In India, a Permanent Account Number (PAN) card is a crucial identity document. Without a PAN, it is impossible to carry out any financial transactions. The Income Tax Department issues this 10-digit alphanumeric and unique account number, which has lifetime validity. The good news is that getting a PAN card is now easier than ever, as the process has gone digital and can be completed in just 10 minutes. Here's a step-by-step guide to obtaining your PAN card quickly and without any cost.

| Characteristics | Values |

|---|---|

| Time taken to get PAN card | 10 minutes |

| Cost | Free |

| Prerequisites | Valid Aadhaar, mobile number registered with Aadhaar, no other PAN card |

| Where to apply | e-Filing website of the Income-tax Department |

| Application process | Enter Aadhaar number, submit OTP, fill in details, download PAN card |

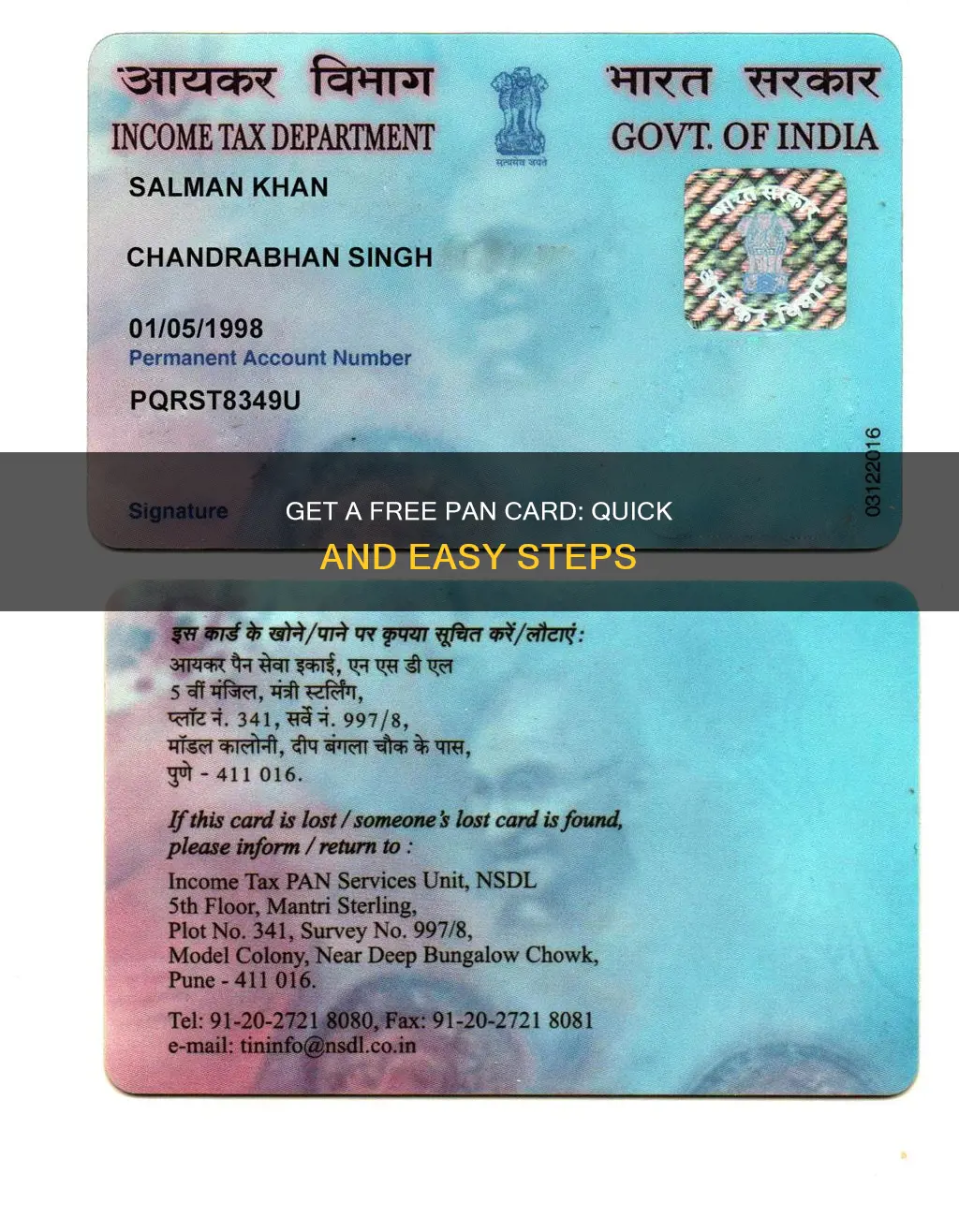

| PAN card format |

What You'll Learn

How to get an instant PAN card in 10 minutes

The Indian government has made it possible to obtain an instant e-PAN card in 10 minutes. Here is a step-by-step guide on how to get one:

Prerequisites

Before starting the application process, ensure you meet the following requirements:

- You must have a valid Aadhaar card with an updated mobile number registered with your Aadhaar.

- You should not already possess a PAN card, as this service is only available to first-time applicants.

- You should not be a minor at the time of application.

- Your full date of birth (DD/MM/YY) should be present on your Aadhaar card.

- You should not fall under the category of Representative Assessee as per section 160 of the Income Tax Act.

Step-by-Step Guide

- Visit the official e-filing website of the Income Tax Department: https://www.incometax.gov.in/iec/foportal/.

- On the homepage, locate and click on the 'Instant E-PAN' tab under the 'Quick Links' section.

- Click on the 'Get New PAN' button.

- Enter your Aadhaar number and click on the 'I confirm that' check box.

- Validate the OTP sent to your registered mobile number and click 'Continue'.

- Verify the Aadhaar details displayed on the screen.

- Click on 'Confirm and continue with e-KYC data'.

- Upon confirmation of your details, the application will be submitted, and the e-PAN will be generated and sent to your registered email address.

Common Mistakes to Avoid

- Ensure that you enter the correct Aadhaar number and cross-verify it before proceeding.

- Do not ignore the OTP verification step, as this may lead to a failed application.

- Make sure to complete all fields in the application form and provide accurate information.

- Check that your personal details, such as name and date of birth, match those on your Aadhaar card to avoid rejection.

- Only one application is permitted per person. Do not apply multiple times using the same Aadhaar number.

By following these steps and avoiding common pitfalls, you can obtain your e-PAN card quickly and smoothly. This digital process has eliminated the need for lengthy paperwork and waiting periods, making it more accessible to individuals in India.

The Ultimate Cast Iron Pan: Why You Need One

You may want to see also

How to apply for an instant e-PAN card

Applying for an instant e-PAN card is a straightforward and paperless process. Here is a step-by-step guide:

Prerequisites

Before applying, ensure you meet the following prerequisites:

- You have a valid Aadhaar card with updated KYC details.

- Your mobile number is registered with your Aadhaar card.

- You are not a minor.

- You do not already have a PAN card.

- You are not covered under the definition of Representative Assessee u/s 160 of the Income Tax Act.

Step-by-Step Guide

- Visit the e-filing website of the Income Tax Department: https://www.incometax.gov.in/iec/foportal/.

- On the homepage, locate and click on the 'Instant E-PAN' tab under 'Quick Links'.

- On the e-PAN page, click on 'Get New e-PAN'.

- Enter your 12-digit Aadhaar number, select the 'I confirm that' checkbox, and click 'Continue'.

- If your Aadhaar is not linked to a mobile number, you will see an error message. Ensure your Aadhaar has your correct mobile number and try again.

- On the OTP validation page, click 'I have read the consent terms and agree to proceed further'.

- Enter the 6-digit OTP received on your mobile number and click 'Continue'. You have three attempts and 15 minutes to enter the correct OTP.

- On the 'Validate Aadhaar Details' page, select the 'I Accept that' checkbox and click 'Continue'.

- Linking or validating your email ID (registered with your Aadhaar) is optional. If you choose to validate, enter the 6-digit OTP received on your mobile number and click 'Continue'.

- Upon successful submission, you will see a success message along with an Acknowledgement Number. Keep this number for future reference. You will also receive a confirmation message on your mobile number.

- After your e-PAN is generated, you can check its status and download it by visiting the e-Filing portal homepage, clicking 'Instant e-PAN', and then 'Check Status / Download PAN'.

- Enter your Aadhaar number and the OTP sent to your mobile number to check the status and download your e-PAN.

Note: It is essential to ensure that your Aadhaar details, such as your name, date of birth, and other personal information, are correct before initiating the e-PAN application process. Any discrepancies may lead to application rejection.

The Art of Baking with Cast Iron: A Guide to Perfect Pan-Baked Goods

You may want to see also

Documents required for an e-PAN card

The e-PAN card is a digital version of the traditional PAN card, which can be used for financial and tax-related transactions. The process of applying for an e-PAN card is paperless and does not require any fee or charge.

To be eligible for an e-PAN card, you must be a resident of India, an individual taxpayer (not a company or Hindu Undivided Family), and not have an existing PAN card. Additionally, you must possess a valid Aadhaar card with updated and correct details, and your Aadhaar card must have a registered and active mobile number.

- Visit the e-filing website of the Income Tax Department.

- Enter your Aadhaar number and receive an OTP on the registered mobile number.

- Submit the OTP.

- Upload a scanned copy of your signature on white paper with specified dimensions and file type.

- Once all the details are entered correctly, you will receive a 15-digit acknowledgement number on your registered mobile number.

To check the status of your e-PAN card application, you can log in to the income tax India e-filing website, enter the acknowledgement number, and view the status.

It is important to note that the e-PAN card facility is only available to applicants with a valid Aadhaar number and a mobile number registered in the UIDAI database. For those without an Aadhaar number or with an unregistered mobile number, this instant e-PAN card facility will not be available.

Counter Pans: Safe or Not?

You may want to see also

How to apply for a PAN card online via the NSDL website

Applying for a PAN card online through the NSDL website is a straightforward process. Here is a detailed, step-by-step guide on how to do it:

Step 1: Visit the NSDL website

Go to the NSDL site (https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html) to apply for a new PAN.

Step 2: Select the application type

Choose the type of application you are making – New PAN for Indian citizens, foreign citizens, or for change/correction in existing PAN data.

Step 3: Select your category

Select your category from the options provided, such as individual, associations of persons, or a body of individuals.

Step 4: Fill in the required details

Fill in all the necessary details, such as your name, date of birth, email address, and mobile number, in the PAN form.

Step 5: Submit the form and follow the instructions

After submitting the form, you will receive a message with further instructions. Click on the "Continue with the PAN Application Form" button to proceed.

Step 6: Submit your digital e-KYC

You will be redirected to a new page where you must submit your digital e-KYC.

Step 7: Choose your PAN card type and provide Aadhaar details

Select whether you need a physical PAN card or just a digital one. Then, provide the last four digits of your Aadhaar number.

Step 8: Enter your personal, contact, and other details

In this part of the form, enter your personal details, contact information, and any other required details.

Step 9: Enter your area code, AO Type, and other information

Fill in your area code, AO Type, and any other details requested in this section of the form. You can find these details on the same webpage.

Step 10: Submit documents and declaration

The last part of the form involves document submission and a declaration.

Step 11: Enter your PAN card number to submit the application

Enter the first 8 digits of your PAN card to submit the application. Review your completed form and click "Proceed" if no modifications are needed.

Step 12: Verify your identity using Aadhaar OTP

Select the e-KYC option to verify your identity using an Aadhaar OTP. For Proof of Identity, Address, and Date of Birth, choose Aadhaar in all fields and click "Proceed" to continue.

Step 13: Make the payment

You will be redirected to the payment section. Make the payment using either a demand draft or through net banking/debit/credit card.

Step 14: Receive the payment receipt and continue

After successful payment, a payment receipt will be generated. Click on "Continue" to proceed to the next step.

Step 15: Authenticate your Aadhaar and select the declaration

For Aadhaar Authentication, tick the declaration and select the "Authenticate" option.

Step 16: Continue with e-KYC and enter the OTP

Click on "Continue with e-KYC," and an OTP will be sent to your Aadhaar-linked mobile number.

Step 17: Enter the OTP and submit the form

Enter the OTP and submit the form.

Step 18: Continue with e-Sign and enter your Aadhaar number

Click on "Continue with e-Sign" and enter your 12-digit Aadhaar number. An OTP will be sent to your Aadhaar-linked mobile number.

Step 19: Enter the OTP and submit the application

Enter the OTP and submit the application to receive the Acknowledgement slip in PDF form. The password for this PDF will be your date of birth in DDMMYYYY format.

Important Prerequisites:

- The applicant should have a valid Aadhaar that is not linked to any other PAN.

- The applicant should have their mobile number registered with Aadhaar.

- This is a paperless process, and no documents need to be uploaded or submitted.

- The applicant should not already possess a PAN. Holding more than one PAN can result in a penalty.

The Peeling Pan Mystery: Why Cast Iron Needs Care

You may want to see also

How to apply for a PAN card offline

Applying for a PAN card offline is a straightforward process. Here is a step-by-step guide on how to apply for a PAN card offline:

Step 1: Download Form 49A

Visit the NSDL e-Gov website and download Form 49A, which is the application form for a PAN Card. This form is specifically designed for Indian citizens applying for a PAN Card. If you are a foreign citizen, you will need to fill out Form 49AA.

Step 2: Fill in the application form

Complete the application form by providing all the necessary details, such as your name, date of birth, address, etc. Ensure that the information is accurate and legible. You will also need to attach a recent passport-sized photograph and sign the application form.

Step 3: Submit the form and required documents

Submit the completed application form along with the necessary documents, including identity and address proofs, at the nearest PAN centre or to an authorised agent. You will be required to pay the applicable charges for the PAN card, including the issuing charge and any administrative/service fees.

Step 4: Receive acknowledgment and track application status

Upon submitting your application, you will receive an acknowledgment slip containing an acknowledgment number. This number can be used to track the status of your PAN card application. The NSDL/UTIITSL department typically issues the PAN card within 15 days of receiving your application.

Documents Required for PAN Card Application:

- Identity proof: Aadhaar card, voter ID card, passport, driving license, or any other government-issued photo ID.

- Address proof: Aadhaar card, passport, voter ID card, driving license, utility bills, bank account statement, etc.

- Date of birth proof: Birth certificate, passport, Aadhaar card, or any other government-issued document.

- Registration certificate (for companies, firms, HUF, and associations of persons): If you are applying on behalf of an entity, submit the respective registration certificate.

Fees for PAN Card Application:

The fees for a PAN card application vary depending on whether the communication address is within or outside India. For applicants residing in India, the fee is Rs 110, including a processing fee of Rs 93 plus 18% GST. For applicants outside India, the fee is Rs 1020, including an application fee of Rs 93, dispatch charges of Rs 771, plus 18% GST.

Please note that the offline application process may require you to pay an additional administrative/service fee to the PAN centre or agent.

Creating a Comforting Chicken Hot Pot

You may want to see also

Frequently asked questions

You can get a free PAN card by visiting the e-filing website of the Income Tax Department and applying for an instant e-PAN card. This process is available to Indian citizens above 18 years of age with a valid Aadhaar number and an Aadhaar-linked mobile number.

To get an instant PAN card, you must have a valid Aadhaar number that is not linked to any other PAN card. Additionally, your mobile number must be registered with Aadhaar.

If you are an Indian citizen with a valid Aadhaar number, you can obtain your PAN card within 10 minutes by applying for an instant e-PAN card on the Income Tax portal. The normal application process for a PAN card can take anywhere between 15 to 20 days.