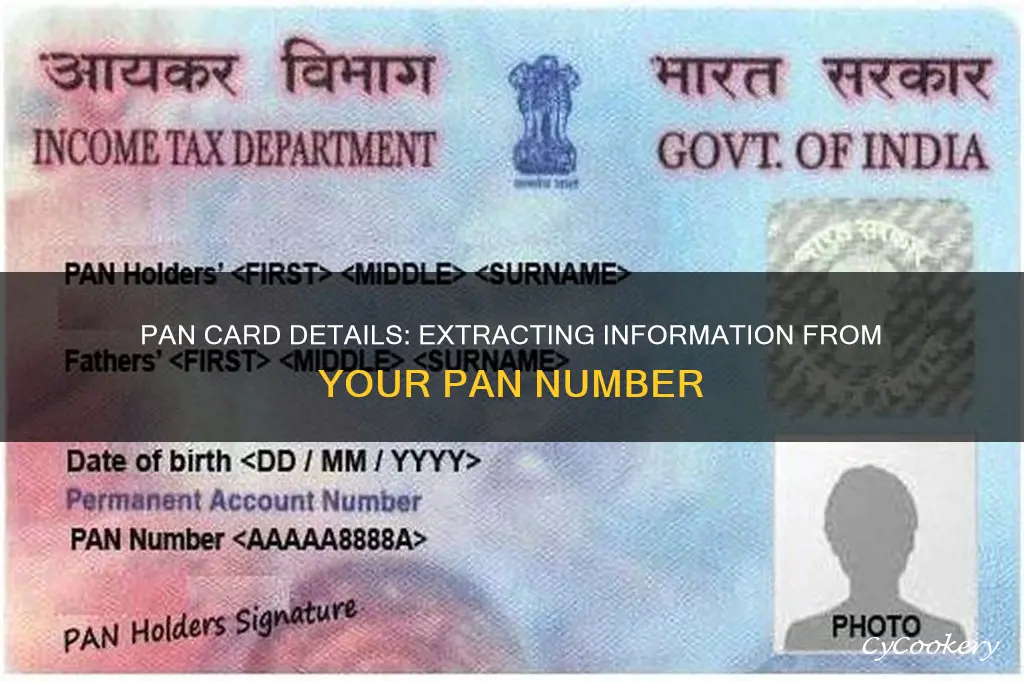

The Permanent Account Number (PAN) is a 10-digit alphanumeric identification number assigned to taxpayers in India. The PAN system is a computer-based method that records all tax-related information for an individual against a single PAN number, which acts as the primary key for storing information. This number is shared across the country, and no two taxpayers can have the same PAN. PAN card details include personal information such as name, address, date of birth, and PAN card number.

To get details from a PAN number, individuals can visit the Income Tax Department e-Filing website and register themselves. After completing the registration form and activating their account, they can access their PAN details, including name, area code, jurisdiction, address, and other information, under the Profile Settings section.

| Characteristics | Values |

|---|---|

| Purpose | Identification of taxpayers across the country |

| Format | 10-digit unique alphanumeric number |

| Information | Name, father's name, date of birth, PAN number, issuing authority |

| Uses | Submission of taxes and tax returns, receiving refunds, identification proof for financial transactions, opening bank accounts |

| Requirements | Mandatory for financial transactions, loan applications, property transactions, vehicle purchases, etc. |

What You'll Learn

How to check PAN card details by name and date of birth

If you don't remember your PAN number, you can retrieve your PAN card details using your name and date of birth on the e-Filing website. Here are the steps to do so:

- Visit the Income Tax Department e-Filing website.

- Navigate to the "Quick Links" section.

- Click on "Know Your PAN".

- Enter your personal information, including your full name (surname, middle name, and first name), date of birth, gender, status, and mobile number.

- An OTP will be sent to your registered mobile number for verification.

- Enter the OTP and submit.

- Your PAN number and relevant details will be displayed.

Please note that the "Know Your PAN" service has been discontinued by the Income Tax Department website and replaced by the "Verify Your PAN Details" service. This means that you can check your PAN card details by verifying your PAN online and entering your name and date of birth.

Additionally, you can also search for PAN card details by name and date of birth through the following steps:

- Visit the Income Tax department's official e-filing website.

- Go to the "Quick Links" section.

- Click on "Know Your PAN".

- Enter your first name, middle name, surname, gender, date of birth, status, mobile number, etc.

- An OTP will be sent to the registered mobile number linked to your PAN card.

- Click on "Validate".

- Enter your father's name.

- Click on "Submit".

- Your PAN number will be displayed on the screen with the relevant details.

Carbon Steel Pans: Hardness and Durability

You may want to see also

How to search PAN card details by PAN number

The Permanent Account Number (PAN) is a unique 10-digit alphanumeric identification number issued by the Indian Income Tax Department to individuals and entities for tracking financial transactions. It is mandatory for individuals and entities to have a PAN card to file taxes, open a bank account, or conduct certain financial transactions in India.

The Income Tax Department provides an online portal for PAN verification and to search for PAN card details. Here are the steps to follow:

Step 1: Visit the Income Tax E-Filing page

Step 2: Click "Register" and enter your PAN

Step 3: Fill in the relevant details carefully and then click "Submit"

Step 4: You will receive an activation link on your email address

Step 5: Click on the link to activate your account

Step 6: Go back to the Income Tax Department's website and click on "Login"

Step 7: Log in to your account

Step 8: Click on "Profile Settings" and then "PAN Details"

Step 9: All the information related to the PAN card will be displayed, including name, address, area code, jurisdiction, and other details

Other ways to check PAN card details:

- Through the PAN verification service, you can check your PAN card details by entering your name and date of birth

- If you have registered on the income tax portal, you can log in to your account and access your PAN details under the "Profile Settings" or "My Account" section

- Contact the PAN card customer care service via phone or email, and they will guide you through the process

- Check your PAN number through a mobile application by downloading the official PAN card app and following the instructions

- If you have already registered on the Income Tax Department's e-Filing website, you can log in and view your complete PAN details, including your address

- Verify the validity of your PAN card details by calling the toll-free numbers provided by the Income Tax helpline and Protean e-Gov Technologies Limited

Tin-Plated Steel Pans: Safe for Food?

You may want to see also

How to search for address in your PAN card

To search for an address in your PAN card, you must first register yourself on the official website of the Income Tax Department. Here are the steps to follow:

- Visit the Income Tax E-Filing page

- Click on "Register Yourself" and enter your PAN card number

- Fill out the registration form and submit it

- You will receive an activation link on your email. Click on the link to activate your account

- Log in to your account

- Click on "Profile Settings" and then "PAN Details"

- Your address and other details will be displayed on the screen

Alternatively, you can also visit any Income Tax PAN Service Center to check your PAN card address. Here are the steps:

- Fill out a PAN card address change form

- Submit the form to a center official along with your PAN card and a copy of your address proof

- You will receive a new PAN card with your updated address within a few weeks

Saladmaster Pans: Oven-Safe?

You may want to see also

Steps to change/update PAN card details

It is important to keep your PAN card details updated, as this document serves as a valid form of identification and is crucial for financial transactions and tax purposes. Here are the steps to change or update your PAN card details:

Online Process via NSDL e-Gov (Protean) Portal:

- Visit the official website of NSDL E-Governance: https://www.protean-tinpan.com.

- Under the "Services" section, click on "PAN".

- Click "Apply" under the "Change/Correction in PAN Data" section.

- From the "Application Type" dropdown menu, select "Changes or Correction in existing PAN data/Reprint of PAN Card (No changes in Existing PAN Data)".

- Select the correct category of the assessee (e.g., "Individual") from the "Category" dropdown menu.

- Enter your name, date of birth, email address, and mobile number.

- Fill in the Captcha and click "Submit".

- You will receive a Token Number via email to continue the process.

- Proceed to the PAN card update form, where you can choose to submit your documents via e-Sign.

- Fill in the necessary details, such as your father's name, mother's name (optional), and Aadhaar number.

- Update your address on the next page.

- Upload the necessary documents, including proof of address, proof of age, proof of identity, and a copy of your PAN card.

- Sign the declaration and click "Submit".

- Make the payment via demand draft, net banking, credit card, or debit card.

- Print and send the acknowledgement slip, along with physical proof of documents and two photographs, to the NSDL e-gov office.

Online Process via UTIITSL Portal:

- Visit the UTIITSL website: https://www.onlineservices.nsdl.com/paam/.

- Under "PAN Card Services," click on "Apply PAN Card".

- Click on "Apply for Change/Correction in PAN Card Details" under the "Change/Correction in PAN Card" tab.

- Choose the mode of document submission, enter your PAN, and select the PAN card mode.

- Re-enter your PAN and click "Ok".

- Once the request is registered, you will receive a reference number.

- Enter your name, address, and other details, then click on the "Next Step" button.

- Enter your PAN and verification details, and click on the "Next Step" button.

- Upload the required documents and click the "Submit" button.

- Verify the details and make the payment.

- A success message will be displayed, and you can print out the form.

Offline Process via NSDL (Protean) or UTIITSL:

- Download the PAN card correction form from the NSDL or UTIITSL website.

- Fill out all the mandatory fields in the form carefully.

- Attach supporting documents, such as proof of identity, proof of address, and passport-size photographs.

- Submit the form at the nearest NSDL collection center or PAN center.

- Pay the applicable charges for PAN card update/correction offline.

- You will receive a 15-digit acknowledgement number to track the status of your PAN card application.

Pan Pizza: Speciality or Not?

You may want to see also

How to update address in PAN using Aadhaar card

Updating your address on your PAN card is a simple process that can be done online or through your Aadhaar card. Here is a step-by-step guide on how to update your address in PAN using your Aadhaar card:

Updating Address in PAN Using Aadhaar Card:

Step 1: Visit the Official Website

Go to the official website of the UTI Infrastructure Technology and Service Ltd. (UTIITSL) or the NSDL eGov portal, depending on which agency issued your PAN card.

Step 2: Navigate to PAN Services

On the UTIITSL website, under 'PAN Card Services', click on 'Apply PAN Card'. On the NSDL eGov portal, click on the 'Services' tab, then select 'PAN' from the dropdown menu.

Step 3: Select Address Update Option

On the UTIITSL website, click on 'Click To Update' under the 'Facility for address update in PAN database through eKYC mode' service option. On the NSDL eGov portal, go to the 'Change/Correction in PAN Data' section and click on 'Apply'.

Step 4: Enter Required Details

Enter your PAN and Aadhaar numbers, along with your personal information such as email, phone number, and address update source.

Step 5: Select Aadhaar-Based Update Option

Choose the option to update your address with the help of your Aadhaar card, such as 'Aadhaar Base e-KYC Address Update'.

Step 6: Agree to Terms and Submit

Enter the captcha, and agree to the terms and conditions. Then, click on 'Submit'.

Step 7: Authenticate with OTP

A One Time Password (OTP) will be sent to your Aadhaar-linked email address and mobile number. Enter this OTP to authenticate and submit your request.

Step 8: Address Updated

Once all the steps are completed, your residential address will be updated in your PAN card to match the address on your Aadhaar card.

Additional Information:

Remember to ensure that your Aadhaar card details are correct and updated before initiating the PAN address update process. Additionally, your PAN should already be linked to your Aadhaar, as this is mandatory.

By keeping your PAN card address updated, you can avoid any discrepancies in the records of the Income Tax Department and ensure that you receive all official letters and notices at your current address.

Publix: Pots and Pans Shopping

You may want to see also

Frequently asked questions

A PAN card contains essential information about the cardholder, including their name, father's name, date of birth, PAN number, and the issuing authority.

Visit the Income Tax E-Filing page, click 'Register Yourself', enter your PAN number and other details, submit, and then follow the remaining steps to verify your PAN card details.

Visit the official website of the Income Tax Department, select 'Verify PAN Details', and fill in the necessary details to check your PAN card details online.

Yes, you can track PAN card details using your Aadhaar number.

You can use the 'Know Your PAN' service on the Income Tax E-Filing portal or visit the NSDL e-Gov official website to get/download your PAN card number using your name and date of birth.