Getting a Permanent Account Number (PAN) is essential for conducting financial transactions in India. While it is impossible to get a PAN number in one day, especially for applicants living outside India, it is still possible to obtain one within 5-7 working days. Here's a simple guide on how to get your PAN number as quickly as possible.

First, identify the type of applicant: Individual with an Indian passport, Individual with a Foreign passport, or Company registered outside India. Next, begin your application online and enter the required details, such as name, address, and contact information. Make the necessary online payment, which includes the shipping fee for sending the PAN card to your international address.

After submitting your application, send proof of name and address to the relevant authorities for review. You will then need to print, sign, and paste your photos on the application form before sending it via post or courier to India, along with copies of your proof documents.

Once the PAN officials receive and process your application, they will allot a unique PAN number. You will first receive a digital PAN via email, which is accepted for bank KYC and property registrations. Subsequently, a physical PAN card will be delivered to your overseas address.

While the process may take longer than a day, it is still relatively quick and efficient, ensuring that applicants can receive their PAN numbers without unnecessary delays.

What You'll Learn

How to get a PAN card for NRIs

A PAN card is a 10-digit alphanumeric identification number assigned to Indian taxpayers. The card is issued by the Income Tax Department in India and is required for all financial transactions, including opening a bank account, getting a loan, or buying high-end consumer products. The same applies to Non-Resident Indians (NRIs) who need to file an income tax return or participate in any economic or financial transactions in India.

Application Process:

The easiest way to apply for a PAN card for NRIs is by filling out the online application form. The form can be found on the official website of TIN-Protean eGov Technologies Limited (formerly NSDL) or UTIITSL. The form must be accompanied by supporting documents, which will be used to verify the applicant's identity and address.

Supporting Documents:

- A copy of your passport.

- Proof of address: This can be a copy of your bank account statement from the country of residence or a copy of an NRE bank account statement with a minimum of two transactions in the last six months, attested by the Indian embassy or consulate. If you don't have an Indian address, a foreign address is allowed for foreign citizens or NRIs.

Application Fee:

The fee for a PAN card depends on the applicant's location. If the mailing address is within India, the fee is INR 107, whereas it is INR 1,017 if the address is outside India. This fee can be paid via debit card, credit card, demand draft, or net banking.

Tracking:

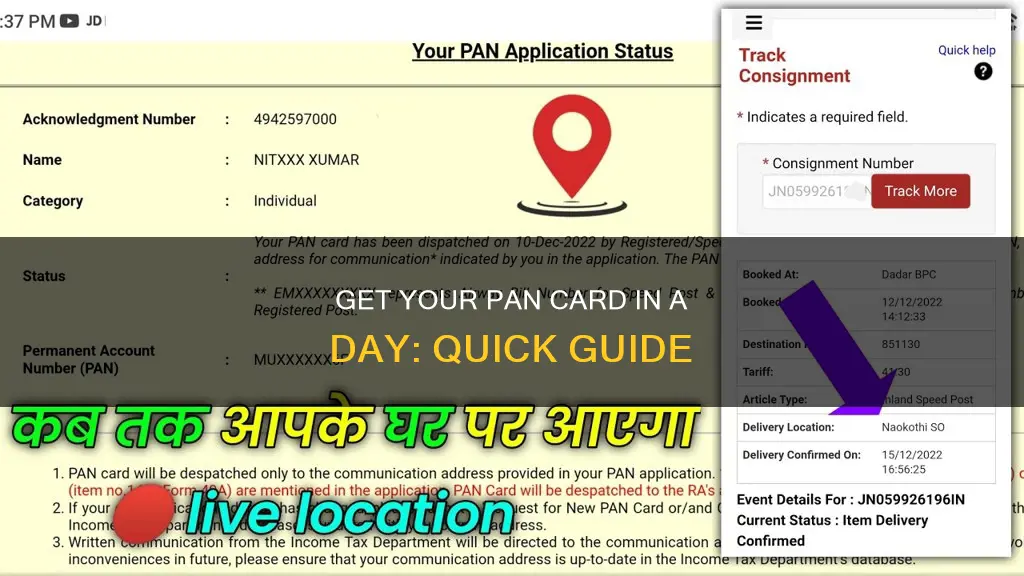

Once the application and documents are submitted, you can track the status of your PAN card application using the unique application number provided to you. You can check the status on either the NSDL or UTITSL website.

Processing Time:

The time taken to receive a PAN card depends on the application method. If you have applied for an ePAN, you may receive the PAN number instantly. For other online applications, it may take around two weeks or longer to receive the physical PAN card.

Important Points to Remember:

- Ensure that the application form is filled out in black ink and that all details are provided in clear block letters.

- Signatures should be placed only in the box provided and not across the photograph.

- Provide the correct AO code, proof of identity, and address.

- If the PAN applicant is a minor, the proof of identity and address documents must be submitted by their representative.

- Avoid making corrections or overwriting on the application form.

- Attach the photograph to the form using adhesive instead of stapling or pinning it.

- Do not write the date or place under your signature.

- Do not state the husband's name in the father's name column.

- Do not apply for a PAN card if you already have one, as holding more than one PAN card can result in a fine of INR 10,000.

By following these steps and providing the necessary documentation, NRIs can obtain their PAN cards within a reasonable timeframe, enabling them to conduct financial transactions in India with ease.

Erase Burned Food from Cookware

You may want to see also

How to get a PAN card without an Aadhaar card

If you are an Indian citizen, a Permanent Account Number (PAN) card and an Aadhaar card are critical identification documents. The PAN card is issued by the Income Tax (IT) department, while the Unique Identification Authority of India (UIDAI) issues the Aadhaar card.

The PAN is a unique identification number issued to individuals and businesses for tax purposes. The Aadhaar number is a 12-digit unique identification number issued to all residents. The IT department has made linking PAN and Aadhaar cards mandatory.

If you do not have an Aadhaar card, you can still obtain a PAN card. Here is a step-by-step guide on how to get a PAN card without an Aadhaar card:

Online Application:

You can apply for a new PAN card by filling out Form 49A online. This form is available on the official website of the Income Tax department. After submitting the form, you will receive a confirmation screen with all the data you filled out. You can edit the information if needed and then confirm it. Once confirmed, an acknowledgement will be displayed, which you should save and print.

Affixing Photographs:

The acknowledgement form will have a space for affixing two recent colour photographs with a white background (size 3.5 cm x 2.5 cm). Make sure the photographs are not stapled or clipped to the form. The clarity of the image on the PAN card will depend on the quality and clarity of the photographs affixed.

Signature or Thumb Impression:

You will need to provide your signature or left thumb impression in the box provided on the acknowledgement form. Ensure that your signature is not on the photograph. If you use a thumb impression, it must be attested by a Magistrate, Notary Public, or Gazetted Officer under their official seal and stamp.

Proof of Identity and Address:

If you do not have an Aadhaar card, you can submit other proof of identity and address along with your PAN application. Acceptable documents include a passport, driver's license, voter ID card, or any other documents specified by the IT department.

Payment of Fees:

The fee for processing a PAN application varies depending on the applicant's location. For applicants with a communication address within India, the fee is INR 110 (including application fee and Goods & Services Tax). For applicants with a foreign address, the fee is INR 1020 (including application fee, dispatch charges, and Goods & Services Tax).

You can make the payment through credit card, debit card, net banking, or demand draft. If you choose to pay by demand draft, make it payable to 'NSDL - PAN' and ensure that the acknowledgement number is mentioned on the reverse of the draft.

Submission of Application:

Finally, send the duly signed acknowledgement form, photographs, demand draft (if any), and proof of identity, address, and date of birth (if applicable) to the following address:

> Income Tax PAN Services Unit,

> NSDL e-Governance Infrastructure Limited,

> 5th floor, Mantri Sterling,

> Plot No. 341, Survey No. 997/8,

> Model Colony, Near Deep Bungalow Chowk,

> Pune - 411016, India

Make sure to superscribe the envelope with 'APPLICATION FOR PAN—N-Acknowledgement Number', where the acknowledgement number is the unique 15-digit number you received after submitting your online application.

Your application and supporting documents should reach NSDL within 15 days from the date of the online application. Once your application is processed, you will receive your PAN card.

Hot Pot Heaven: Finding the Best Beef in Oregon's Bend

You may want to see also

How to get a PAN card for foreign citizens

A PAN card is a 10-digit alphanumeric Permanent Account Number that is a government-issued identification in India. It is required for financial transactions such as opening a bank account, receiving a salary, or buying or selling property. Foreign citizens can obtain a PAN number from India with a faster turnaround time and fewer documents. Here is a step-by-step guide on how to get a PAN card for foreign citizens:

Step 1: Identify the Type of Applicant

First, determine the type of applicant. For foreign citizens, the options are typically "Individual with a Foreign Passport" or "Company registered outside of India".

Step 2: Gather Required Documents

Foreign citizens will need to provide proof of identity and proof of address. A valid passport and address proof are usually sufficient. Additionally, companies registered outside India will need to provide a copy of the certificate of formation and address proof.

Step 3: Complete the Application Form

The application form for foreign citizens is Form 49AA, which can be downloaded online. Fill in the required details, such as name, address, and contact information.

Step 4: Make the Payment

The next step is to make the required payment, which includes the cost of shipping the PAN card to the applicant's international address. The fees can be paid online.

Step 5: Submit Documents for Review

Send proof of name and address via email for review. This step helps identify any errors in the application form, avoiding rework later.

Step 6: Print, Sign, and Send the Application Form

Print the application form, paste two passport-sized photographs, and sign the form as per the instructions provided. Then, send the signed application form along with copies of the proof documents to India by post or courier. Alternatively, applicants in the USA or Canada can send the documents to New Jersey for an additional fee.

Step 7: PAN Card Processing

Once the PAN officials receive the documents, they will scrutinize and validate the information. This process includes scanning the signature, photo, and creating an electronic version of the PAN card with a digital signature.

Step 8: Receive Digital and Physical PAN Card

After processing, the applicant will first receive a digital PAN card (e-PAN) via email. This e-PAN is accepted for bank KYC, property registrations, etc. Subsequently, a physical PAN card will be delivered to the applicant's overseas address via international speed post.

While it is not possible to obtain a PAN number within one day for applicants living outside India, the entire process typically takes around 7 to 10 working days. Utilizing the services of an agent or professional service can improve the success rate for foreign applicants.

Bathtub Pan Liners: Necessary or Not?

You may want to see also

How to get a PAN card for foreign companies

All foreign companies wishing to establish themselves in India must apply for a PAN card to ensure compliance with taxes and other financial transaction rules. Foreign companies can apply for PAN through two methods: online or through a PAN Application Centre. Here is a step-by-step guide on how to obtain a PAN card for foreign companies:

Online Application:

- Visit the official website: https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html.

- Fill out the form with accurate details. Ensure that the form is filled out in block letters, and all required sections are completed with the necessary information. Avoid using salutations such as Mr., Mrs., or Dr.

- Submit the form and pay the processing fee. The total cost of applying for a PAN is INR 93 (excluding GST) for delivery within India and INR 864 (excluding GST) for international delivery.

- The PAN will be delivered to the mentioned address.

PAN Application Centre:

- Obtain a PAN application form from an authorized PAN Centre.

- Fill out the form with the required details and attach the necessary documents.

- Submit the form and pay the processing fee.

- The PAN will be delivered to the address provided on the form.

Documents Required for Foreign Companies:

When applying for a PAN card, foreign companies must fill out Form 49AA and submit it along with the required documents for verification. Here is a list of the necessary documents:

Identity Proof:

- Copy of the Certificate of Registration issued in the country where the company is located, duly attested by "Apostille" (for countries that are signatories to the Hague Convention of 1961) or by the Indian Embassy or High Commission or Consulate in the respective country.

- Alternatively, provide a copy of the registration certificate issued in India or approval granted to set up an office in India by Indian authorities.

Address Proof:

- Copy of the company's passport.

- Copy of the Person of Indian Origin (PIO) card or Overseas Citizen of India (OCI) card issued by the Government of India.

- Copy of other national or citizenship Identification Number or Taxpayer Identification Number, duly attested, similar to the Identity Proof requirements.

- Copy of the bank account statement in the country of residence or a Non-resident External (NRE) bank account statement in India.

- Copy of the Certificate of Residence or Residential Permit issued by the State Police Authorities in India.

- Copy of the Registration Certificate issued by the Foreigner's Registration Office, displaying the Indian address.

- Copy of the Visa granted, appointment letter or contract from an Indian company, and a Certificate of Indian address issued by the employer.

Additionally, the authorized signatory for the business firm must sign the application. The PAN Card application process typically takes 7 to 10 working days, with an additional week required for printing and international delivery.

Toasting Pine Nuts: Pan Perfection

You may want to see also

How to get a PAN card for Indian citizens

The Permanent Account Number (PAN) is a 10-digit alphanumeric identification number assigned to Indian citizens, primarily for taxation purposes. It is issued by the Indian Income Tax Department and is required to carry out financial transactions, operate bank accounts, and purchase or sell assets. Here is a step-by-step guide on how Indian citizens can obtain a PAN card:

Step 1: Identify the Type of Applicant

First, determine the type of applicant you are. For Indian citizens, the options are typically "Individual with India Passport" or "Company registered in India".

Step 2: Gather Required Documents

Indian citizens will need to provide supporting documents to establish their proof of identity and proof of address. Acceptable identity proofs include a valid Indian passport, Aadhaar card, voter ID card, or driving license. For address proof, you can submit a copy of your passport, Aadhaar card, utility bill, or bank statement.

Step 3: Complete the Application Form

You can apply for a PAN card online by visiting the official website of the Income Tax Department of India or through authorized agents such as NSDL or UTI-ITSL. Fill out the application form, providing your name, address, and contact details. For Indian citizens, the relevant form is typically Form 49A.

Step 4: Submit Documents and Photos

Submit the required proof of identity and address along with your application form. You will also need to provide two passport-sized photographs. Ensure that the photos meet the specified size and placement requirements on the application form.

Step 5: Make the Payment

Make the required payment, which includes the cost of processing the application and shipping the PAN card to your address. The fees can be paid online using net banking, credit or debit card, or demand draft.

Step 6: Track Your Application

Once your application is submitted, you will receive an acknowledgment number or coupon number. Use this number to track the status of your PAN card application online.

Step 7: Receive Your PAN Card

After your application is processed and your PAN number is allotted, you will first receive a digital copy of your PAN card (e-PAN) via email. This is accepted as valid proof of PAN for bank KYC, property registrations, etc. Subsequently, a physical PAN card will be dispatched to your address via registered post or courier.

Please note that the entire process typically takes around 7 to 10 working days, and it is not possible to obtain a PAN number within 24 hours. Additionally, ensure that you provide accurate information and documents to avoid delays or rejections.

Mastering the Beaumark Hot Pot: The Ultimate Guide to Cooking Gammon

You may want to see also

Frequently asked questions

It is not possible to obtain a PAN number in one day. The process involves sending signed documents with photographs for processing, which takes time. However, e-PAN is a digitally signed PAN card that can be issued in electronic format, and it is a valid proof of PAN.

To obtain a PAN number, individuals must begin their application online and provide necessary details such as name, address, and contact information. They also need to submit proof of identity and address. Once the application is processed and the necessary payments are made, a unique PAN number is allotted to the applicant.

Individual applicants must provide proof of identity and address. For company applicants, a certificate of incorporation and proof of address for the business are required.

Yes, an Aadhaar card is not mandatory for obtaining a PAN number, especially for Non-Resident Indians (NRIs) and foreign citizens.