The US tax system is a progressive tax system, meaning that the tax rate increases as income increases. There are seven federal income tax brackets, ranging from 10% to 37%. The average income tax rate in 2020 was 13.6%, while the top 1% of taxpayers paid an average rate of 25.99%. The US tax system is complex and there are many deductions and credits that can reduce the amount of tax paid. The type of tax paid depends on the source of income, with wages and salaries subject to federal and state income tax, as well as payroll tax, while capital gains are taxed at a lower rate.

| Characteristics | Values |

|---|---|

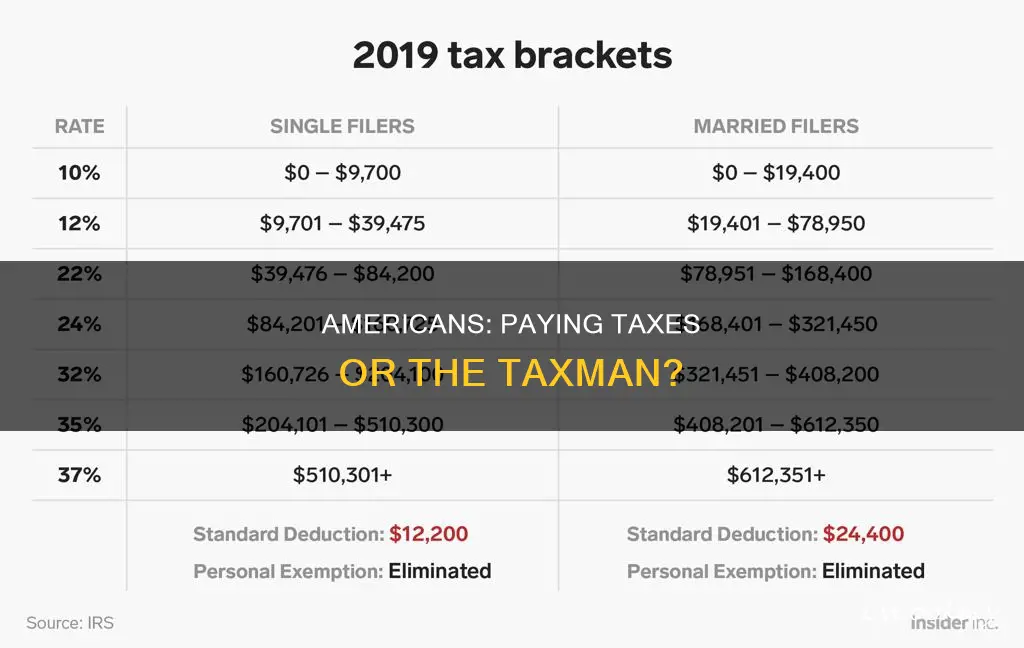

| Number of federal income tax brackets | 7 |

| Federal income tax rates | 10%, 12%, 22%, 24%, 32%, 35% and 37% |

| Average income tax rate | 13.6% |

| Average income tax rate for the top 1% | 25.99% |

| Average income tax rate for the bottom 50% | 3.1% |

| Number of tax returns filed in 2020 | 157.5 million |

| Total income taxes paid in 2020 | $1.7 trillion |

| Total income taxes paid by the top 1% | $723 billion |

| Total income taxes paid by the bottom 50% | $450 billion |

What You'll Learn

How much do the top 1% of income earners pay in taxes?

The top 1% of income earners in the US pay a significant proportion of taxes. In 2020, the latest year with available data, the top 1% of income earners earned 22% of all income and paid 42% of all federal income taxes. This is more than the bottom 90% of taxpayers combined (37%).

The top 1% of earners are defined as those with incomes over $548,336, or $682,577, depending on the source. In 2021, the top 1% paid nearly 46% of all income taxes, according to the IRS. This is the highest level recorded since 1980.

The average tax rate for the top 1% was 25.99% in 2020, more than eight times higher than the 3.1% average rate paid by the bottom half of taxpayers. However, the average tax rate paid by the top 1% has declined in recent decades. For example, in 2001, the top earners had an effective tax rate of 27.6%, almost two percentage points higher than the current rate.

It is worth noting that federal income taxes are just one component of the total tax system, which also includes state and local taxes. State and local sales taxes, for example, are levied at the same rate on every consumer, regardless of their income level. Therefore, low-income Americans pay a bigger share of their earnings towards sales taxes than higher-earning individuals.

Overall, the US tax system is designed to be progressive, meaning that lower-income Americans pay a smaller proportion of their income in federal taxes than high-income earners.

Deep Pan Pizza: Calorie Bomb?

You may want to see also

How does the US tax system compare to other countries?

The US tax system varies significantly from other countries' systems, with US taxes being relatively low compared to other high-income countries. In 2021, taxes at all levels of the US government represented 27% of gross domestic product (GDP), while the weighted average for the other 37 member countries of the Organisation for Economic Co-operation and Development (OECD) was 34%. This difference is largely due to higher taxes funding social insurance programs in other developed nations, such as Social Security and Medicare in the US.

The US has some of the lowest taxes in the world when it comes to personal income tax rates and goods and services tax rates (sales taxes). In 2020, US taxes represented about 25.5% of the country's GDP, compared to an average of 33.5% for other OECD countries. Several European countries, including Denmark, France, Belgium, and Italy, tax over 40% of their GDP. The US ranks eighth in the OECD for income tax rates, with the average person without children paying 22.7% of their income in taxes.

The US has a more complex tax filing system than many other countries, with US taxpayers spending around six billion hours preparing and filing their returns annually. While the US does not have a value-added tax (VAT), a type of general consumption tax, every other OECD member country does. Instead, the US relies on state and local sales taxes, which vary across states and localities. California has the highest sales tax rate at 7.25%Tennessee has the highest combined state and local tax rate at 9.47%.

Corporate income tax rates in the US are higher than the worldwide average, with a rate of 39.1% compared to an average top corporate income tax rate of 22.6%. However, when compared globally, the US comes in third behind Chad and the United Arab Emirates.

Greasing the Pan: Cookie Edition

You may want to see also

How does the US federal income tax work?

The US federal income tax is levied by the Internal Revenue Service (IRS) on the annual earnings of individuals, corporations, trusts, and other legal entities. Federal income taxes apply to all forms of earnings that make up a taxpayer's taxable income, including wages, salaries, commissions, bonuses, tips, investment income, and certain types of unearned income.

In the US, federal income tax rates for individuals are progressive, meaning that as taxable income increases, so does the tax rate. Federal income tax rates range from 10% to 37% as of 2024. The income ranges to which these rates apply are called tax brackets. Income that falls within each bracket is taxed at the corresponding rate.

The federal income tax is the largest source of revenue for the US government. Federal income tax is used for various expenses, including building and repairing the country's infrastructure, improving education and public transportation, and providing disaster relief.

Federal income taxes are based on income and filing status; they apply to everyone, regardless of where they live or work. An individual's taxable income is their gross income minus allowable deductions. Gross income includes all income earned or received from any source, including salaries, wages, tips, pensions, fees earned for services, gains from the sale of property, rents received, interest, and dividends.

Federal income tax liability can be reduced by tax deductions and tax credits, which provide benefits to specific types of taxpayers. Tax deductions reduce the amount of income that is taxed, while tax credits directly reduce the amount of tax owed.

The US federal government and most state governments impose an income tax. State income taxes can vary significantly from one state to another, with some states having a flat tax and others using a progressive tax system like the federal government. Some states do not levy any income tax at all.

Copper Pans: To Line or Not to Line?

You may want to see also

How much do Americans pay in federal income tax?

The amount of federal income tax Americans pay depends on a variety of factors, including income level, source of income, marital status, age, residence, homeownership, and parenthood. The US tax system is progressive, meaning that those with higher incomes pay at higher rates. The average federal income tax rate in 2020 was 13.6%, but this varies significantly depending on income level. For example, the top 1% of taxpayers paid an average rate of 25.99%, while the bottom 50% paid an average rate of 3.1%. The top 1% of taxpayers paid 42.3% of all federal income taxes, while the bottom 50% paid just 2.3%.

In 2021, the average federal income tax rate increased slightly to 14.9%. The top 1% of taxpayers paid an average rate of 25.9%, while the bottom 50% paid an average rate of 3.3%. The top 1% of taxpayers paid 45.8% of all federal income taxes, while the bottom 50% paid 2.3%.

The federal income tax brackets for 2022 range from 10% to 37%. The specific income thresholds for these brackets vary depending on factors such as filing status (single, married filing jointly, etc.). For example, for single filers in 2022, the lowest marginal tax rate applies to incomes up to $10,275, while the top rate of 37% applies to incomes above $539,900.

It's worth noting that federal income tax is just one component of an individual's overall tax burden. Other taxes, such as payroll taxes for Social Security and Medicare, can also represent a significant portion of an individual's total tax liability.

Baking Ham: No Roasting Pan, No Problem!

You may want to see also

How much do Americans pay in state income tax?

The amount of state income tax paid by Americans varies depending on the state in which they live. Some states have a progressive tax system, similar to the federal income tax system, while others have a flat tax rate or no state-level tax at all.

Nine states do not levy a state income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. New Hampshire has a 5% tax on dividends and interest only, and Washington has a 7% tax on long-term capital gains over $250,000.

State income tax rates vary widely by jurisdiction, from 0% to 13.30% of income. Most rates are the same for all types of income. State and local income taxes are imposed in addition to federal income tax, and state income tax is allowed as a deduction in computing federal taxable income. However, the 2017 tax law imposed a $10,000 limit on the state and local tax ("SALT") deduction, which raised the effective tax rate on medium and high earners in high-tax states.

State income tax returns are typically due on the same day as federal income tax returns, in mid-April, but there are exceptions. For example, residents of Virginia have until May 1 to file their state returns.

State income tax is determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Individuals are permitted to reduce taxable income by personal allowances and certain non-business expenses, including home mortgage interest, state and local taxes, charitable contributions, and medical and certain other expenses incurred above certain percentages of income.

Perfect Pan Size for Pillsbury Pizza Crust

You may want to see also

Frequently asked questions

In 2021, the average tax rate was 22.6% in the U.S., according to the Organisation for Economic Co-operation and Development.

In 2020, Americans filed 157.5 million tax returns and paid $1.7 trillion in individual income taxes.

Assuming no deductions, a single taxpayer with no children who earned $1 million would pay a little over $335,000 in federal income tax, or an effective tax rate of 33.5%.

In 2020, the top 1% of taxpayers paid an average income tax rate of 25.99%. They earned 22.2% of the total adjusted gross income and paid 42.3% of all federal income taxes.

The U.S. has a progressive tax system with seven tax brackets ranging from 10% to 37%. This means that as income increases, the tax rate applied to that income also increases.