The Permanent Account Number (PAN) is a 10-digit alphanumeric code issued by the Income Tax Department of India to each taxpayer. It is used to identify the income of a taxpayer or PAN cardholder and is mandatory for financial transactions such as filing income tax returns, buying mutual funds, and applying for loans. While there is no direct way to check income details using a PAN number, one can verify their PAN card details by entering their name and date of birth. This article will outline the steps to verify your PAN card details and discuss the importance of keeping your PAN information up to date.

| Characteristics | Values |

|---|---|

| How to get income details from PAN number | Visit the Income Tax E-Filing page, click 'Verify Your PAN', enter your PAN, full name, date of birth and mobile number, enter the OTP and click 'Validate' |

What You'll Learn

Verify your PAN card details

Verifying your PAN card details is a simple process that can be done online. This process is essential for guarding against identity theft and fraud and is also necessary for statutory compliance and financial transactions.

To verify your PAN card, you will need to provide some core personal details. This includes your full name, date of birth, and your father's name. Additionally, you will need to enter your PAN number. This information should match the details mentioned on your PAN card.

There are several online tools and services available for PAN verification. The Income Tax Department (ITD) has authorized Protean eGov Technologies Limited to launch an online PAN verification service. This service is available to specific entities, including financial institutions, government agencies, and educational institutions. The service offers three modes of verification: screen-based, file and screen-based, and software (API)-based verification.

You can also verify your PAN details on the National Government Services Portal. Here, you can search for your Permanent Account Number (PAN) by selecting your date of birth and full name. This will provide you with details such as your PAN, name of the PAN cardholder, jurisdiction, and status.

It is important to ensure that the information associated with your PAN card is accurate and up-to-date to avoid any issues with financial transactions and statutory compliance.

Gotham Steel Pans: Lifetime Warranty?

You may want to see also

Register yourself on the Income Tax website

Registering yourself on the Income Tax website is a simple process, similar to signing up for an e-commerce website. Here is a step-by-step guide to registering yourself on the Income Tax e-filing website:

Step 1: Visit the e-Filing Portal

Go to the official e-Filing portal of the Income Tax Department: www.incometaxindiaefiling.gov.in.

Step 2: Click on "Register Yourself"

On the homepage, look for the "Register Yourself" button, usually located on the right side. Click on it to initiate the registration process.

Step 3: Select User Type

Select the applicable user type from the given options. Typically, you would choose "Individual." However, if you are a tax professional, you may have other options, such as "Chartered Accountant."

Step 4: Enter Basic Details

Fill in the mandatory basic details, including your PAN, name, residential status, and date of birth. Ensure that the information matches the details on your PAN card.

Step 5: Provide Contact and Address Details

In this step, you will need to provide your contact details, such as your current address, verified mobile number, and valid email address.

Step 6: Set a Password and Security Questions

In the next part of the registration form, you will be asked to set a password and choose secret questions for security purposes. Choose a strong password that meets the password policy requirements.

Step 7: Submit and Verify

Click on "Submit" after filling in all the required details. You will then receive two separate six-digit One-Time Passwords (OTPs) on your registered mobile number and email address. Enter these OTPs on the respective columns to verify your information. For non-resident individuals, the OTP will only be sent to the email address.

Note that the OTPs are typically valid for a limited time, such as 24 hours, so be sure to enter them promptly.

Step 8: Complete Registration

After entering the correct OTPs, your registration process will be completed. You will receive a confirmation message, and your login credentials will be sent to your primary email address.

By registering on the Income Tax e-filing website, you can access various services, such as filing Income Tax Returns (ITRs), accessing previous year's ITRs, e-verifying ITRs, and checking the status of tax refund claims. Keep your login credentials secure, just as you would with your banking information.

The Best Ways to Clean Black Grime Off Your Pans

You may want to see also

Track your PAN card status

To track your PAN card status, you can use any of the following methods:

Online

You can check your PAN card status online by visiting the official Tax Information Network of the Income Tax Department website. Here, you can select the application type as 'PAN – New/Change Request' from the drop-down menu and enter your acknowledgement number, captcha code, and click 'Submit'. The status of your PAN application will be displayed on the screen.

Alternatively, you can visit the UTIITSL website, click on the 'Track PAN Card' tab, and enter your application/coupon number and date of birth. The PAN application status will then be displayed on the screen.

By Phone

You can call the TIN call centre on the following numbers and provide your 15-digit acknowledgement number of your PAN application to check its status:

- 020-27218080 (7:00 am to 11:00 pm every day)

- 08069708080 (24 hours)

By SMS

You can send an SMS of your 15-digit acknowledgement number to NSDL PAN on 57575. The status of your PAN card application will be sent to the mobile number you entered in the PAN application form.

By WhatsApp

Open WhatsApp on your mobile phone and message 'Hi' to '8096078080'. You will receive a message asking for your consent to receive emails or SMS from 'Protean eGov Technologies Limited'. Select 'Yes'. Next, click on the 'Services' option and select 'Status of Application' from the list. Then, click on the 'PAN Application' option and enter your 15-digit acknowledgement number. You will receive the PAN card application status.

Care Tips for Stone Pizza Pans

You may want to see also

Update your PAN card details

Updating your PAN card details is a straightforward process that can be done online or offline. Here is a step-by-step guide to help you through the process:

Online Process:

You can update your PAN card details online through the NSDL e-Gov website or the UTIITSL website. It is important to note that you need to use the same website through which you had initially applied for your PAN card.

NSDL e-Gov Website:

- Go to the NSDL e-Gov website.

- Click on the 'Services' tab and select 'PAN' from the dropdown menu.

- Locate and click on 'Change/Correction in PAN Data'.

- Click on 'Apply' from the list of options.

- Fill out the Online PAN Application form:

- Application type: Select 'Changes or Correction in existing PAN Data/Reprint of PAN Card'.

- Category: Choose the relevant category.

- Other details: Provide additional personal details such as Date of Birth, Incorporation/Formation, and Citizenship.

- Enter the 'Captcha Code' and submit the form.

- You will receive a Token Number on your registered Email ID. This token can be used to access the draft form if needed.

- Continue with the PAN Application Form and follow the subsequent steps for updating your specific details.

- Submit the form and complete the KYC process.

- An OTP will be sent to your Aadhaar Registered mobile number for verification.

- After verification, you can download the acknowledgement form. The password to open this file is your date of birth in the DD/MM/YYYY format.

UTIITSL Website:

- Go to the UTIITSL website.

- Click on the 'Click to Apply' option under the 'Change/Correction in PAN Card' tab.

- Click on the 'Apply for Change/Correction in PAN card details' tab.

- Select the mode of submission of documents and enter your PAN number and PAN card mode.

- Click 'Submit' and you will receive a reference number.

- Tick the fields that require updates or corrections and enter the new details.

- Proceed to the next steps, providing your contact details and verifying your PAN number.

- Upload the required documents and click 'Submit'.

- Verify the details on the form and make the payment.

- Select the mode of online payment and complete the payment process.

Offline Process:

If you prefer to update your PAN card details offline, you can follow these steps:

- Download the PAN card correction form online.

- Fill out the form and submit it along with the necessary documents at any nearest PAN centre.

- After submission and payment, you will receive an acknowledgement slip.

- Send this slip to the Income Tax PAN Service Unit of the NSDL within 15 days.

Documents Required:

Regardless of the method you choose, you will need to provide certain documents for verification. These include:

- Identity proof: Aadhaar card, Voter's ID, driving license, ration card, etc.

- Address proof: Aadhaar card, Voter's ID, property tax receipts, utility bills, etc.

- Proof of date of birth: Aadhaar card, Voter's ID, birth certificate, matriculation marksheet, etc.

Fees for PAN Card Update:

The fees for updating your PAN card vary depending on the method of submission and the location of dispatch. For offline submissions, the fee is Rs.110. If the PAN card needs to be dispatched outside India, an additional fee of Rs.910 is applicable. The fees for online submissions range from Rs.50 to Rs.1,017, depending on the mode of submission and dispatch location.

Brining Chicken: Stainless Steel Pan?

You may want to see also

Find your PAN card number

To find your PAN card number, you can use the official Income Tax website. This method requires you to register an account. Here are the steps:

- Visit the official website.

- Click on "Register Yourself" if you are a new user. If you already have an account, click on "Registered User".

- Select your user type and click "Continue".

- Fill out the registration form and click "Submit".

- Check your email for the activation link and click on it to activate your account.

- Log in to your account on the e-Filing website.

- Select "Profile Settings" and then "My Account".

- Your PAN details will be displayed, along with your address and contact details in separate tabs.

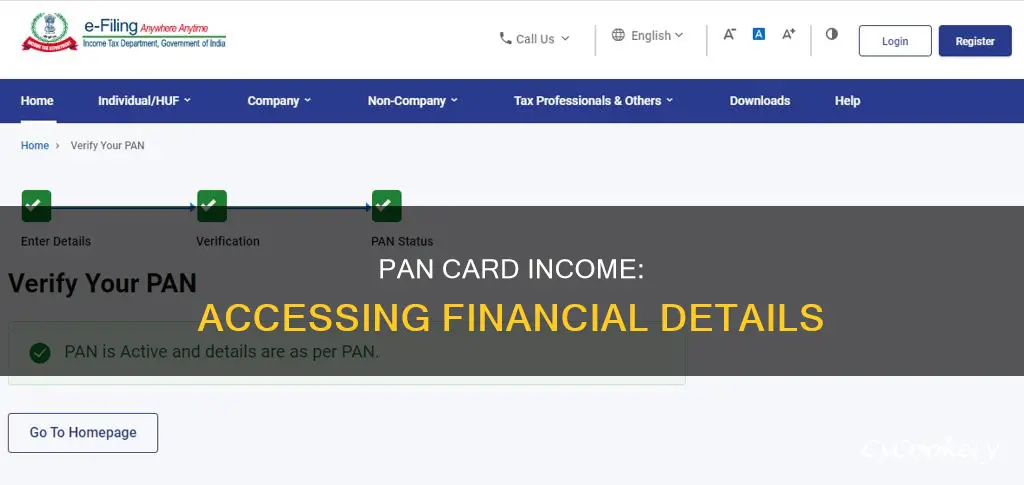

Alternatively, you can verify your PAN card details on the e-Filing Home Page without registering an account. Here are the steps:

- Visit the e-Filing Home Page.

- Under the "Quick Links" section, click on "Verify your PAN Details".

- Enter your PAN, full name, date of birth, and mobile number.

- Click on "Continue".

- Enter the OTP that you receive on your mobile number.

- Click on "Validate".

- You will be redirected to a new page that will show whether your PAN is active and the details match the PAN database.

There are also other ways to find your PAN card number. You can use the Indian PAN Card mobile app, call a toll-free number, or use an online tool such as the one previously offered by Quicko.

VW Pan: How Much Transmission Fluid?

You may want to see also

Frequently asked questions

Visit the official website of the Income Tax Department, opt for the "Verify PAN Details" option and fill in and submit the necessary details.

Go to the Income Tax E-Filing page, click "Register Yourself" and enter your PAN number, then enter the mandatory details and click "Submit". You will then receive an activation link to your email address. After activating your account, go to "My Account" and click on "PAN Details" under the "Profile Settings" section.

You can get/download your PAN Card number using your name and date of birth from the NSDL e-Gov official website.