code

To change your AO code, you must first understand why you need to change it. An AO code, or Assessing Officer code, is a combination of your Area Code, AO Type, Range Code, and AO Number. It is used to determine the jurisdiction under which you fall as a taxpayer.

There are two common reasons why you may need to change your AO code:

- Change of permanent address: If you have shifted your residence to a new area, you will need to change your AO code when filing returns. This is because your AO code is linked to your address, and the tax laws applicable to you may change depending on your jurisdiction.

- Unsatisfactory behaviour of the current AO: If your current Assessing Officer is not performing their duties efficiently or is displaying unprofessional behaviour, you can request a change.

- For a change of permanent address:

- Write an application to your current AO, stating the reason for the change (i.e., address change).

- Write another application to the new AO, requesting them to apply to the existing AO for the change.

- The current AO must accept this application.

- Once approved, the application is forwarded to the Income Tax Commissioner.

- After the commissioner's approval, your AO is changed from the existing one to the new AO.

For unsatisfactory behaviour of the current AO:

- Write a detailed application and send it to the Income Tax Ombudsman, providing all relevant details such as your name, address, and the name of your current Assessing Officer. Clearly state the reasons for your dissatisfaction with their work.

- The ombudsman must approve and sign the request.

- Attach any supporting documents to your application, if necessary.

- Once approved, the application is forwarded to the Income Tax Commissioner.

- Upon the commissioner's approval, your current AO will be changed to a new Assessing Officer.

It is important to note that if the existing AO does not approve the application request for a change of address, the migration of your PAN will not be processed. Additionally, ensure that you carefully select the correct AO code as per your jurisdiction, as this is essential for taxation purposes.

POTS and the Heat: A Recipe for Disaster?

You may want to see also

Frequently asked questions

An AO code is a combination of the area code, AO type, range code, and AO number. It is used to identify the assessing officer for an individual's PAN card.

You can find your AO code by visiting the local Income Tax Office or online through the NSDL, UTIITSL, or Income Tax e-Filing websites.

The components of an AO code are:

- Area code: the region of jurisdiction

- AO type: the category of the applicant (individual, organisation, non-resident, or defence personnel)

- Range code: based on the residential address of the PAN card applicant

- AO number: a unique number assigned to the assessing officer

There is no specific AO code for a non-employed person on a PAN card. However, there is an option to select a salary below a certain amount.