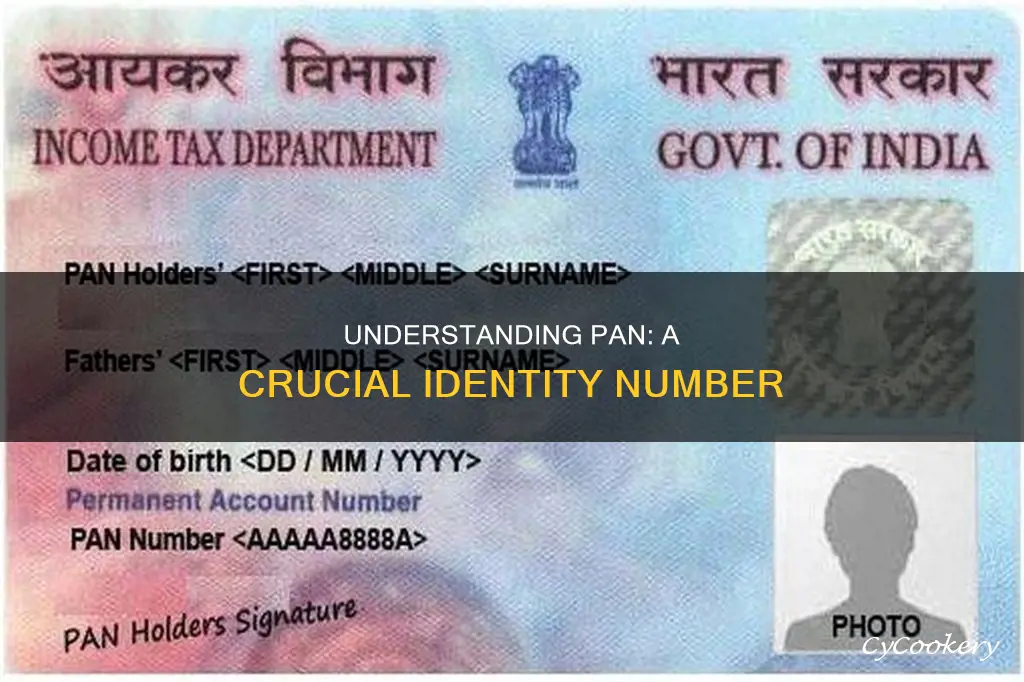

A Permanent Account Number (PAN) is a unique 10-digit alphanumeric identification number assigned to taxpayers in India. Issued by the Indian Income Tax Department, it serves as a universal identification key for all financial transactions, helping to prevent tax evasion. PAN is mandatory for tax payments, opening bank accounts, and other financial transactions. The PAN card, available in physical or digital form, contains personal details such as the cardholder's name, date of birth, and signature, and acts as a photo identity proof.

| Characteristics | Values |

|---|---|

| Name | Permanent Account Number (PAN) |

| Format | 10-digit alphanumeric |

| Description | Assigned to all taxpayers in India |

| Issuing Authority | Income Tax Department, Govt. of India |

| Purpose | Records all tax-related information for a person/company against a single PAN number |

| Uniqueness | No two tax-paying entities can have the same PAN |

| Validity | Unaffected by a change of name, address, or location within India |

| Card Format | Physical or digital card with PAN and other important information |

| Card Details | Name, father's name, date of birth, signature, and photograph of the individual |

| Card Fee | Varies based on mode of submission and dispatch method |

| Mandatory For | Tax payment, financial transactions, and other purposes |

What You'll Learn

What is a PAN card?

A PAN card is a physical or digital identity card issued by the Indian Income Tax Department to any person who applies for it. It is also issued to foreign nationals (such as investors) subject to a valid visa. PAN stands for Permanent Account Number and is a unique, 10-digit alphanumeric identifier. It is issued under the Indian Income Tax Act, 1961, and serves as an important proof of identification.

The PAN card contains the following information:

- Name of the cardholder (individual, partnership firm, LLP, or company)

- Name of the cardholder's father or mother (in the case of a single parent)

- Date of birth of the cardholder or date of registration (in the case of a company or firm)

- PAN number (a 10-digit alpha-numeric number)

- Signature (applicable only for individual cardholders)

- Photograph of the individual (PAN acts as a photo identity proof)

The PAN number is structured as follows:

- First three characters: a random combination of three letters of the alphabet from AAA to ZZZ

- Fourth character: an alphabet representing the category of the taxpayer (e.g. P for Person, H for Hindu Undivided Family, A for Association of Persons)

- Fifth character: the first letter of the individual's surname or last name

- Sixth to ninth characters: sequential numbers starting from 0001 to 9999

- Tenth character: an alphabetic check digit to verify the validity of the PAN number

The PAN card can be obtained in two ways: as a laminated card or as a PDF file known as an e-PAN from the website of the Indian Income Tax Department. The application process can be done online or offline and typically takes around 15-20 days.

The PAN card is mandatory for all tax-paying entities in India and is necessary for various financial transactions such as opening a bank account, purchasing property or vehicles, and making bank deposits above a certain threshold. It is also required for phone and gas connections. The primary purpose of the PAN card is to provide a universal identification for all financial transactions and to prevent tax evasion.

The Best Places to Find Pan Cubano

You may want to see also

Who needs a PAN card?

A PAN card is a Permanent Account Number, a 10-digit alphanumeric identifier, issued as a laminated card or PDF file by the Indian Income Tax Department. It is a unique identifier issued to all judicial entities identifiable under the Indian Income Tax Act, 1961. The income tax PAN and its linked card are issued under Section 139A of the Income Tax Act.

The primary purpose of the PAN is to bring a universal identification to all financial transactions and to prevent tax evasion by keeping track of monetary transactions. It is also issued to foreign nationals (such as investors) subject to a valid visa, and hence a PAN card is not acceptable as proof of Indian citizenship.

The following categories of people need a PAN card:

Indian Citizens

Indian citizens/companies/entities need to apply for a PAN card using Form 49A. The basic and important eligibility criteria and supporting documents required by Indian citizens/companies/entities who want to apply for a PAN card include:

- Individual: The applicant should be an Indian citizen with valid identity proof, address proof, and date of birth proof.

- Hindu Undivided Families (HUF): The PAN card can be applied for in the name of the Hindu Undivided Family (HUF) to enter into financial transactions. The head (Karta) of the family can apply for a PAN card on behalf of the family by furnishing their proof of identity, proof of address, and date of birth proof, along with providing the fathers' names and addresses of all the co-parceners of the HUF. An affidavit needs to be made by the Karta of the HUF mentioning all the details.

- Minors: Minors can also apply for a PAN card, which is mandatory when making them a nominee for a property or making investments in their name. Parents of minors can sign Form 49A on their behalf. Proofs of parents are to be submitted along with the date of birth proof of the child while submitting the form. The Aadhar number of the minor needs to be quoted in the form.

- Mentally Retarded Individuals: If needed, mentally challenged individuals can also obtain a PAN. The application has to be submitted by their representatives.

- Students: All Indian and foreign citizens, including minors and students, can apply for a PAN card.

- Companies: PAN card for companies can be applied for online. Companies need to register with the state Registrar of Companies before applying for a PAN card as the registration number is mandatory. A copy of the Certificate of Registration issued by the Registrar of Companies needs to be furnished along with the form.

- Local Authorities: Local authorities can also place an application for obtaining a PAN by submitting a copy of the agreement.

- Artificial Judicial Person: They are eligible to apply for a PAN card by submitting the registration certificate from the government establishing their identity and address.

Foreign Citizens/Entities

Foreign citizens/entities can use Form 49AA to apply for a PAN card. Here are some of the basic eligibility criteria and documents required:

- Foreign Citizens/Individuals: Foreign individuals who intend to do any financial transactions in India must apply for a PAN card by submitting valid ID, address proof, and date of birth proof. They can furnish a copy of the following documents as proof:

- Passport/PIO card/OCI card

- TIN (Taxpayer Identification Number) or CIN (Citizenship Identification Number) attested by the Ministry of External Affairs or High Commission or Indian Embassy. The applicant can even get this attested by the consulate of the country where he/she resides or from an authorized official of an Indian scheduled bank branch situated overseas.

- Bank account statement (from the country where he/she resides)

- NRE (Non-resident External) bank account statement held in India

- Certificate showing the residence status in India or residence permit issued in India by the police authorities

- Certificate of registration carrying Indian residential address issued by the Foreigner’s Registration Office.

- Copy of visa granted or a contract or letter of appointment given by an Indian company. Even an address proof letter issued by an Indian employer in the original can be produced.

- Foreign Entities: They are eligible to apply for a PAN card by submitting the required documents along with PAN Form 49AA:

- A photocopy of the Registration certificate issued by the country where the entities are situated, duly attested by the Ministry of External Affairs or High Commission or Indian Embassy. The applicant can even get this attested by the consulate of the country where he/she resides or from an authorized official of an Indian scheduled bank branch situated overseas.

- A copy of the Registration Certificate issued in India or approval obtained from Indian authorities to set up a branch office in India.

Removing Rust from Muffin Pans: Quick and Easy Guide

You may want to see also

How to apply for a PAN card

The process of applying for a PAN card can be done online or offline. The PAN card is a Permanent Account Number and is a 10-digit identification number assigned to all taxpayers in India. It is issued by the Income Tax Department of India and acts as an identity proof for various purposes.

Online Application

The online application can be made through the NSDL or UTIITSL portals. The steps are similar for both portals and are as follows:

- Visit the official website and select the application type (Form 49A for Indian citizens or Form 49AA for foreign citizens) and category (individual).

- Fill in your name, date of birth, email ID, and mobile number.

- Agree to the consent terms and click 'Submit'.

- A Token Number will be sent to your email or registered mobile number.

- Proceed with the PAN application form, where you will be given options to submit your documents. You can do this through e-KYC and e-sign, submit scanned images via e-sign, or forward documents physically.

- Decide if you want a physical PAN card or a digital one via email.

- Enter your personal details, including your Aadhaar number, name, gender, date of birth, and parents' names.

- Fill in your income sources, communication address, residential address, and office address.

- Enter your Assessing Officer (AO) code.

- Upload the necessary documents, complete the declaration, and submit the form.

- Make the payment and an acknowledgment slip with a unique 15-digit number will be generated.

- If you chose to forward your application documents physically, print the acknowledgment slip, attach your photo and signature, and send it to the NSDL or UTIITSL office, as applicable, within 15 days from the application date.

Offline Application

- Download Form 49A for Indian citizens or Form 49AA for foreign citizens from the NSDL website.

- Fill in the AO code and area code in the first column of the form.

- Complete the form using block letters and a black ink pen.

- Affix two recent colour passport-sized photographs with a plain background in the designated boxes.

- Sign the form in the specified places and across the photograph on the top left side of the form.

- Attach self-attested copies of your proof of identity, address, and date of birth to the form.

- Submit the completed form and documents at the nearest PAN centre, pay the required fees, and receive an acknowledgment number.

Documents Required

The documents required for a PAN card application include:

- Proof of Identity: Aadhaar card, passport, voter ID, driving license, ration card, photo ID card issued by the government, pensioner card, bank certificate, etc.

- Proof of Address: Aadhaar card, passport, voter ID, driving license, post office passbook, utility bills, property registration document, bank account statement, etc.

- Proof of Date of Birth: Aadhaar card, birth certificate, matriculation certificate, photo identity card issued by the government, etc.

Fees

The fee for a new PAN card application depends on the communication address of the applicant. For an Indian address, the fee is Rs. 93 (excluding GST), and for a foreign address, it is Rs. 864 (excluding GST).

Processing Time

The processing time for a PAN card application is typically 15-20 working days for normal service.

Stainless Steel vs Non-Stick: Which Pan Wins?

You may want to see also

Benefits of a PAN card

A PAN card is a Permanent Account Number that is a 10-digit alphanumeric identification number assigned to all taxpayers in India. It is issued by the Indian Income Tax Department and serves as an important proof of identification. Here are some of the key benefits of a PAN card:

Facilitates Financial Transactions:

PAN card is required for various financial transactions such as opening a bank account, making high-value transactions, investing in mutual funds, buying or selling property, and more. It acts as a valid identity proof and helps streamline these processes.

Enables Income Tax Compliance:

One of the primary purposes of the PAN card is to ensure income tax compliance. It is mandatory for individuals earning a taxable income to possess a PAN card. Filing income tax returns, claiming tax refunds, and fulfilling other tax obligations all require a PAN number.

Prevents Tax Evasion:

The PAN card plays a crucial role in preventing tax evasion. By connecting financial transactions to a unique identification number, the government can effectively monitor and trace individuals' financial activities, promoting a transparent and equitable taxation system.

Proof of Identity:

PAN card can be used as a valid proof of identity and address when applying for various services such as obtaining a SIM card, applying for a passport, or getting a driving license. It is widely accepted as an identity proof by financial institutions and other organizations.

Mandatory for Specific Transactions:

PAN card is mandatory for several specific transactions in India. For example, it is required for purchasing or selling immovable property valued at ₹10 lakhs or more, buying a four-wheeler vehicle, making cash deposits over ₹50,000, and more.

Starting a Business:

A PAN card is necessary for registering a business in India. Companies also need a Tax Registration Number (TRN) to trade and file tax returns, which can only be obtained with a PAN.

Deduction in Taxation:

Having a PAN card can help reduce tax deductions. If an individual's annual interest earnings exceed ₹10,000 on savings deposits and their PAN is not linked to their bank account, the bank will deduct TDS at 30% instead of 10%.

Claiming Income Tax Refund:

To claim a refund for excess tax deducted, an individual must have their PAN linked to their bank account.

In conclusion, a PAN card is a crucial document for individuals and entities in India, facilitating financial transactions, ensuring tax compliance, and providing a valid form of identification.

Replacing Oil Pan Gasket on a 2004 Sienna: Step-by-Step Guide

You may want to see also

PAN card details

A Permanent Account Number (PAN) is a 10-digit identification number assigned to all taxpayers in India. It is issued by the Indian Income Tax Department and serves as an important proof of identification. The PAN is issued in the form of a laminated "PAN card", or as a PDF file known as an e-PAN.

The PAN card contains various personal details, including the name of the cardholder, the name of the cardholder's father (or mother, in the case of a single parent), the date of birth of the cardholder, and the PAN number. The PAN number is a 10-digit alphanumeric character, with the first five characters being letters, the next four being numbers, and the last character being a letter. The PAN card also includes the cardholder's signature and photograph, which acts as photo identification.

The PAN card is necessary for filing income tax returns and for carrying out various financial transactions in India, such as opening a bank account, purchasing a vehicle, or buying or selling assets. The process of applying for a PAN card can be done online or offline, and the card is typically dispatched within 15-20 days of submitting the application.

The PAN card is not acceptable as proof of Indian citizenship, as it is also issued to foreign nationals who wish to undertake business or invest in India. However, it is an essential document for tax-paying entities in India and plays a crucial role in preventing tax evasion by keeping track of monetary transactions.

Searing Burgers: Pan Perfection

You may want to see also